Ideal Ratio Analysis Of Cipla

According to these financial ratios Cipla Limiteds valuation is way above the market valuation of its sector.

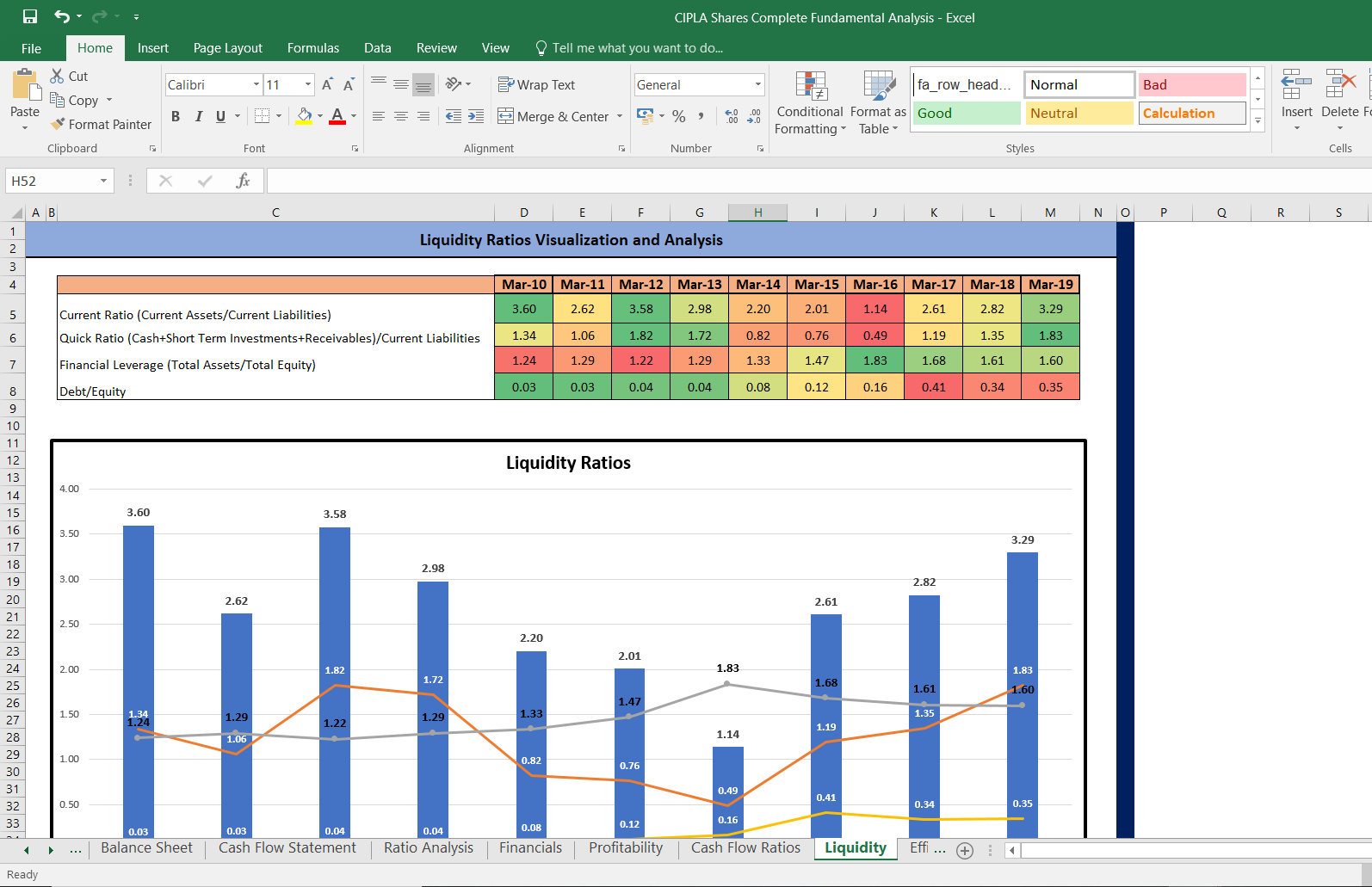

Ratio analysis of cipla. Pranita Narkar MMS First Year Sem II Presented to. The companys current ratio improved and stood at 33x during FY19 from 28x during FY18. So Debt to Equity ratio is important to analyze the companys sustainability.

