Smart Disclosure Of Related Party Transactions In Financial Statements

Appendix A Guidance on financial statements disclosures.

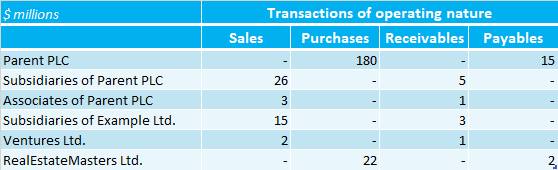

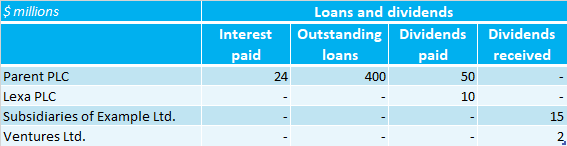

Disclosure of related party transactions in financial statements. Paragraph 339 outlines the disclosures required when an entity has related party transactions. For each related party disclosed in Note 19 include a separate paragraph presenting the following information. The entire disclosure for related party transactions.

C and entity and its principal owners. Intragroup related party transactions and outstanding balances are eliminated except. Cash and cash equivalents 115 8.

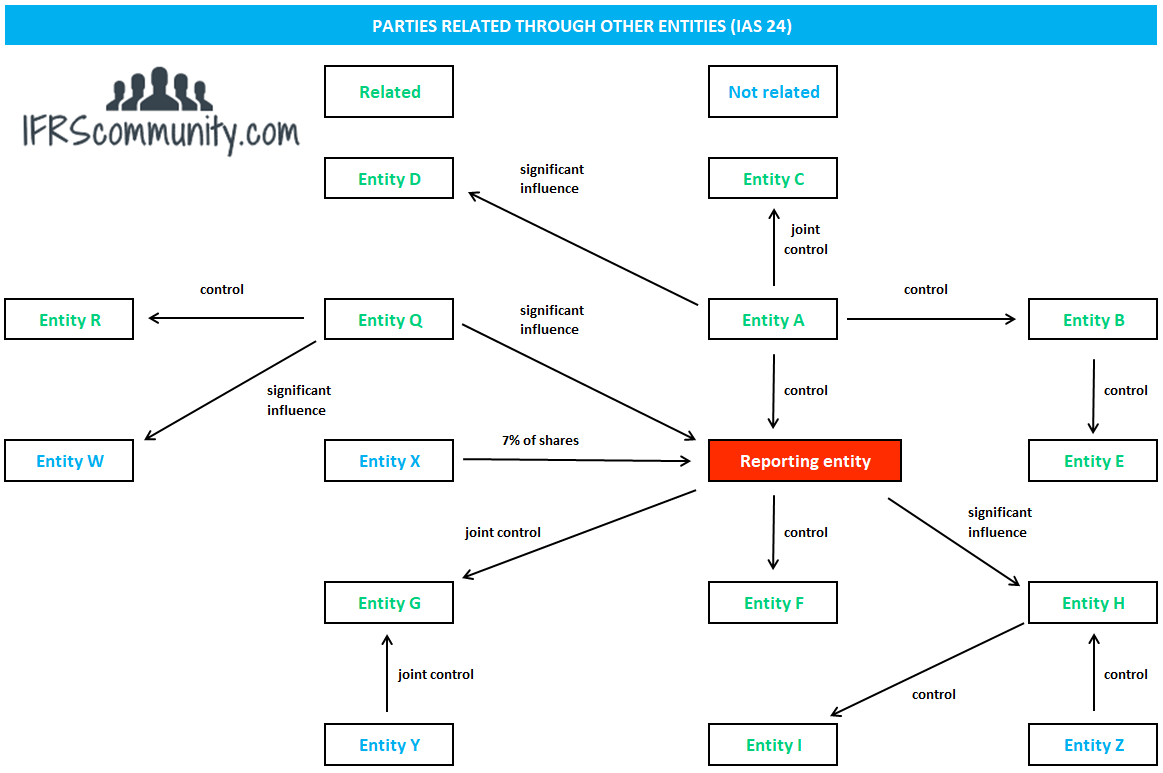

B subsidiaries of a common parent. To reflect that transaction may not be at arms length price. In addition to disclosing the nature of the related party relationship and information about the transactions outstanding balances and commitments necessary for an understanding of the effect of the related party relationship on the financial statements a reporting entity is also required to disclose.

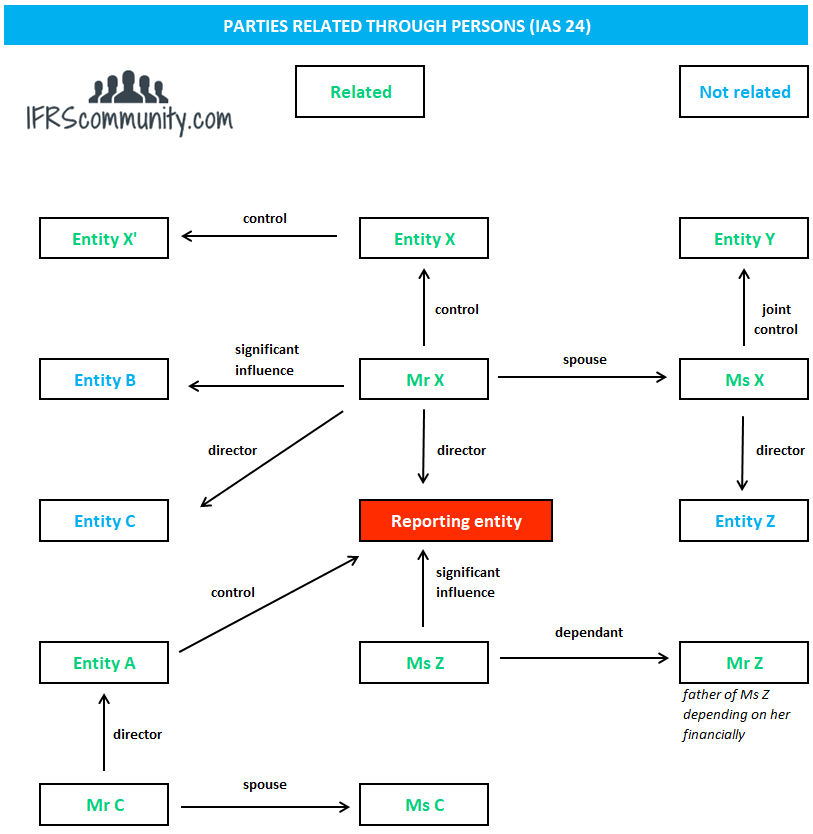

Existence of related parties. The financial reporting framework may require disclosure in the financial statements of certain related party relationships and transactions such as those required by IAS 24. 19-2020 defines related party transaction as the transfer of resources services or obligations between a reporting entity and a related party regardless of whether a price is charged.

A description of the nature of the relationship involved including the name of the related party A description of each type of transaction including the total dollar amount completed in the current year and transactions. The transaction occurs between two unrelated parties and is not affected by any relationship. To understand clearly RR No.

4 Related party transactions and outstanding balances with other entities in a group are disclosed in an entitys financial statements. Examples of related party transactions include transactions between a a parent company and its subsidiary. Intragroup related party transactions and outstanding balances are eliminated in the preparation of consolidated financial statements of the group.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)