Cool Common Size Statement Value Of Interest Expense

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

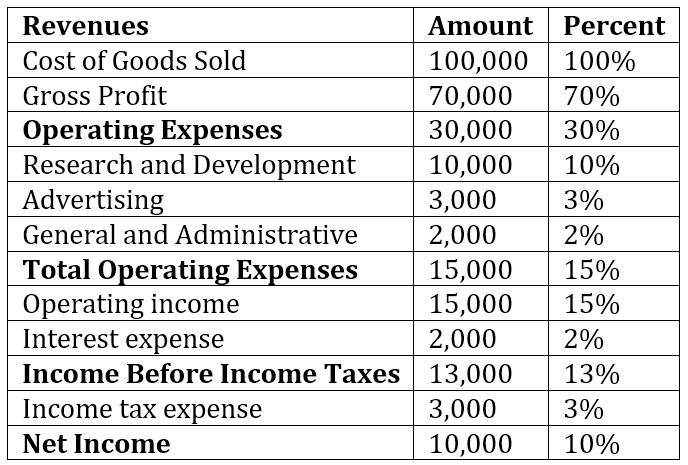

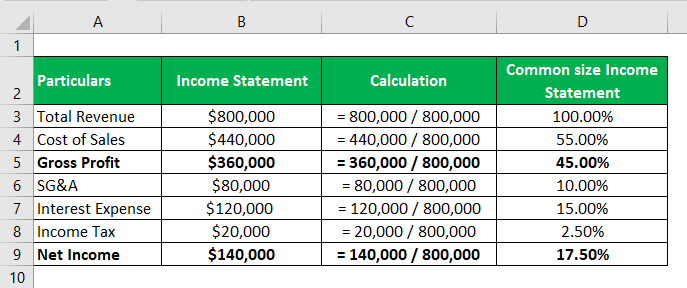

What is the common-size statement value of the interest expense.

Common size statement value of interest expense. Interest expense is 50. Last year which is used as the base year a firm had cash of 52 accounts receivable of 218 inventory of 509 and net fixed assets of 1107. 50000 350000 or 143.

200000 350000 or 571. Creating common size financial statements makes it. What is the common-size statement value of the interest expense.

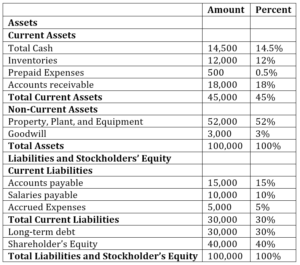

Common size analysis mostly uses the total assets value as the base value. What is the return on equity. 1 to evaluate information from one period to the next within a company and 2 to evaluate a company relative to its competitors.

