Stunning Cash Budget Uses

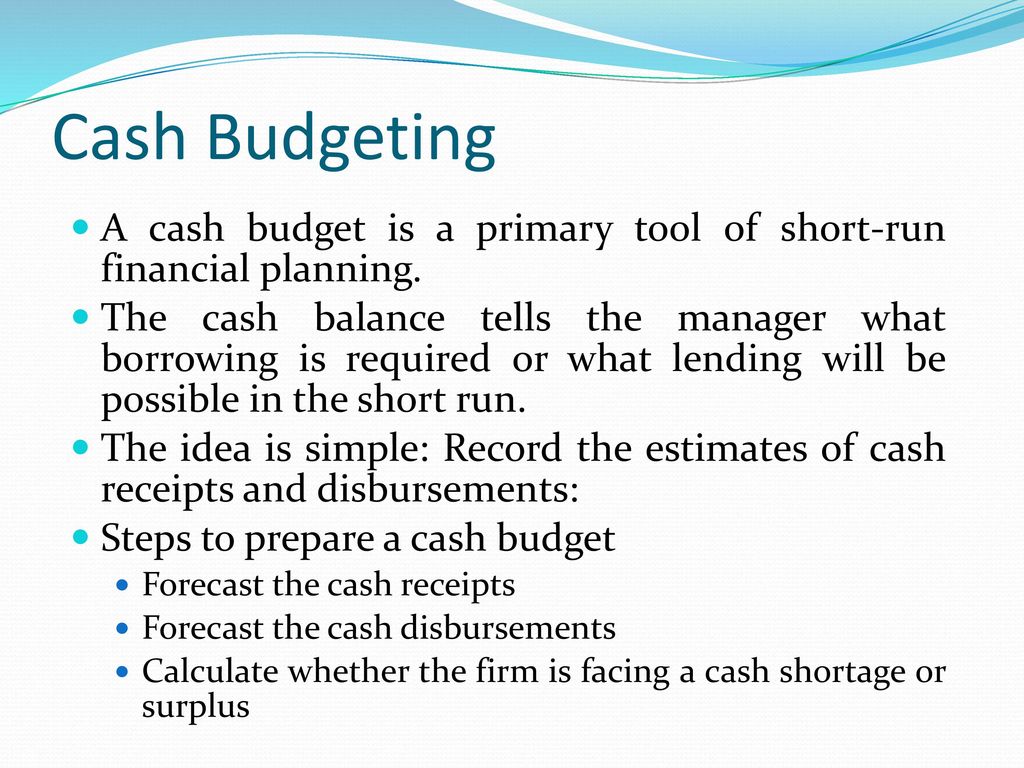

A cash budget is a document produced to help a business manage their cash flow.

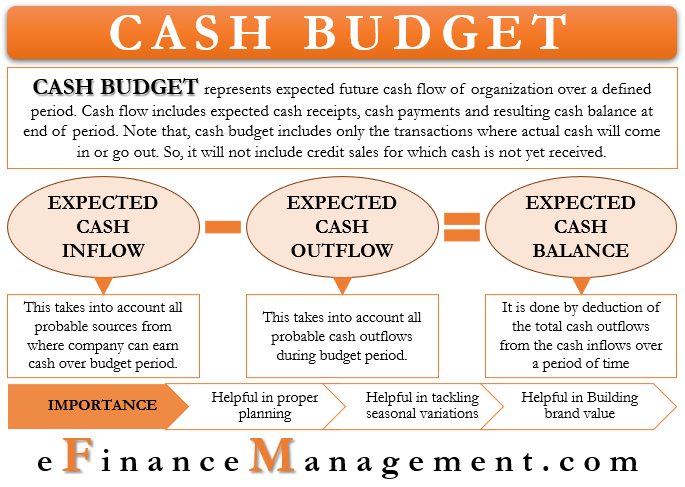

Cash budget uses. Variable costs which include expenses like fuel lodging and other operating costs range greatly from month to month. Cash Budget A cash budget is a forecast of estimated cash receipts estimated cash payments and the resultant cash position for a certain period of time. This involves estimates of revenue.

Why is a cash budget important. It can also be used to determine whether too much of a companys cash is being spent in unproductive ways. A cash budget is prepared in advance and shows all the planned monthly cash incomings receipts and.