RETURN ON INVERSTED CAPITAL RATIO. In the latest quarter company has reported Gross Sales. Ratio Analysis of cipla Current RatioCurrent assets Current Liabilities Fy2008745128829 Fy200944181405314 Fy201043671214359 The ideal Current ratio is 21If the current ratio is 21 the companys position is goodThe current assets is more than 21 then its shows that the funds are unnecessarily blocked in the current assets.

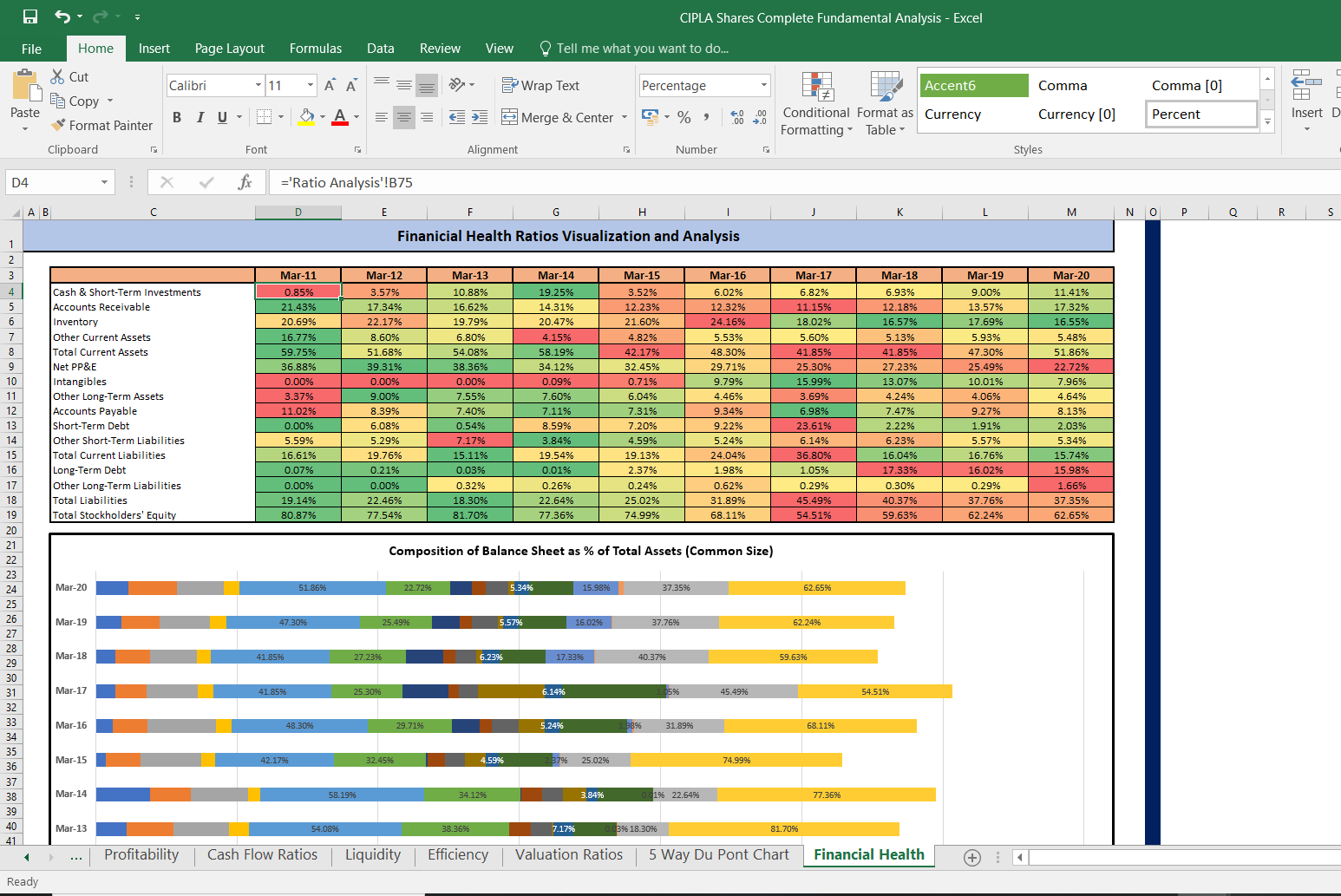

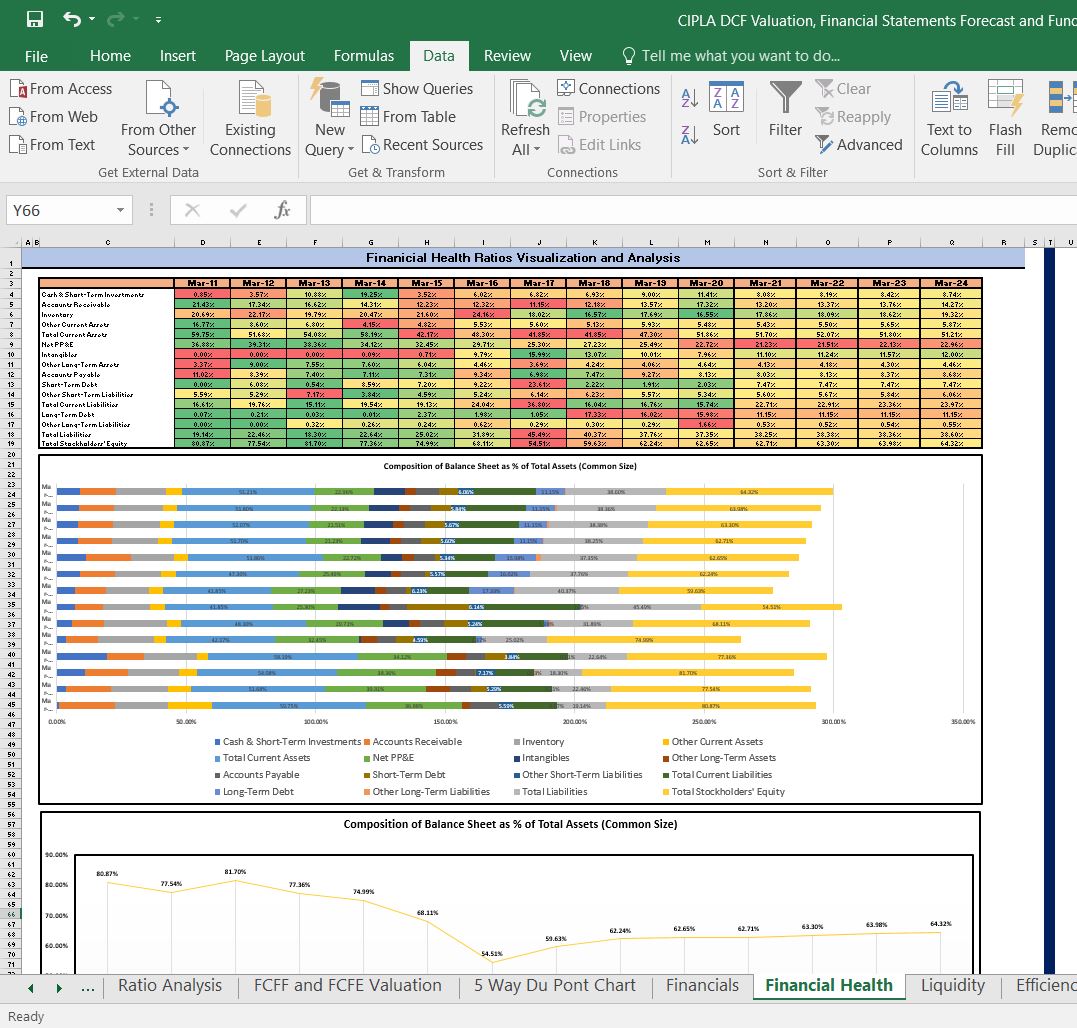

The Model covers all the major fundamental aspects of Cipla Ltd over the ten year period. Operating Costs to Assets. The model is easy to edit and update for the future years as well.

Operating profit margins witnessed a fall and stood at 192 in FY20 as against 194 in FY19. Its current market capitalisation stands at Rs 7423531 Cr. Its todays share price is 9203.

