First Class Treatment Of Preliminary Expenses In Cash Flow Statement

Examples of Preliminary Expenses are.

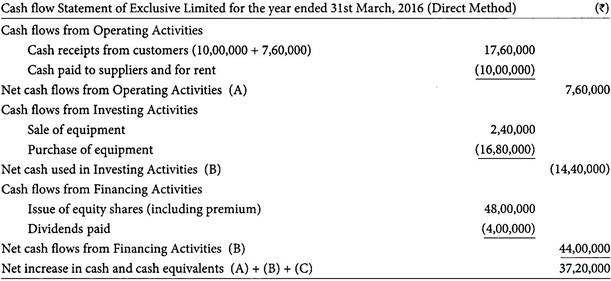

Treatment of preliminary expenses in cash flow statement. The method used is the choice of the finance director. Expense in connection with a marketing survey or feasibility study. The portion which is written off from the gross profit in the current year is shown on the income statement and the remaining balance is placed in the balance sheet.

Legal charges paid before incorporation. Deducted as a cash outflow under cash. Any revenue expenditure whether accrued or paid is reported in the income statement as an operating expense.

Underwriting commission is also an expense related to issue of shares. C All other items for which the cash effects are investing or financing cash flows. Current Period Profit Add.

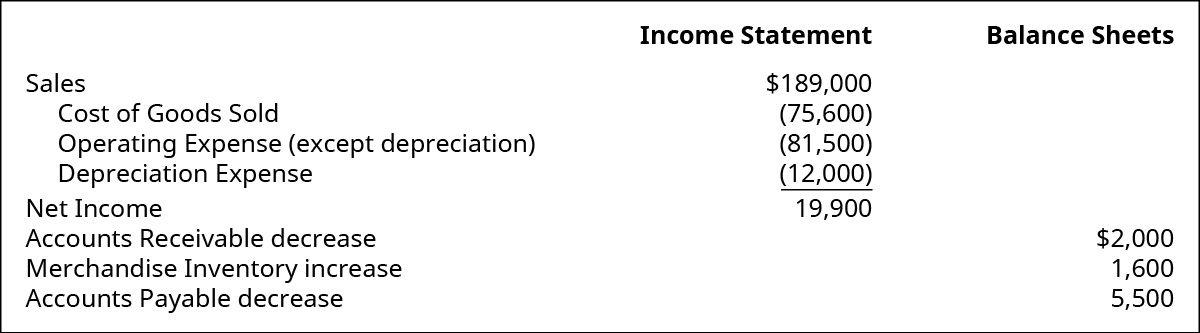

Again it differs from Local GAAP vs IAS. Cash Interest Interest Expense - increase or decrease in interest payable amortization of bond premium or - discount. When the balance of Preliminary Expenses decline from previous year to current year it implies that these expenses are written off.

Any foreign exchange loss since no cash item 5. Many companies present both the interest received and interest paid as operating cash flows. Depreciation Expense 15000 Cash Flow from Operations 21500 Cash Flow from Investments.

Depreciation provided during the year since no cash item 4. However only accrued expenses are accounted for in the balance sheet as a current liability. In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)