Casual Credit Balance Of Profit And Loss Account Is Written In

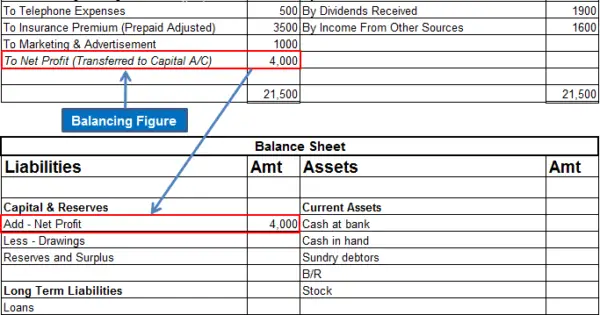

A net profit is a Credit in the Profit and loss account.

Credit balance of profit and loss account is written in. Let the Savings Begin. In case of corporates balance sheet credit balance of profit and loss of previous financial years will be reflected in Balance Sheet on Liabilites Credit side. - Book Keeping and Accountancy Advertisement Remove all ads.

It is added to the amount of capital. When the credit side is more than the debit side it denotes profit. A net loss is a Debit in the Profit and loss account.

PL is an industry abbreviation for profit and loss as in charged off to profit and loss. It is prepared to determine the net profit or net loss of a trader. Hence Credit balance of Profit and loss account is profit.

Ad Find Loss Profit Statement. This will be the accumulated credit balance in Profit and Loss account which will be for previous financial years. Recall that the balance sheet reflects the accounting equation Assets Liabilities Owners Equity.

Content updated daily for balance credit. Under International Accounting Standards the profit and loss account is superseded by the Statement of profit or loss and other comprehensive income. The liabilities and owners equity or stockholders equity are presented on the right side or credit side.

A profit and loss account records all the incomes and expenses that have taken place in the year. The credit balance of Profit and Loss Account is regarded as net profit. Ad Find Loss Profit Statement.