Out Of This World Financial Statements Prepared On A Liquidation Basis

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

Financial statements might be prepared under what is sometimes referred to as a break-up basis or liquidation basis.

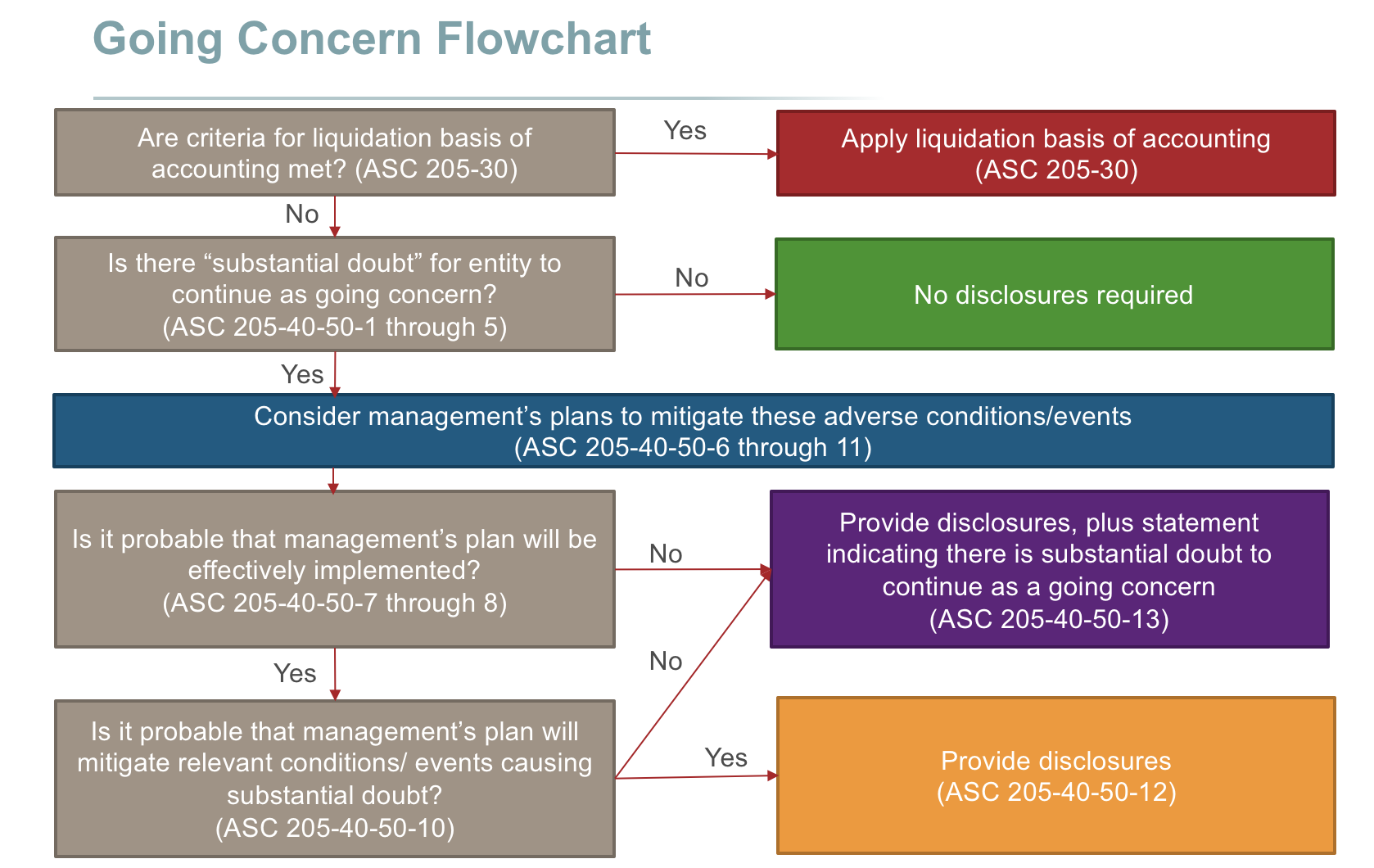

Financial statements prepared on a liquidation basis. It is one of the basic assumptions described in IAS 1 Presentation of financial statements. Disclosed together with the basis on which the financial statements are prepared and the reason why the entity is not considered a going concern. The proper application of Liquidation Basis of Accounting LBOA within financial statements can be quite challenging.

ASC 205 requires that the financial statements prepared on the liquidation basis of accounting consist of at a minimum 1 a statement of net assets. Paragraph BC13 of the ASUs Basis for Conclusions notes that financial statements prepared under the liquidation basis of accounting are intended to report the amount of cash or other consideration that an investor might reasonably expect to receive after liquidation. If the annual reporting period changes and financial statements are prepared for a different period the entity must disclose the reason for the change and state that amounts are not entirely comparable.

For an enterprise that has adopted the liquidation basis of accounting the financial statements consist of a statement of net assets in liquidation and a statement of changes in net assets in liquidation. Some people argue that under such a break up basis the objective of the financial statements changes from reporting financial performance to consideration of matters such as. It says that all entities have to prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or.

Financial statements might be prepared under what is sometimes referred to as a break-up basis or liquidation basis. STATEMENT OF COMPLIANCE The financial statements have been prepared in accordance with International Financial Reporting Standards IFRS as issued by the International Accounting Standards Board IASB. There is a presumption that financial statements will be prepared at least annually.

The goal behind LBOA is to report the amount that an investor may expect to receive after the completion of the liquidation process. 35 Typically the financial statements of entities that adopt a liquidation basis of accounting are presented along with financial statements of a period prior to adoption of a liquidation basis that were prepared on the basis of GAAP forgoingconcernsInsuchcircumstancestheauditorsreportordinarilyshould. In our opinion the accompanying statement of assets and liabilities in liquidation and the related statements of operations in liquidation and of changes in net assets i n liquidation and the financial highlights present fairly in all m aterial respects the financial.

The amendments require financial statements prepared using the liquidation basis of accounting to present relevant information about an entitys expected resources in liquidation by measuring and presenting assets at the amount of the expected cash proceeds from liquidation. The statement of changes in net assets in liquidation. When an entity does not prepare financial statements on a going concern basis it shall disclose that fact together with the basis on which it prepared.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)