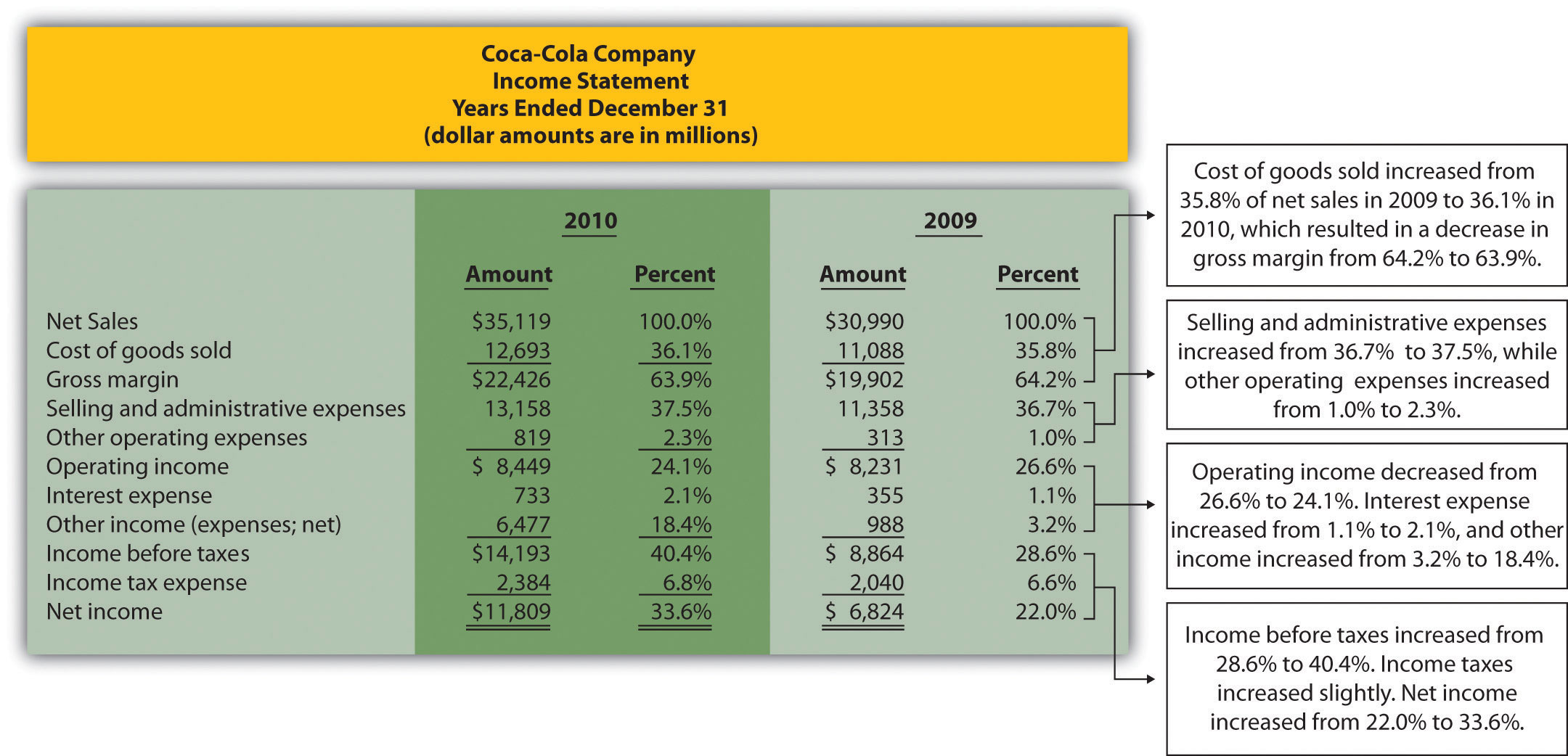

A sales minus accounts receivable divided by sales. Interest expense is 40. The common-size percent is simply net income divided by net sales or 336 percent 11809 35119.

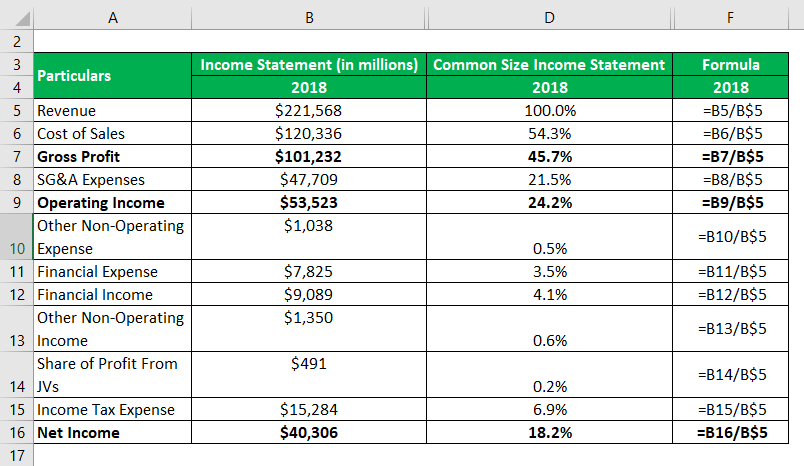

Gross profit operating income marketing expenses by revenue or sales. For example gross margin is calculated by dividing gross profit by sales. Lee Suns has sales of 3000 total assets of 3000 and a profit margin of 5.

What is the common-size statement value of the interest expense. This means your common size ratios are. To find the common size ratio of each sales line item take the amount and divide it by 350000.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)