Outrageous Voluntary Separation Payment In Cash Flow

Reduces profit but does not impact cash flow it is a non-cash expense.

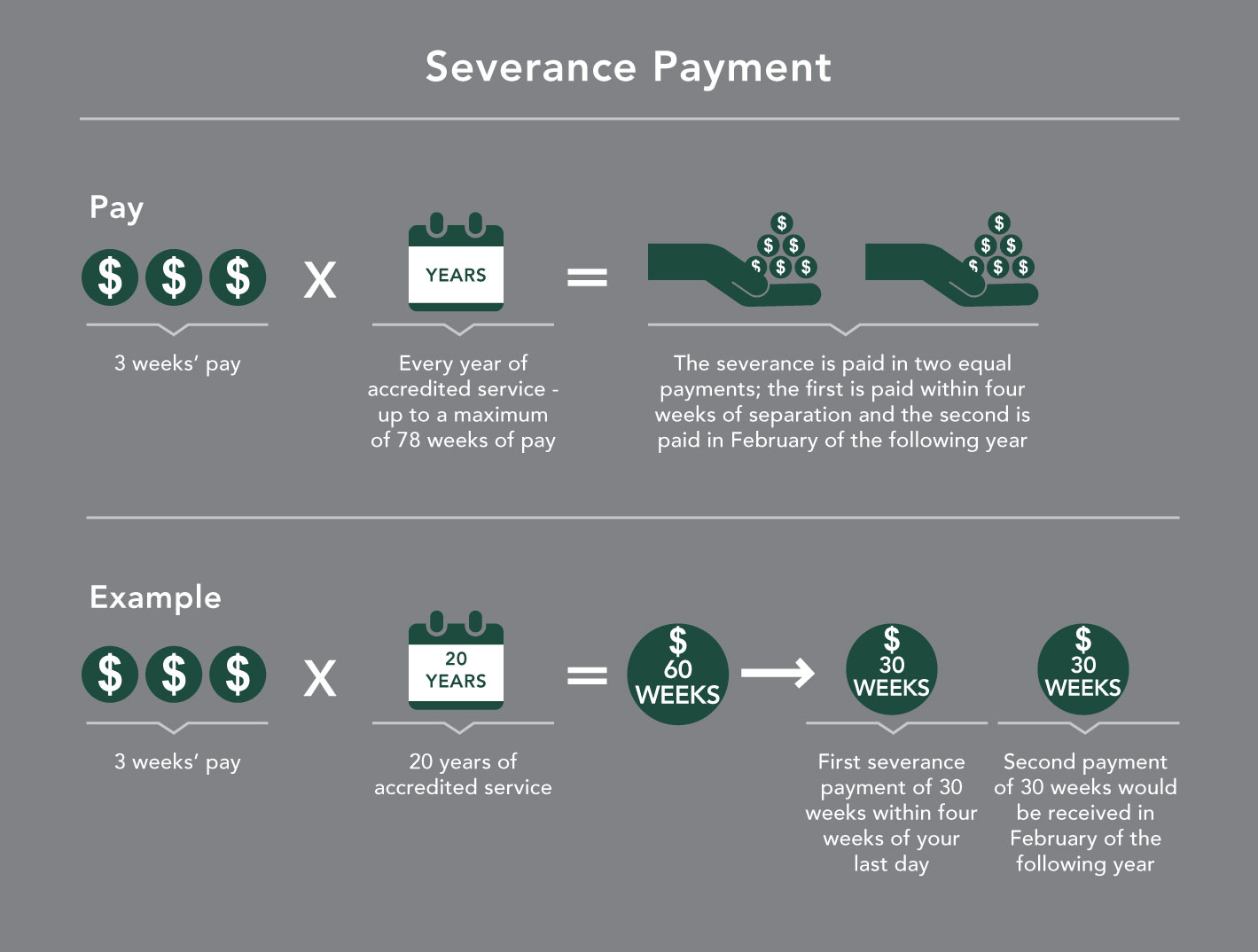

Voluntary separation payment in cash flow. Cash flow from operations is the section of a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Cash payments of income taxes unless they can be specifically identified with financing and investing activities. The payment will equal three months of annual salary based upon your annual base salary as of September.

