Great Modified Cash Standards

Issued the Modified Cash Standard hereafter the Standard which sets out the principles for the recognition recording measurement presentation and disclosure of information required in terms of the prescribed formats.

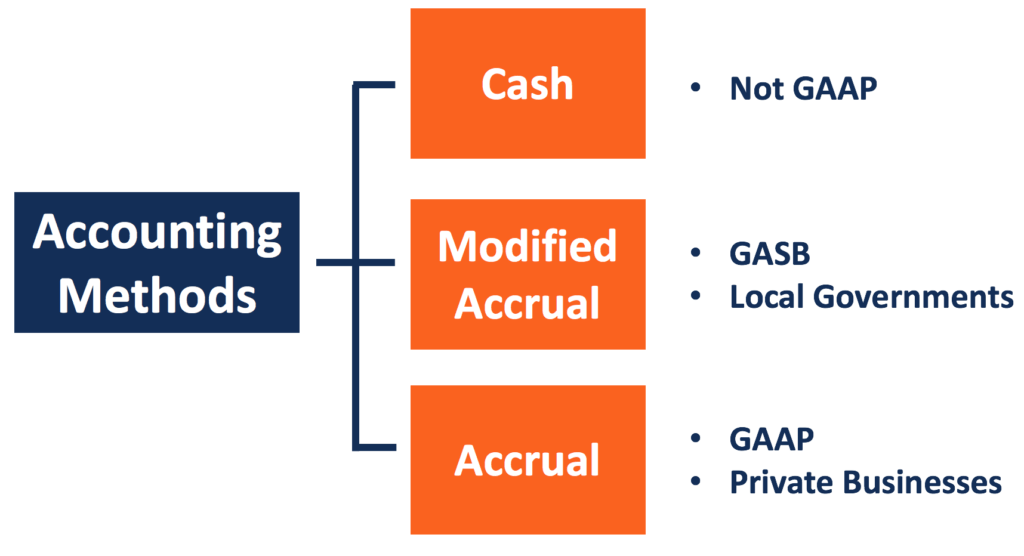

Modified cash standards. 03 Departments that claim compliance with the modified cash basis of accounting must adhere fully with. To avoid cash basis or modified cash basis statements being mistaken for GAAP financial statements different titles are used for them. Issued the Modified Cash Standard hereafter the Standard which sets out the principles for the recognition recording measurement presentation and disclosure of information required in terms of the prescribed formats.

If youre a small business owner using cash basis but need some extra insight into say inventory or accounts receivable modified cash basis can be the middle ground that you need. Modified cash accounting also costs less than accrual accounting. The importance of the reporting attributes in GAAP to a special purpose framework such as the cash basis or modified cash basis is a matter of professional judgment.

The Office of the Accountant General OAG in the National Treasury has developed and issued the Modified Cash Standard which is a generally recognised accounting practice for departments and sets out the principles for the recognition recording measurement presentation and disclosure of information required in terms of the prescribed formats. This MCS implementation course focusses on the recognition recording measurement and disclosure requirements as determined by. This short course provides detailed knowledge for the implementation and financial reporting as required by the Modified Cash Standard prescribed by the National Treasury as applicable to South African National and Provincial Government Departments and their ocials.

The auditor will then make the following determinations. The modified basis has the following features. The Office of the Accountant-General OAG in the National Treasury has accordingly developed and issued the Modified Cash Standard hereafter the Standard which sets out the principles for the recognition recording measurement presentation and disclosure of information required in terms of the prescribed formats.

Modified cash basis provides an extra level of insight into your financials that you arent able to gain by just using cash basis. The Office of the Accountant General OAG in the National Treasury has developed and issued the Modified Cash Standard which is generally recognised accounting practice for departments and sets out the principles for the recognition recording measurement presentation and disclosure of information required in terms of the prescribed formats. The Office of the Accountant General OAG in the National Treasury has developed and issued the Modified Cash Standard which is generally recognised accounting practice for departments and sets out the principles for the recognition recording measurement presentation and disclosure of information required in terms of the prescribed formats.

It follows the cash-basis method to record short-term events and follows the accrual method to record long-term events. I If the current award is 50 million or more or if less than 50 million but the client receive 50 million or more in net CAS covered awards in the preceding cost accounting period or the client received a single CAS covered contractsubcontract of 50 million or more during the current cost accounting period the contract or subcontract is subject to full CAS coverage or all of the 19 standards. Records short-term items when cash levels change the cash basis.