Beautiful Income Measurement Process For A Merchandising Company

These entities use the same basic accounting methods as service companies but the process of buying and selling merchandise required some additional accounts and concepts.

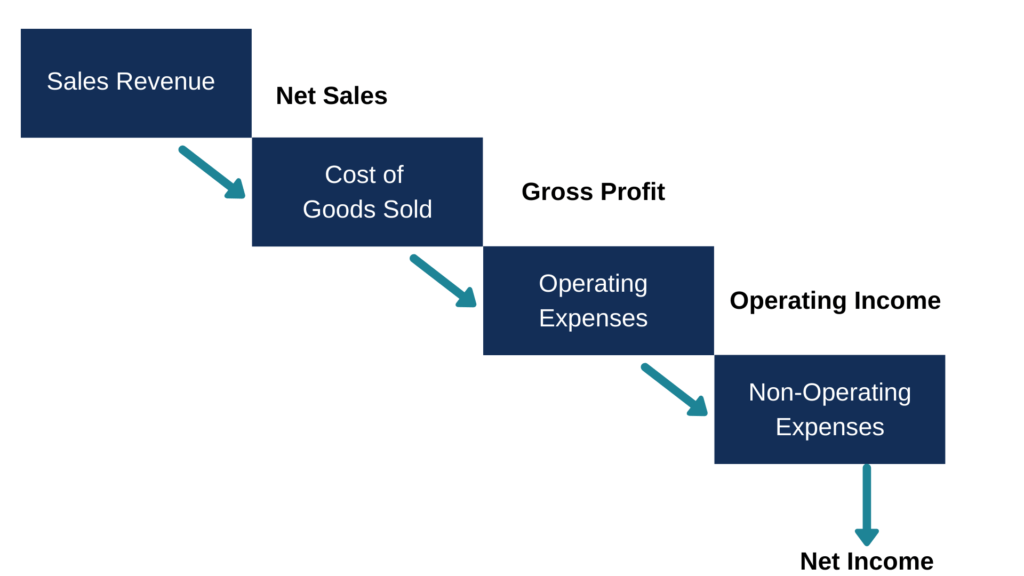

Income measurement process for a merchandising company. A Determine the missing amounts 1 through 5. An income statement that shows only one step in determining net income. Sales Revenue Less Cost of Goods Sold Equals Gross Profit Less Operating Expenses Equals Net Income 4.

B The income measurement process is as follows. However the income statement for the service company subtracts the operating expenses from the revenues to arrive at net income. Selected information from the income measurement process for a service company and a merchandising company is shown below.

How does income measurement differ between a merchandising company. Selected information from the income measurement process for a service company and a merchandising company is shown below. Net income is measured as the difference between revenues from services and expense.

Sales Revenue - Cost of goods sold Gross profit - Operating expenses Net Incomeloss. Just like all income statements the first line is revenue. Companies that provide services such as Ernst Young accounting and Accenture LLP consulting do not sell goods and therefore have no inventoryThe accounting process and income statement for service companies are relatively simple.

Sales revenue - cost of goods sold gross profit - operating expenses profit loss before income tax -. A Determine the missing amounts 1 through 5. Expenses for a merchandising company must be broken down into product costs cost of goods sold and period costs selling and administrative.

Summarize the income measurement process for a merchandising company. As you can see in merchandising companies we have more specialcomponents of revenues and expenses than service. To determine the cost of goods sold in any accounting period management needs inventory information.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)