Fantastic Income Tax Form 26as Pdf

To record such tax credits of an assess the Department of Income Tax maintains Form 26AS.

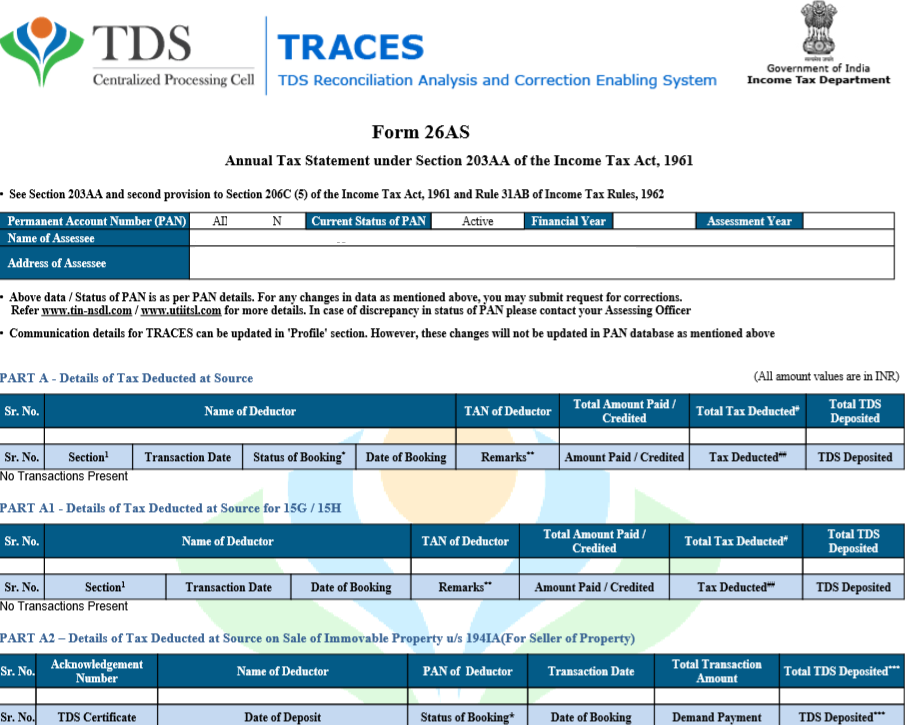

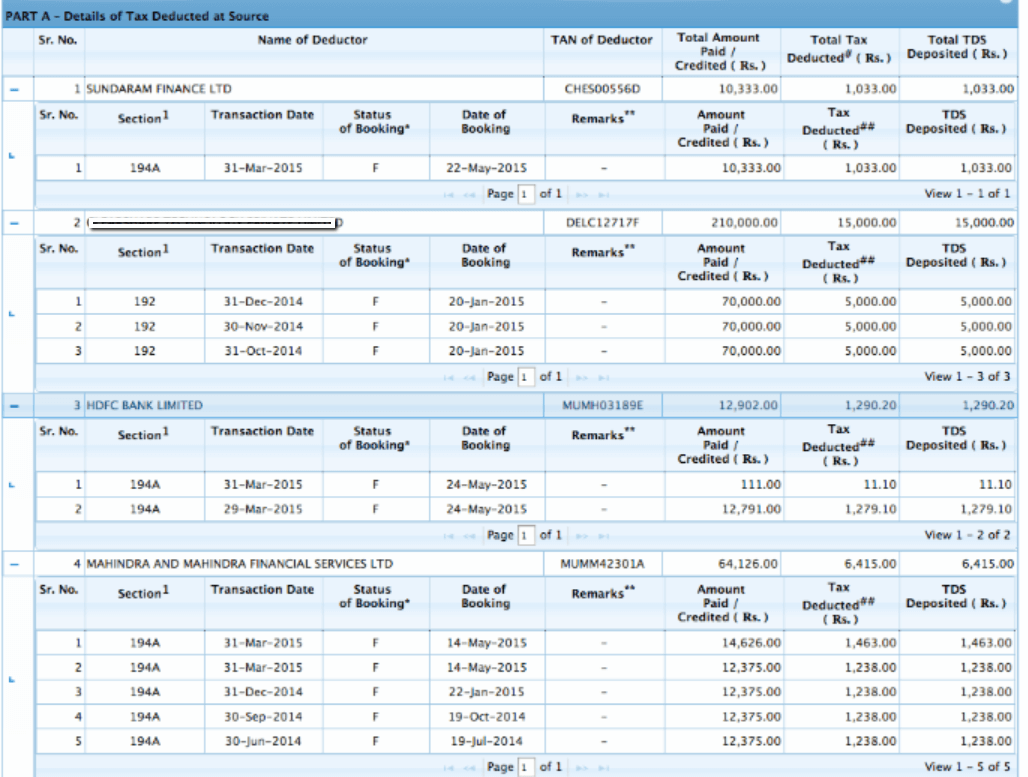

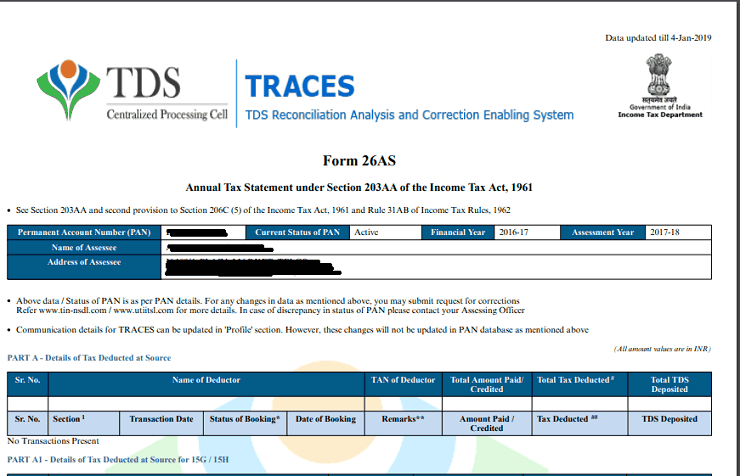

Income tax form 26as pdf. The Income Tax Department updates the TDS details in Form 26AS on basis of details provided by the person deducting the tax ie the deductor hence if there is any default on the part of deductor like non -furnishing of TDS details ie TDS return to the ITD deducting the tax in incorrect PAN etc. Any other information in relation to sub-rule 2 of rule 114-I _____ 1. Information relating to payment of taxes 4.