Cash budget is an extremely important tool available in the hands of a finance manager for planning fund requirements and for controlling cash position in the firm. Ie month-by-month or even week-by week. This budget is used to ascertain whether company operations and other activities will provide a sufficient amount of cash to meet projected cash requirements.

For example a company experiencing cash budget problems may need to borrow money in the short term for emergency equipment repairs the payment of taxes or a monthly payroll. The cash flow budget is an effective way to keep up with real-time company expenditures. Cash disbursements Companies need cash to pay for purchases wages rent interest income taxes cash dividends and most other expenses.

There is no guarantee that cash. Half the sales are normally paid for in the month in which they occur and the customers are rewarded with a 5 cash discount. A Cash budget represents the expected future cash flow of an organization over a defined period of time.

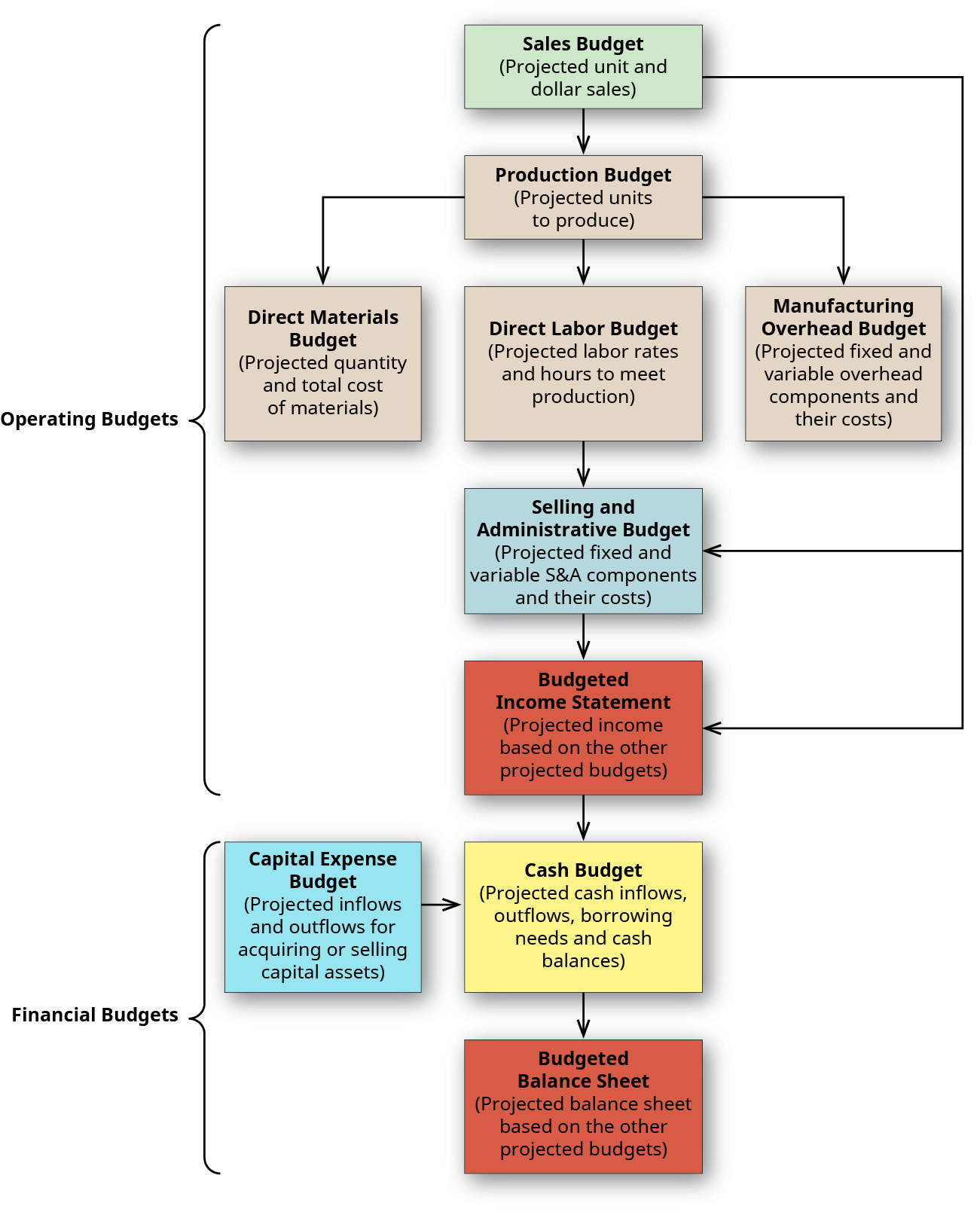

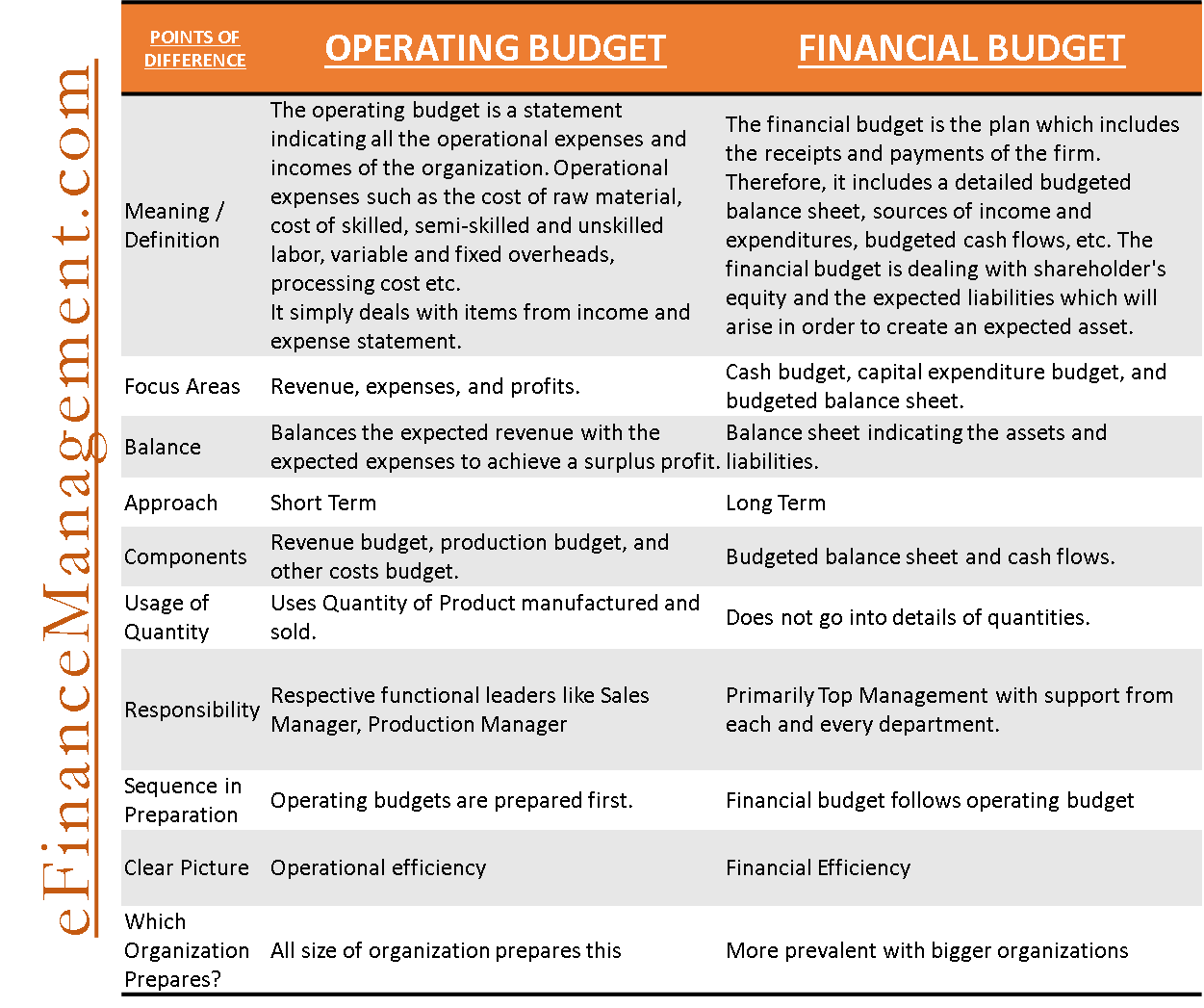

That means each annual budget is an estimate based on the previous results generated. Budgeting is an integral part of running a business efficiently and effectively. The primary use of a cash budget is that it allows a company to map out expected inflows and outflows of cash during a specified period of time usually a year.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)