Fun Provision For Bad Debts In Income Statement

An additional provision would be made for only 1400.

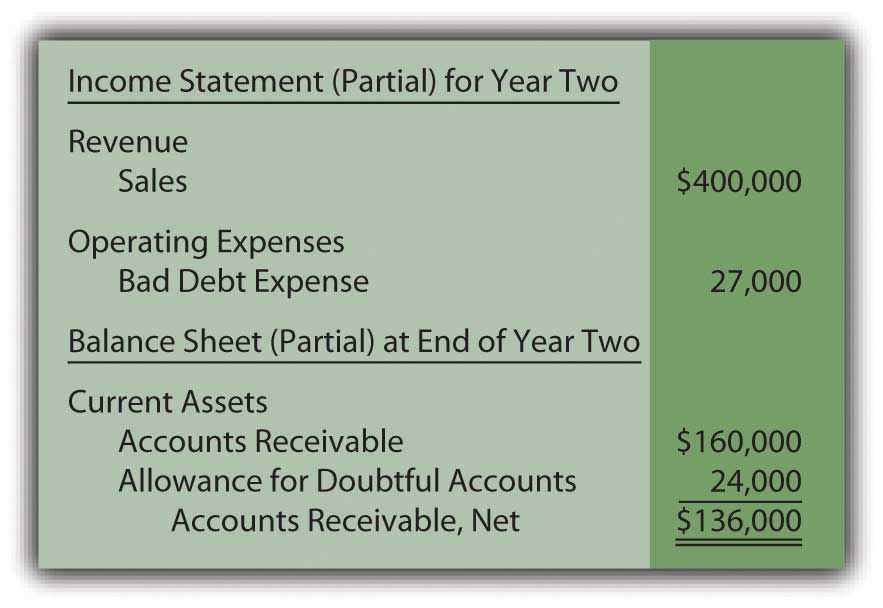

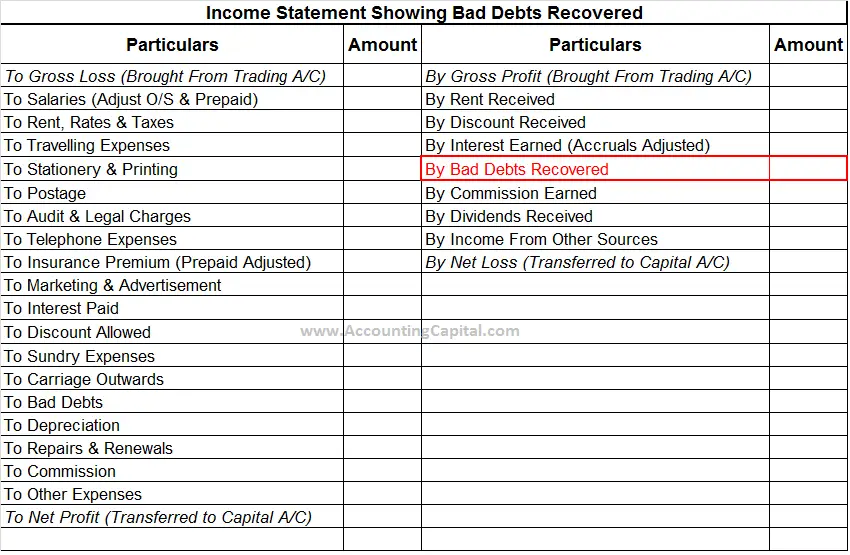

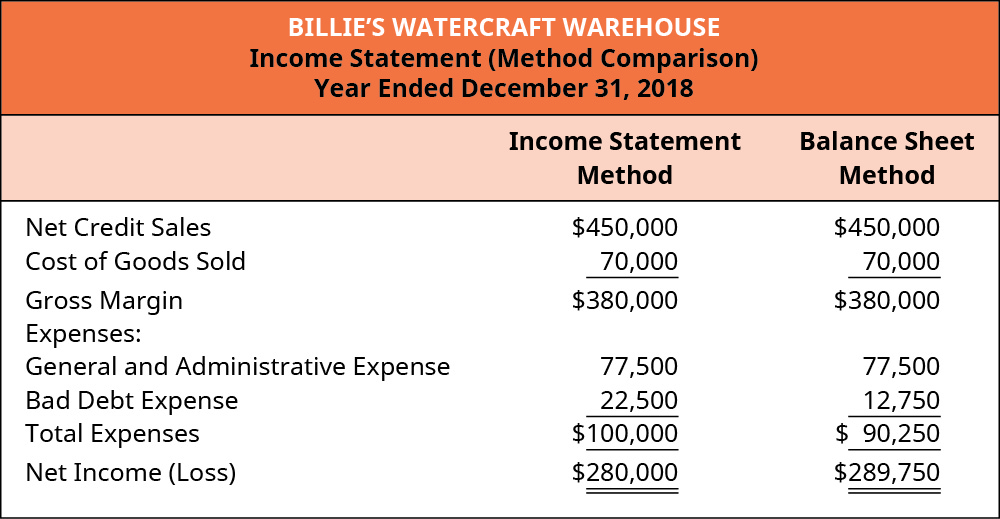

Provision for bad debts in income statement. The entry to increase the credit balance in these contra accounts is a debit to the income statement account Bad Debts Expense. Under this accounting treatment 5420 would be written off as bad debt and provisions for bad debts will be increased from 5600 to 7000 ie. Only change increase or decrease in provision for doubtful is shown in the income statement.

When increase then expense deducted from profit and when decrease then income added in profits. The bad debt provision may affect your cash flow statement but it isnt one of the items the cash flow statement records. If it remains the same then it only affects the balance sheet on the Accounts Receivable.

Some companies might use the description provision for bad debts on its income statement in order to report the credit losses that pertain to the period of the income statement. Definition of Provision for Bad Debts The provision for bad debts could refer to the balance sheet account also known as the Allowance for Bad Debts Allowance for Doubtful Accounts or Allowance for Uncollectible Accounts. Thus the total debit to profit and loss account of Year 2015 would be 6820 ie.

The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the debtors. That gives you a more realistic picture of your businesss income than assuming every receivable will be paid in full. A provision for bad debts is the amount of receivable where the accounts manager feels that certain receivable amount could not be recovered.

It is similar to the allowance for doubtful accounts. If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal credit sales it will appear as an operating expense on the companys income statement. A fixed percentage of trade receivables.

The effects of provision for doubtful debts in financial statements may be summed up as follows. A provision for doubtful debts may be calculated as follows. The bad debt provision reduces your accounts receivable to allow for customers who dont pay up.