Outrageous Liquidation Expenses In Statement Of Liquidation

Submit all outstanding Income Tax Returns Form C-S C and audited unaudited financial statements and tax computations of the company in liquidation up to the date of liquidation.

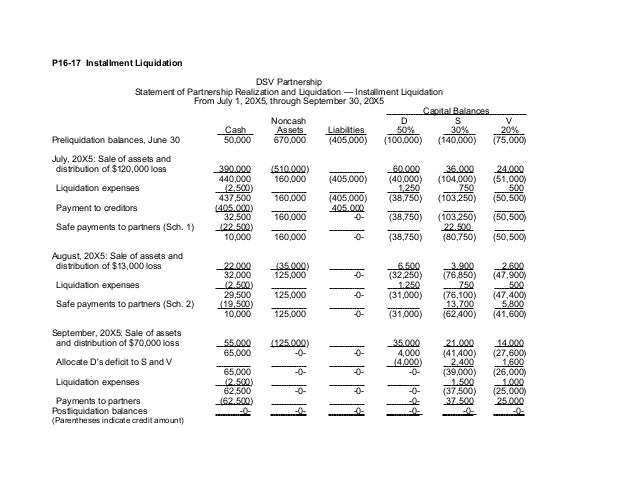

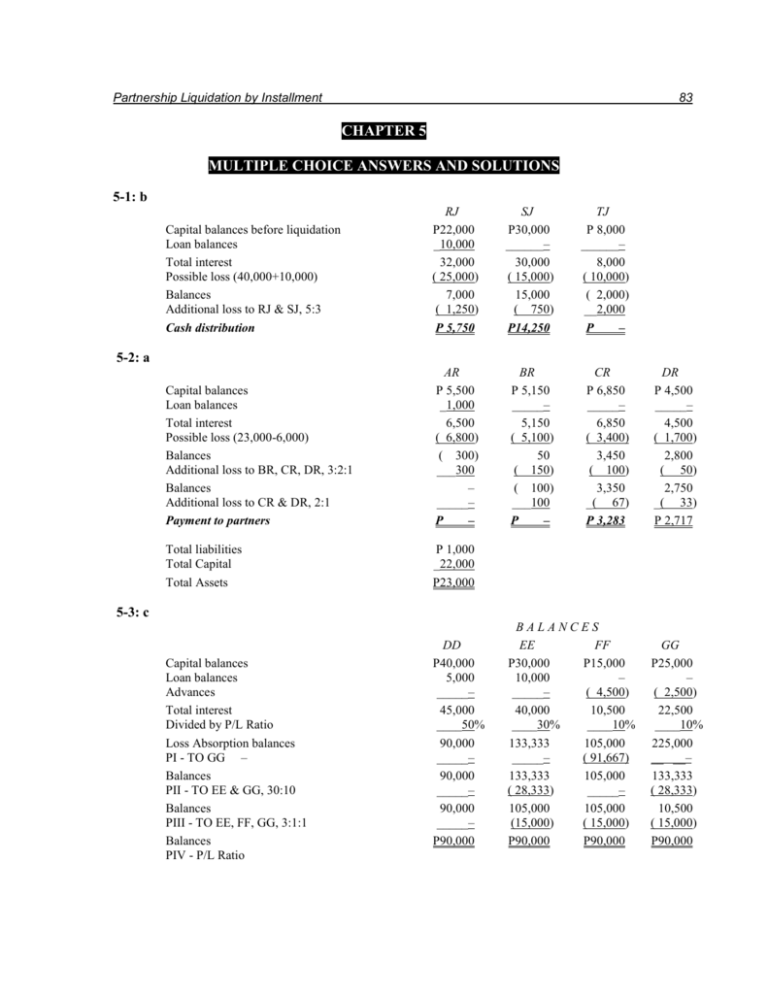

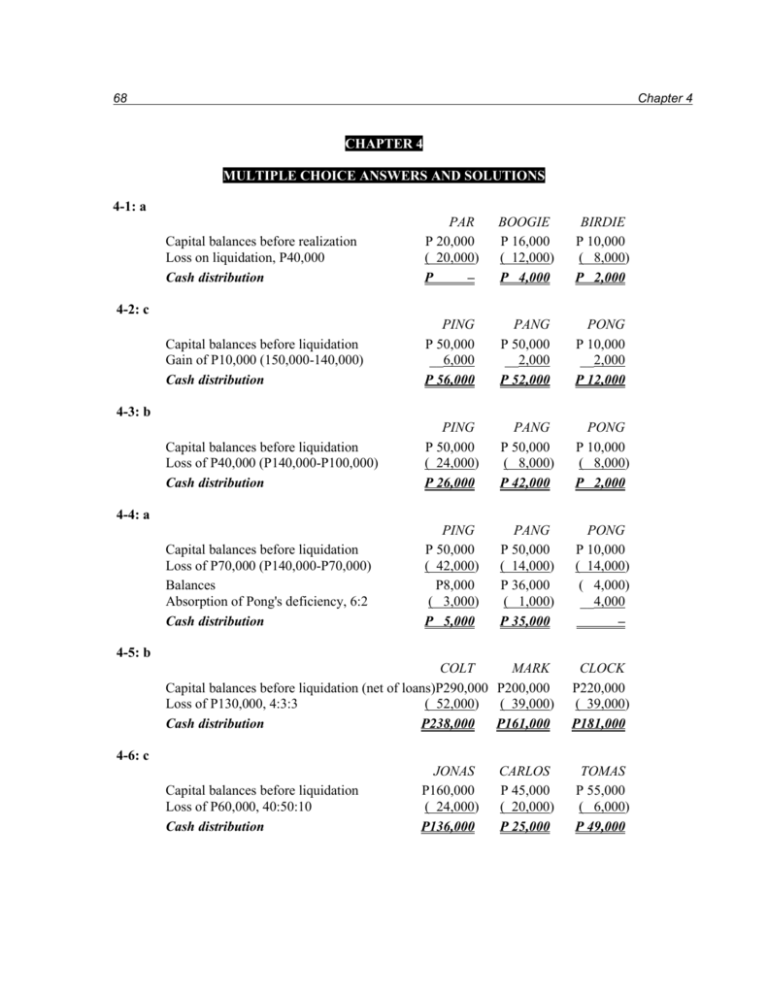

Liquidation expenses in statement of liquidation. Liquidator expenses and liquidators remuneration amounted to Rs 3000 and Rs 10000 respectively. The liquidator is entitled to a commission of 3 per cent on all assets realised except cash and a commission of 2 per cent on amounts distributed among unsecured creditors. Liquidation Basis Financial Statements.

The change in accounting basis did not. The liquidators remuneration was agreed at 1 on the assets converted into cash and in addition 2 on the total return of capital to contributories. The assets were realised as follows.

