Formidable Direct And Indirect Cash Flow Statement Investopedia

The direct method is a better indicator of company solvency has a sounder conceptual framework and reflects accepted business practice.

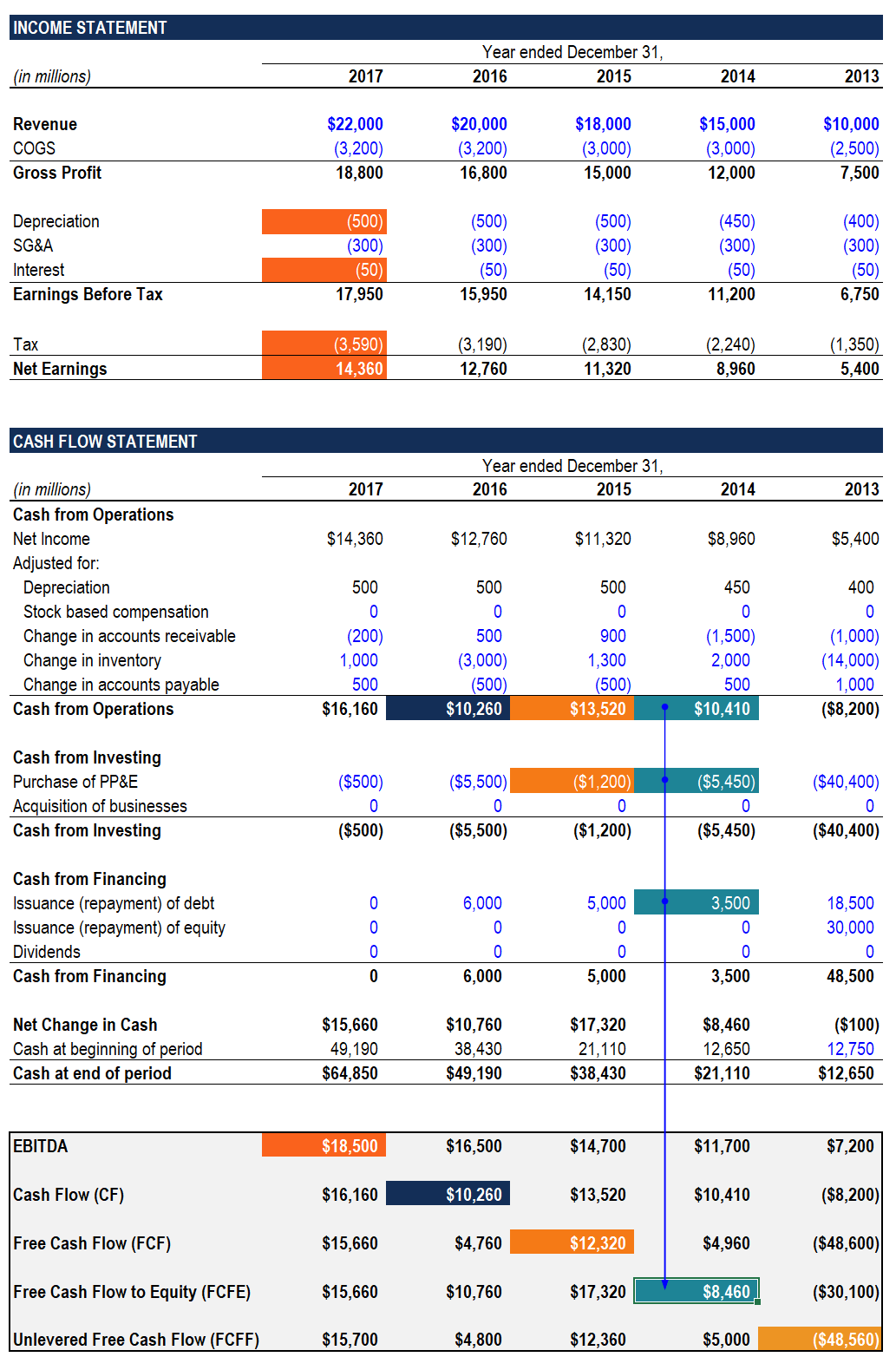

Direct and indirect cash flow statement investopedia. There are two ways to prepare your cash flow statement. Either the direct or indirect method may be used to report net cash flow from operating activates. With the indirect cash flow method you begin with your net income and then add back or deduct those items that do not impact cash.

As an analytical tool the statement of cash flows. It permits an evaluation of cash flow relating to specific line items of income statement such as sales and cost of goods sold. The statement starts with the operating activities section.

The indirect method works from net income so the bottom of the income statement and adjusts it to the cash basis. In direct method the cash flow from business activities are broken down into cash inflows and cash outflow. We are now ready to prepare the statement of cash flows.

In other words changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow. The direct method of cash flow and the indirect method of cash flow. Direct and indirect cash flow are two methods of arriving at the net cash flow from operating activities in the cash flow statement.

This process comes in handy when there is a higher volume of transactions. The statement of cash flows under indirect method for Tax Consultation Inc. Indirect method of cash flow Both methods of cash flow analysis yield the same total cash flow amount but the way the information is presented is different.

Basically indirect method is a reconciliation of net income. Using a firms Balance Sheet Income. The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/cash-flow-concept-992325826-02e39ab9d9394062817a6dd4c62b7a56.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)