Cool Stockholders Equity Partial Balance Sheet

This total represents the accounting value of all stockholders stake in the company.

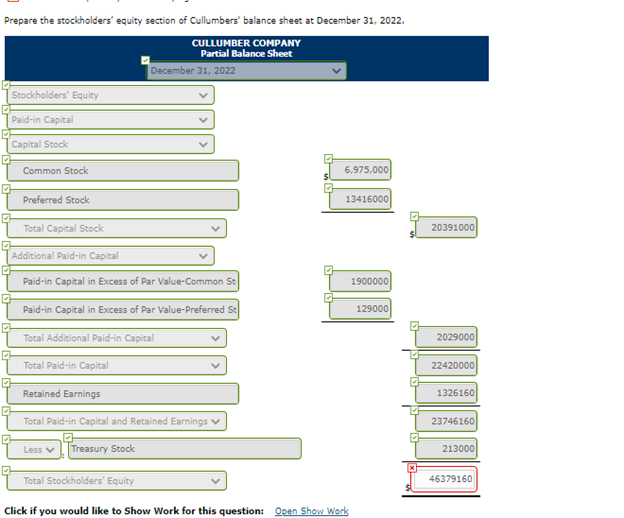

Stockholders equity partial balance sheet. Liabilities and owners capital are the two major sources of financing the assets of a company. Stockholders equity represents the cumulative net contributions by stockholders plus accumulated earnings less dividends. What youll find under stockholders equity On the balance sheet what gets listed as stockholders equity typically falls into two categories.

Shareholders equity is an important metric for investors. Stockholders equity aka shareholders equity is the accounting value book value of stockholders interest in a company. This guide will show you how to calculate stockholders equity for a balance sheet.

Stockholders equity is the value of a firms assets that remain after subtracting liabilities. Stockholders equity is synonymous with net worth or net assets assets less liabilities. If the stockholders equity is negative then the balance sheet is in deficit.

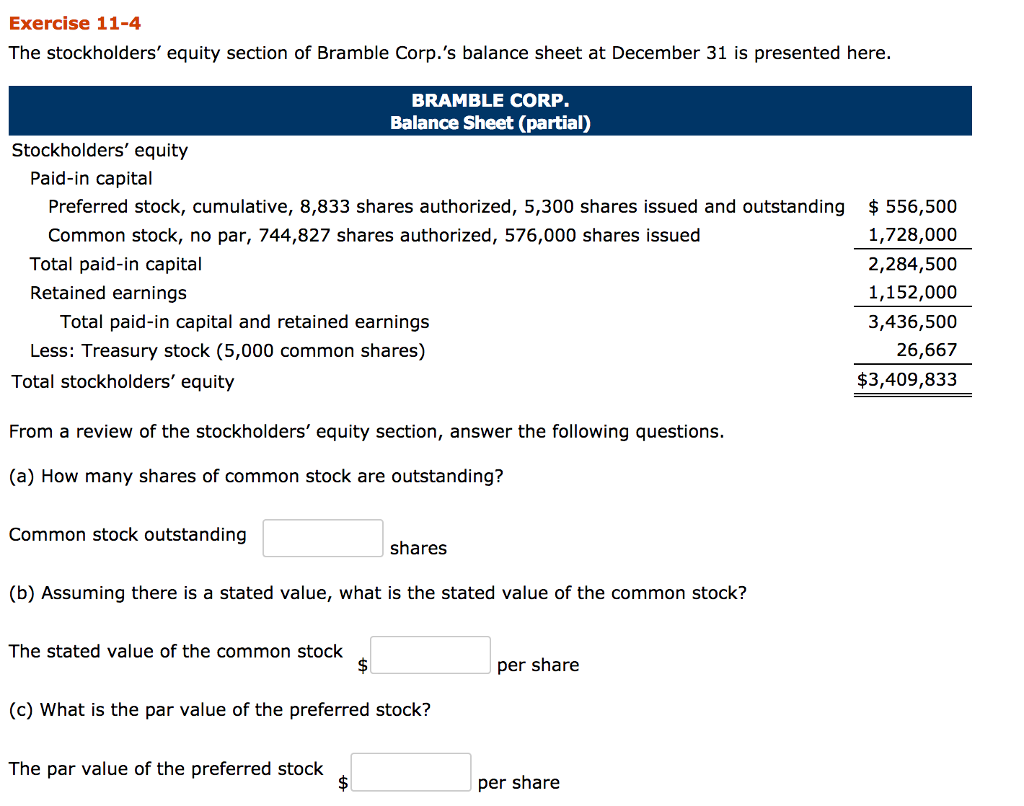

Information regarding the par value authorized shares issued shares and outstanding shares must be disclosed for each type of stock. Kohls has several line items comprising its stockholders equity. Stockholders equity is a key component of an organizations financial statements that can be used to evaluate its financial condition.

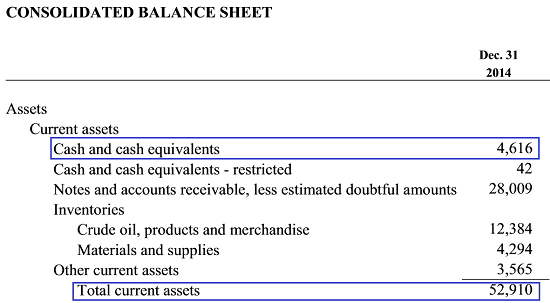

This amount appears on the balance sheet as well as the statement of stockholders equity. If the company is a sole proprietorship it is referred to as Owners Equity The amount of Stockholders Equity is exactly the difference between the asset amounts and the liability amounts. This means that the total value of a firms assets must equal the sum of its liabilities plus shareholder equity.

Keep in mind the shareholders interest is a residual one. The total amount of the stockholders equity section is the difference between the reported amount. Every balance sheet must balance.