Perfect Stp Income Statement

STP Income Statement Featured here the Income Statement earnings report for Song Da Industry Trade JSC showing the companys financial performance from operating and non operating activities.

Stp income statement. If your income statement shows as Not tax ready you will see a red box with. After 1 July your STP income statement information will be pre-filled into myTax even if your employer hasnt finalised it yet. This also means that 201920 payment summaries will not be available in StaffLink.

I have 1 employee in which their income statement via MyGov is not showing the correct amounts and is also stating Not tax ready. No other employees have reported this problem. However once your income statement information is finalised by your employer it will be identified as Tax ready.

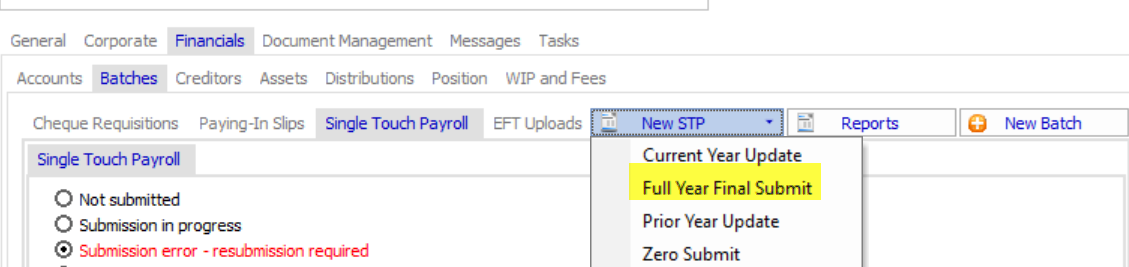

To reconcile STP figures this Financial year do we use the Payment Summary Assistant without lodging EMPDUPE. As the ATO doesnt allow you to delete these reports the Business Portal will show every pay run declared through STP including ones that you have deleted or. Income statement 1 Income statement 2 2.

Tax code set up Lump sum A Tax code set up ETP Job Keeper. 1750000 Payment Summaries Individual Non Business Income. Income Statement is the new name for payment summaries and is found in your myGov account.

The free STP app contains the final pay event declaration which needs to be ticked if its the final pay of the financial year as youve already mentioned in your above post. Employer finalises this income statement on 1372019. Income statement is the new term for their payment summary to wait until their income statement is Tax ready before lodging their tax return to check their personal details and if necessary update with both you and the ATO incorrect personal details may prevent them from seeing their STP information.

You can view your income statement at any time throughout the financial year. Rostered Day Off RDO Leave opening balances and adjustments. No payment summary or income statement If your employer was using single touch payroll STP they had until 31 July to finalise their reporting.