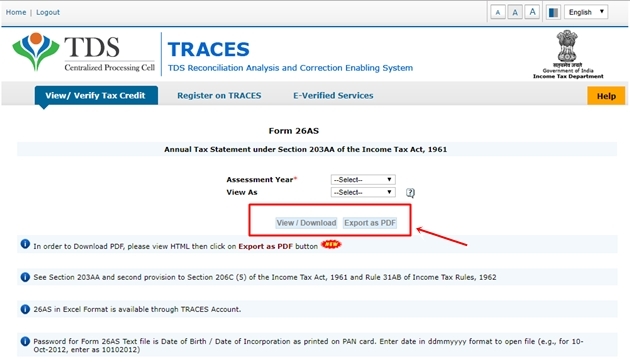

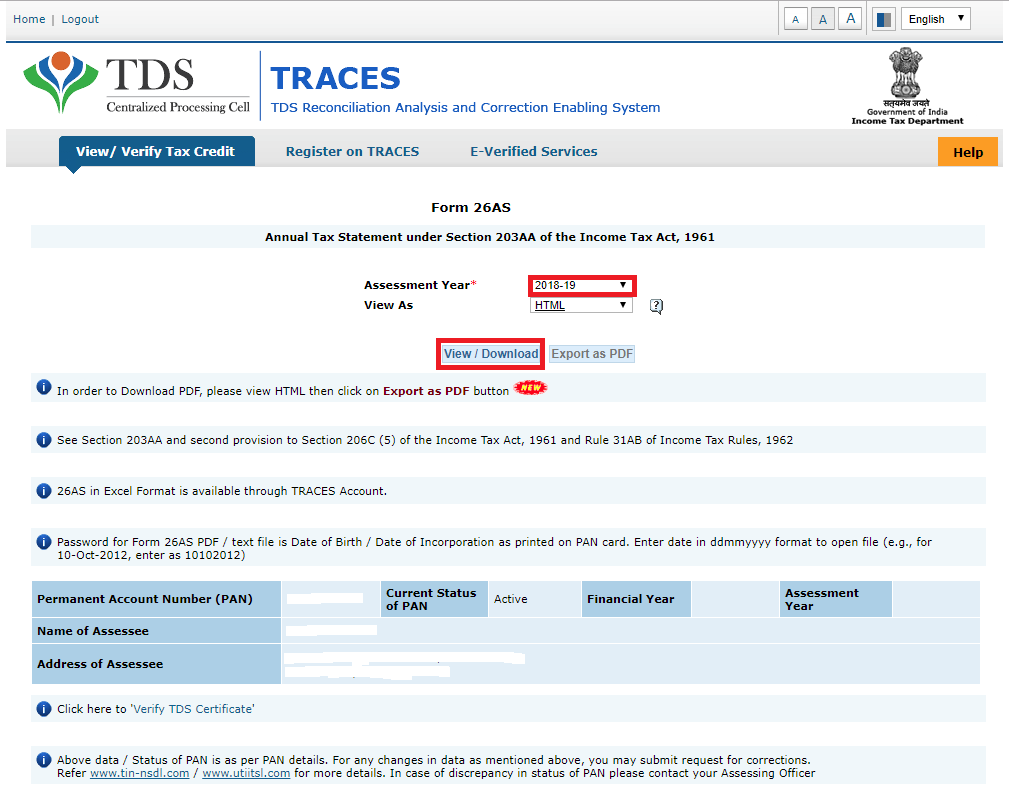

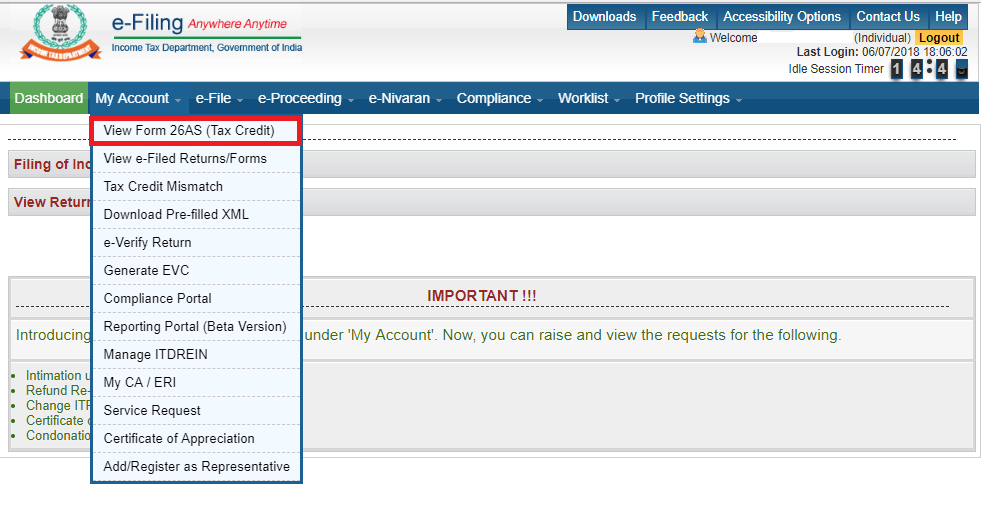

View Tax Credit Statement Form 26AS Perform the following steps to view or download the Form-26AS from e-Filing portal. Information relating to pending proceedings 6. The new Form 26AS offers a more detailed view of the financial information of the assessee.

Part A- Part A provides details of tax deducted for taxpayer by deductors This part of form 26AS mentions the amount of TDS deducted and deposited TAN of the deductor. Form 26AS contains the following information partwise. Log in to income tax new website incometaxgovin.

Create Legally Binding Electronic Signatures on Any Device. It is one of the most important documents taxpayers should verify before filing their ITR. Substituted by the Income-tax Eleventh Amendment Rules 2020 wef.

To download ones Form 26As the income taxpayer needs to log in at the new income tax website wwwincometaxgovin. Data updated till 21-Jul-2018 Form 26AS Annual Tax Statement under Section 203AA of the Income Tax Act 1961 See Section 203AA and second provision to Section 206C 5 of the Income Tax Act 1961 and Rule 31AB of Income Tax Rules 1962 Permanent Account Number PAN GYCPS3989A Current Status of PAN Active Financial Year 2017-18 Assessment Year 2018-19 Name of Assessee. Ad E-sign DOC JPG.

There are other two ways to download this tax. Information relating to demand and refund 5. Then Form 26AS will not reflect the actual TDS.