Brilliant Distinguish Between Horizontal And Vertical Analysis Of Financial Statement Data

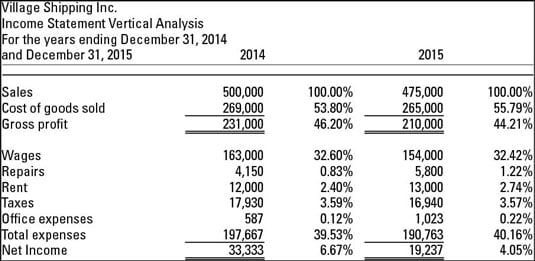

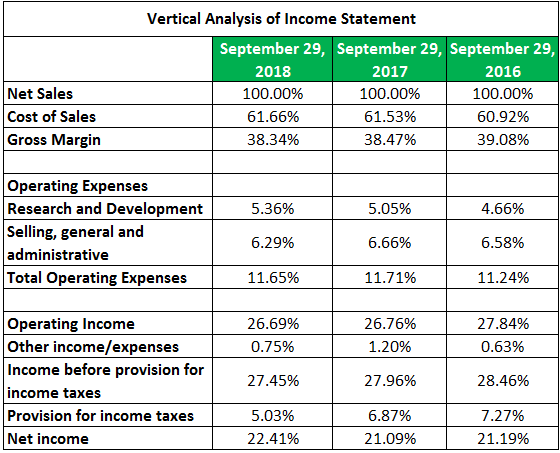

Vertical analysis refers to financial statement amounts expressed each year as proportions of a base such as sales for the income-statement accounts and total assets for.