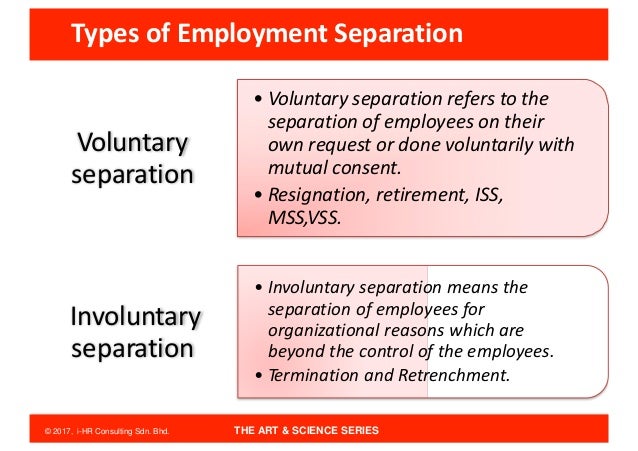

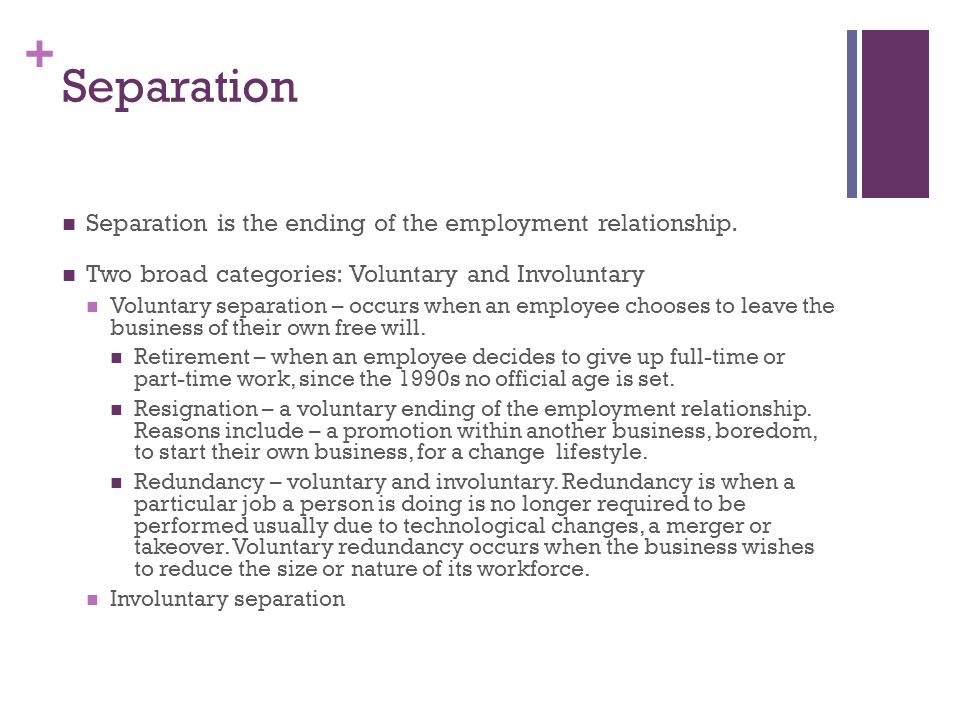

We find that corporate voluntary disclosure is negatively associated with the separation of cash flow rights from control rights. 15 June 2010 It means voluntary retirement cost n d same will be considered as operating exp for the purpose of cash flow statement. It is a defined period in time over which a defined cash flow amount is being.

However errors in the statement. The net position is shown in case of operating cash flows. The information provided in a statement of cash flows.

In order to minimise the risk of errors misuse of funds or fraudulent activities all financial transactions eg. Receipting cash or making payments should pass. Cash withdrawal limit incase of Pvt Ltd company.

392 Separate accounts. Cash flows are classified and presented into operating activities either using the direct or indirect method investing activities or financing activities with the latter two categories generally presented on a gross basis. Recreation club for all financial transactions.

1 The accounting principles related to the statement of cash flows have been in place for many years. Find out if these payments are assessable income to the volunteer. Receipts and cash payments of an entity during a period.