First Class Types Of Expenses On Income Statement

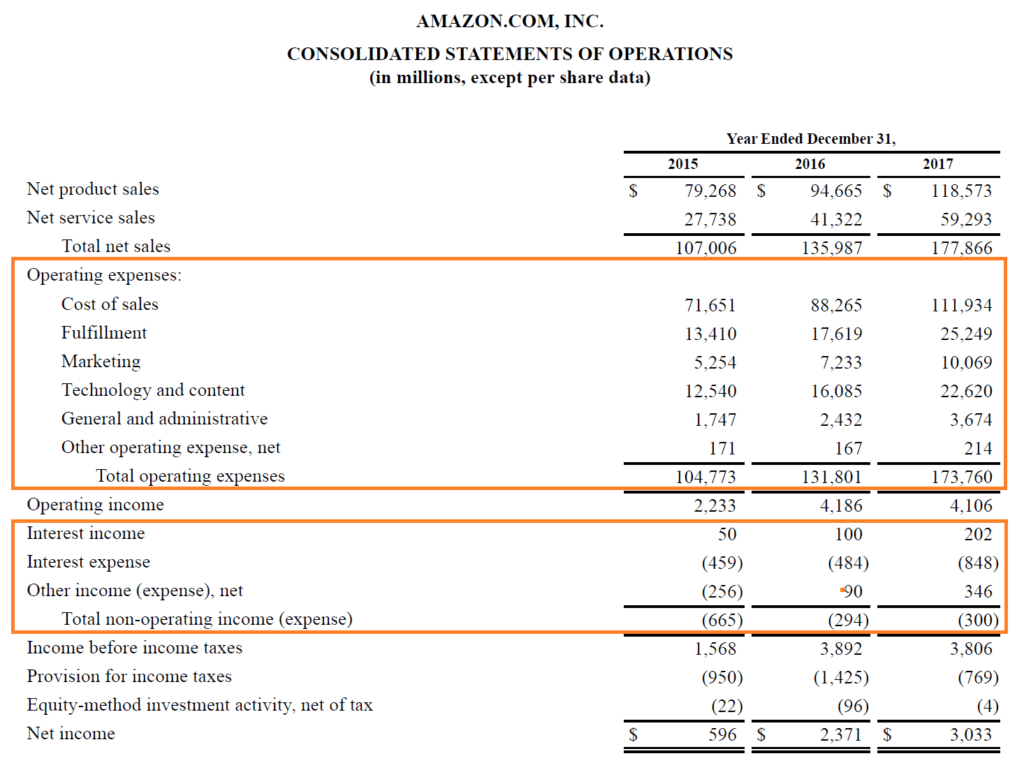

If an expense isnt directly related to producing or making a good or service also known as the cost of goods sold it counts as an operating expense.

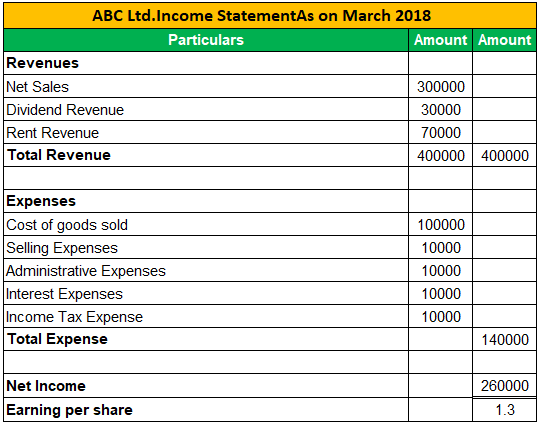

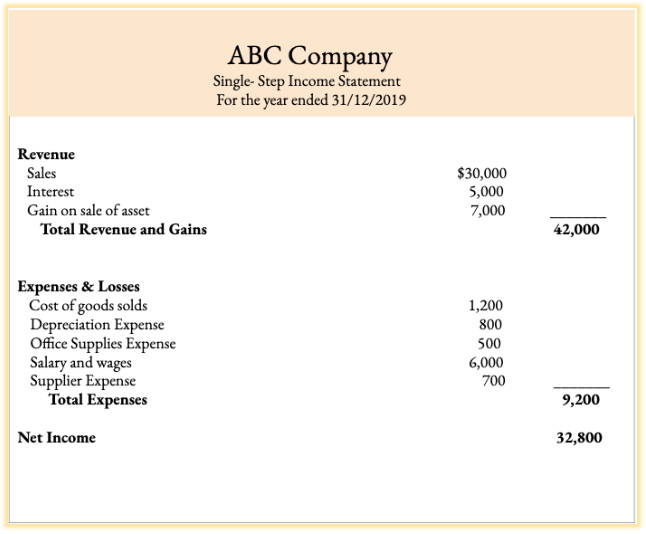

Types of expenses on income statement. Ad Managing your expenses has never been easier. They appear on the income statement under five major headings as listed below. As the name suggests a single-step income statement is a simplified version of the income statement compared to the multi-step income statement.

Examples are sales salaries wages fringe benefits advertising travel entertainment catalogues rent utilities telephone commissions warehousing shipping depreciation office supplies postage etc. The entity could choices to prepare and present its revenues and expenses in two different formats either. According to the statistics from the Small Business Administration there are 302 million of small businesses across the United States of America which accounts for 999 of all companies in the United States.

A separate statement of profit or loss and a statement of other comprehensive income. The income statement comes in two forms multi-step and single-step. Cost of Goods Sold COGS.

Types of Expenses. Validate or refuse with just one click. In a single statement of profit or loss and other comprehensive income.

Far more common and often much more important for most types of businesses is the interest expense on the income statement. The income statement summarizes a companys revenues and expenses over a period either quarterly or annually. This figure shows how much it costs to borrow money from banks brokers and other sources to meet short-term needs such as working capital buying property buying plant equipment or supplies or bulking up on inventory.

Validate or refuse with just one click. It tells the financial story of a businesss activities. Salaries and Wages as Expenses on Income Statement Salaries and wages of a companys employees working in nonmanufacturing functions eg.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)