Fine Beautiful Can A Balance Sheet Be Negative

The operating statement the balance sheet and the statement of cash flows.

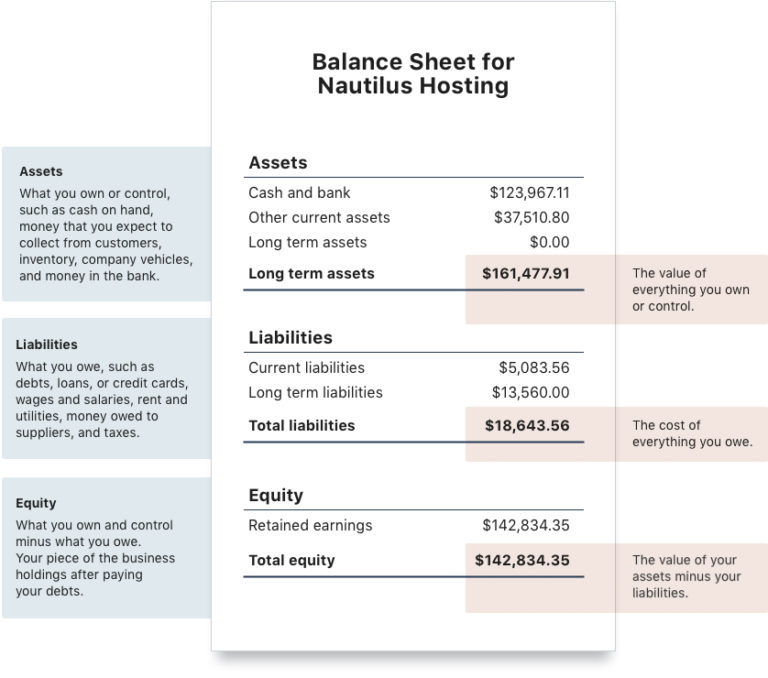

Can a balance sheet be negative. If the current years net income is reported as a separate line in the owners equity or stockholders equity sections of the balance sheet a negative amount of net income must be reported. Items presented in the balance sheet are the account balances presented in the post-closing trial balance. This happens when the business has issued checks for more funds than it has on hand.

Negative retained earnings can be an indicator of bankruptcy since it implies a long-term series of losses. When a company prepares its balance sheet a negative balance in the cash account should be reported as a current liability which it might describe as checks written in excess of cash balance. A negative balance in account Payable now and then implies that bills were entered and checks were composed against those bills yet because of certain reasons the first bills got erased or expelled.

NB for filing to HMRC you have to submit a iXBRL file ie you cant lob them a paper fileso do be warned your hard work in trying to do this yourself might be thwarted at the last minute. If things are bad enough a business can have negative net assets on the balance sheet. Negative Balance Sheets Whilst Companies House will almost certainly accept your accounts as qualified with a negative balance sheet I would suggest you take advice on the implications for your personal guarantees.

Low net assets means that the company doesnt have much cash and property relative to what it owes. The operating statement the balance sheet and the statement of cash flows. If you made a loss in the year you will almost certainly have a negative balance sheet.

Book value is the balance sheet value of assets minus the balance sheet value of liabilities. Although negative cash flow and the inability to pay creditors on time is a clear indicator of financial troubles these may just be temporary but a balance sheet test can provide a broader view of the problems youre facing. You also need to analyse the figures on your balance sheet to be certain of your situation.

The logic is that the company likely issued the checks to reduce its accounts payable. Low cash balances and high net debt are warning signs. The bill installment checks stay unfilled or hanging in the framework demonstrating a negative balance in the Accounts payable.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)