Supreme Debt To Equity Ratio Interpretation Example

If the company for example has a debt to equity ratio of50 it means that it uses 50 cents of debt financing for every 1 of equity financing.

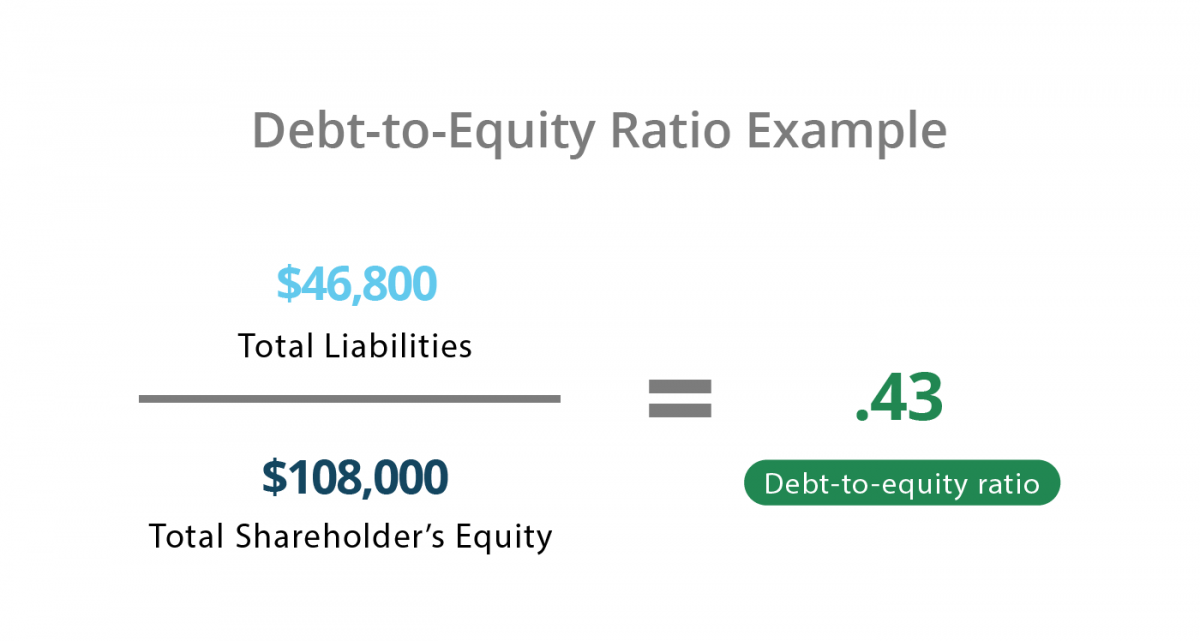

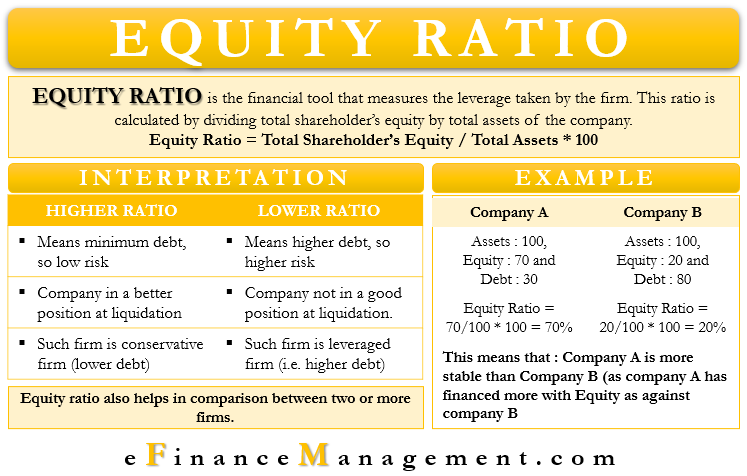

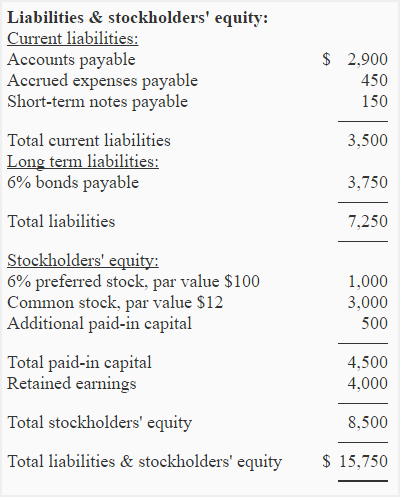

Debt to equity ratio interpretation example. The debt-to-equity ratio shows the proportion of equity and debt a company is using to finance its assets and signals the extent to which shareholders equity can fulfill obligations to creditors. By itself a low debt-to-equity ratio may not mean that a company is a good potential investment. From the balance sheet we can see that the business has a long-term debt amount of 102408 million.