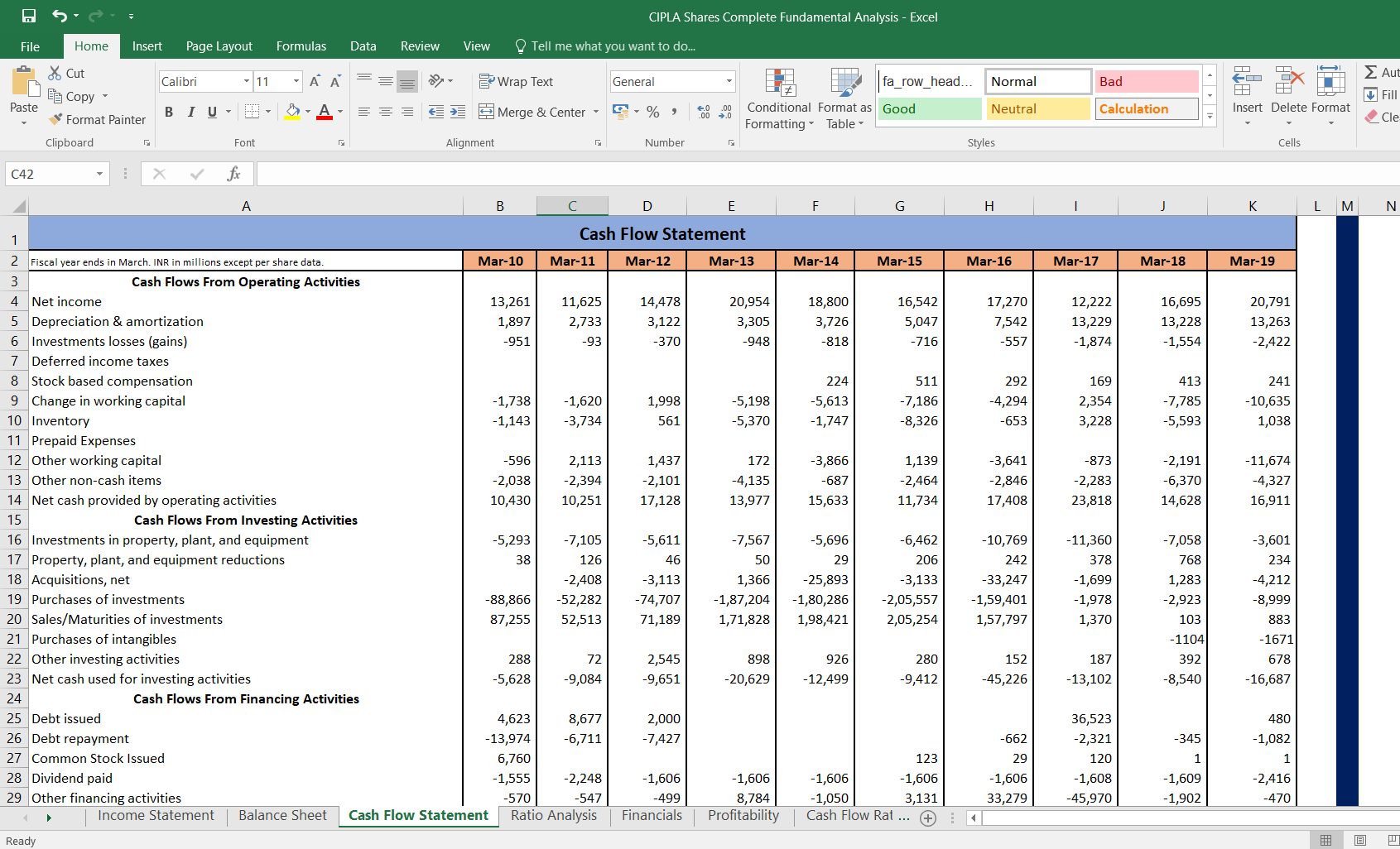

Interest Coverx 1204 1334 1561. 2021 was 040Therefore Ciplas PE Ratio for today is 000. Cash Flow Ratios 4.

It has 46 state of the art manufacturing facilities across 5 countries and has 1500 products. This ratio is showing decreasing trend. This ratio is decreasing from 2007 to 2009 and increased in 2010 because total assets are increasing faster than profit after tax.