Finally all pictures we have been displayed in this site will inspire you all. During the liquidation process expenses are usually incurred such as legal and acounting expenses and advertising cost of selling the assets. File the subsequent Receipts and Payments for the liquidation period.

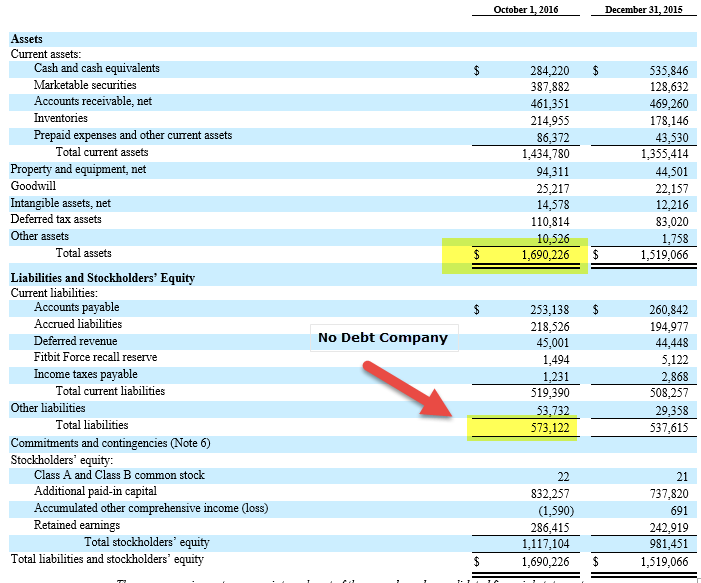

The partners have agreed to liquidate the partnership and anticipate that liquidation expenses will total P 1000. For assets net realizable value would equal net liquidation value. Its basis of accounting from a going concern basis to a liquidation basis.

An example of such an income item is the expected profits from orders that have not yet been fulfilled. What are the Costs of Voluntary Liquidation. Third party expenses relating to such items as brokerage fees disposal fees or other such expenses are often required during liquidation and should be considered in the estimated value.

Liquidation expenses totalled Rs 2000. Net realizable value is equal to the expected selling price less the expected selling costs. The expenses of liquidation amounted to Rs 10900.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)