Divine Balance Sheet Of Sbi With Ratio Analysis

We also provide our clients with the Balance Sheet of SBI Life Insurance with Ratio Analysis.

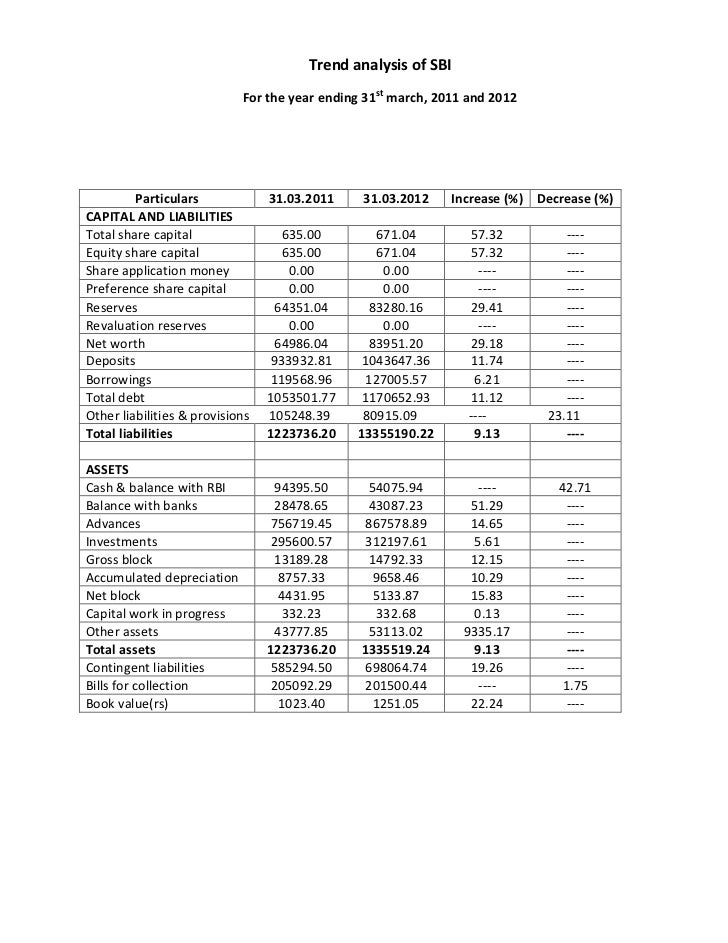

Balance sheet of sbi with ratio analysis. DEBT EQUITY RATIO 042 chg. Total DebtEquityx 006 005 006 006 006 007. Current Ratiox 043 038 038 043 040 036.

Balance SheetProfit Account Report of Auditors. State Bank of India Q1 Net Profit seen up 633 YoY to Rs. It is concluded that the Average Credit Deposit ratio of SBI is 83 and it indicates that out of every 100 Deposited 83 being lent.

Balance sheet ratios are the ratios that analyze the companys balance sheet which indicate how good the companys condition in the market. State Bank of India Q1 Net Profit seen up 633 YoY to Rs. Return on shareholders investment net profit after interest and tax shareholders fund The ratio is generally calculated as percentages by multiplying the above with 100.

Net Interest Margin NIM NIM of the bank eroded YoY as well as QoQ to 294 in Q4 FY20 from 302 in Q4 FY19 and 359 in last quarter Q3 FY20. SBI Cards And Payment Services ShareStock Analysis - Latest fundamental analysis information of Profit Loss Statement Balance Sheet with Ratios ROCE ROE and ROA Shareholding Pattern Cash Flow Statement Valuations and Recommendations. The Balance Sheet Page of State Bank of India presents the key ratios its comparison with the sector peers and 5 years of Balance Sheet.

Quick Ratiox 1168 1017 1407 1356 1294 1603. The term ratio refers to the numerical or quantitative relationship between two itemsvariables. Ratio analysis is defined as the systematic use of ratio to interpret the financial statements so that the strengths and weaknesses of a firm as well as its historical performance and current financial condition can be determined.

Sbi icici ratio analysis. It is because of the mismanagement on the side of bank. LoansDepositsx 012 010 014 014 013 016.