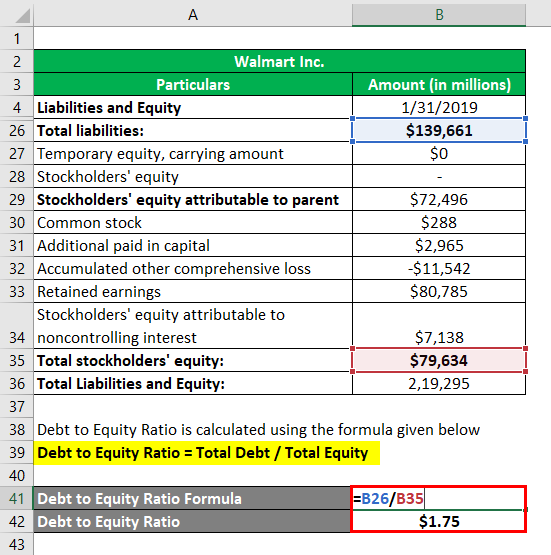

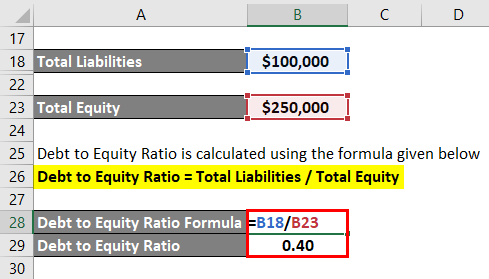

Interpreting Debt to Equity Ratio For example a debt to equity ratio of 15 means a company uses 150 in debt for every 1 of equity ie. To illustrate suppose the company had assets of 2 million and liabilities of. As evident from the calculation above the DE ratio of Walmart is 068 times.

For example if a company took on debt for expansion purposes their debt-to-equity ratio may be high this year but it may be a positive sign of growth. 54170 79634 068 times. Debt level is 150 of equity.

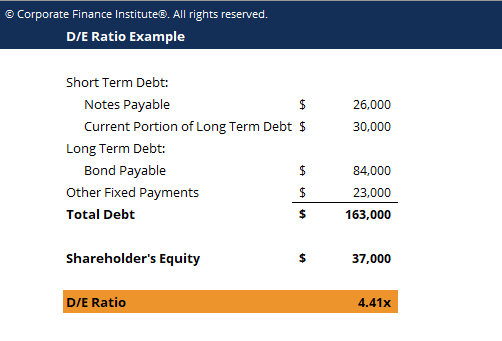

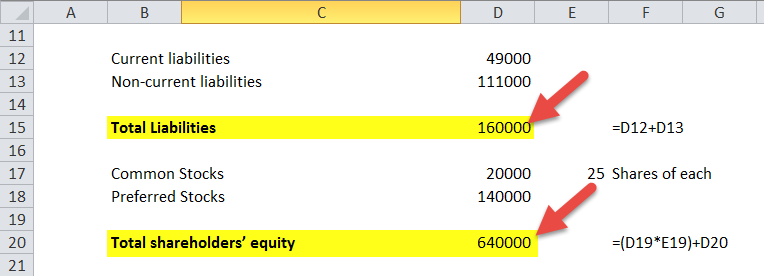

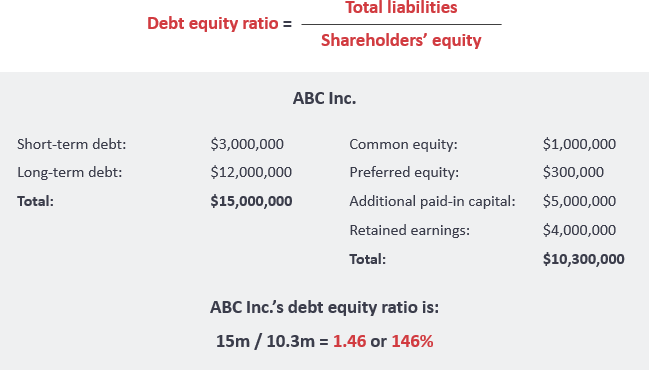

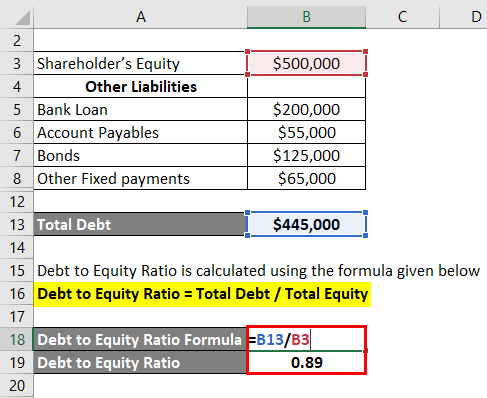

Debt Equity Ratio Formula Total Debt Total Equity. Debt to Equity Ratio Total Debt Total Equity. Suppose the ratio comes to be 12 it says that for every 1 financed by debts there are 2 being brought in by the equity shareholders.

Interpretation of Debt to Equity Ratio The ratio suggests the claims of creditors and owners over the assets of the company. Another version of Debt-Equity ratio known as external-internal equity ratio is where relationship is established between borrowed funds and owners equity. Long Term Debt to Equity Ratio Example For this example we will look into the balance sheet of American automaker corporation GoCar in the fiscal year of 2019.

On the other hand if a company doesnt take debt at all it may lose out on the leverage. What this indicates is that for each dollar of Equity the company has Debt of 068. For example if a company is too dependent on debt then the company is too risky to invest in.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)