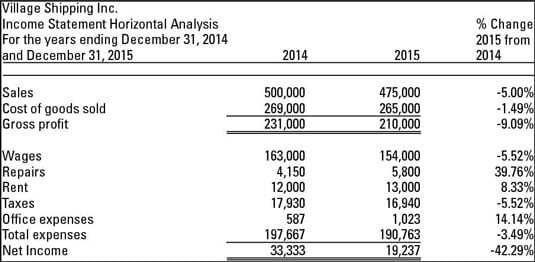

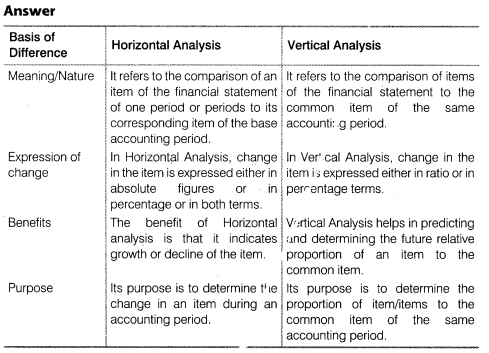

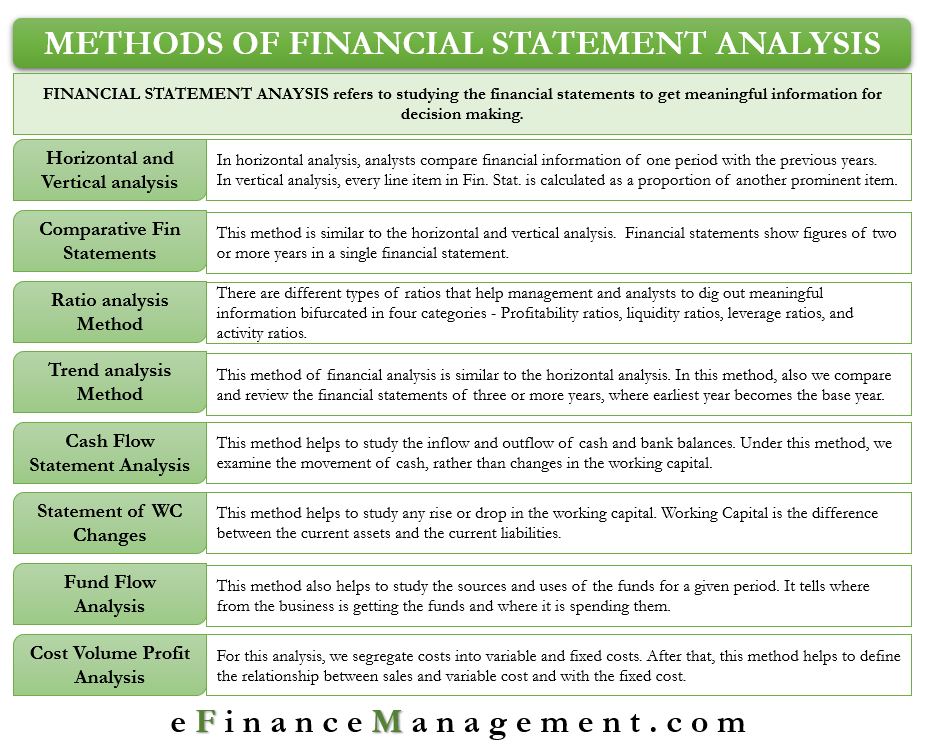

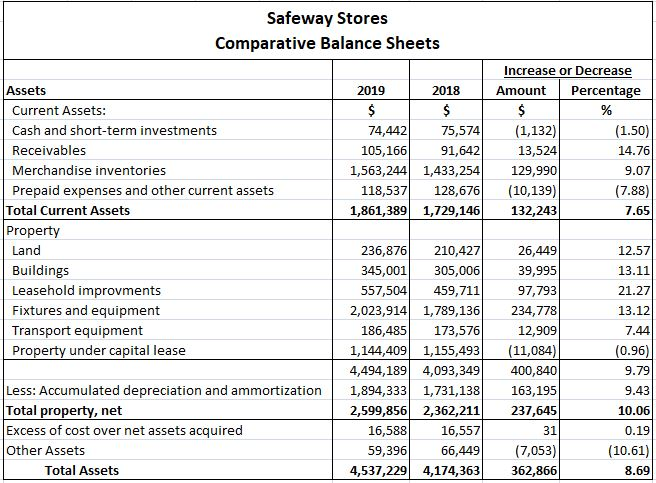

Distinguish between horizontal and vertical analysis of financial statement data. What other kinds of comparisons might an analyst make. Specifically its an analysis of the trends for one or a couple. Study of percentage changes in comparative financial statements.

Horizontal analysis is performed horizontally across time periods while vertical analysis is performed vertically inside of a column. Horizontal analysis refers to changes of financial statement numbers and ratios across two or more years. Horizontal analysis represents changes over years or periods while vertical analysis represents amounts as percentages of a base figure.

Its main aim is to compare line items to calculate the changeover the time. Definition of Vertical Analysis. What is meant by the term financial leverage.

In Horizontal Financial Analysis the comparison is made between an item of financial statement with that of the base years corresponding item. Horizontal analysisalso known as trend analysis is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of time. Horizontal analysis is useful because it helps a company identify trends and predict future performance.

For vertical analysis the firm compares the financial statement figures for. 100 8 ratings 15-1 Horizontal analysis examines how a particular item on a financial statement such as sales or cost of goods sold behaves over time. Distinguish between horizontal and vertical analysis of financial statement data Horizontal-how a particular item behaves over time Vertical-item over particular period.

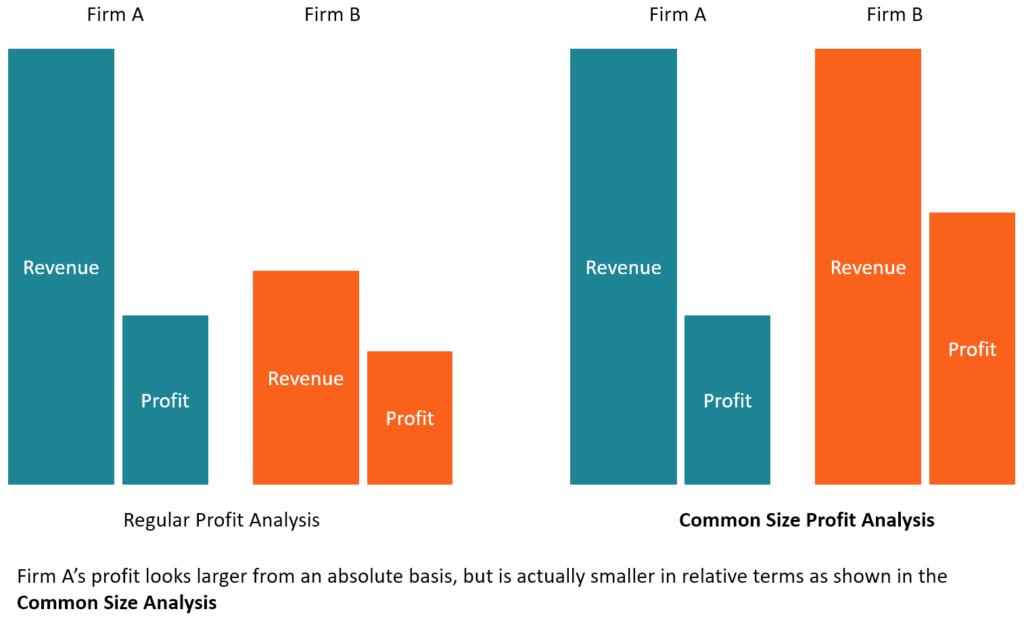

Leave a Reply Cancel reply. Analysis of financial statement that reals the relationship of each statement item to a specific base which is the 100 figure. Vertical analysis also called common-size analysis focuses on the relative size of different line items so that you can easily compare the income statements and balance sheets of different sized.