Neat Loss On Disposal Double Entry

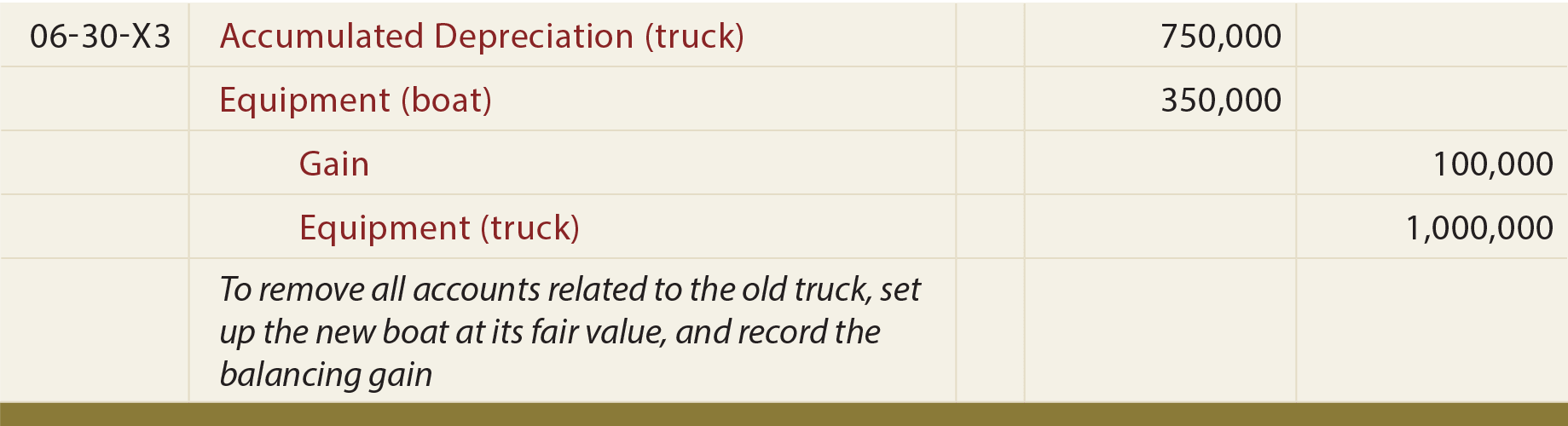

As consideration received is higher than carrying value by 105000 230000 125000.

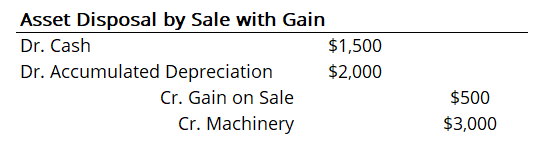

Loss on disposal double entry. Assuming the transaction has commercial substance first we need to calculate the loss on disposal of the old motor vehicle. On the disposal of asset accounting entries need to be passed. This gain on disposal is recorded by making following journal entry.

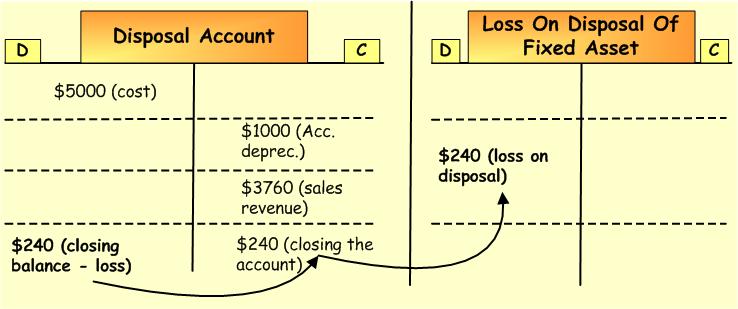

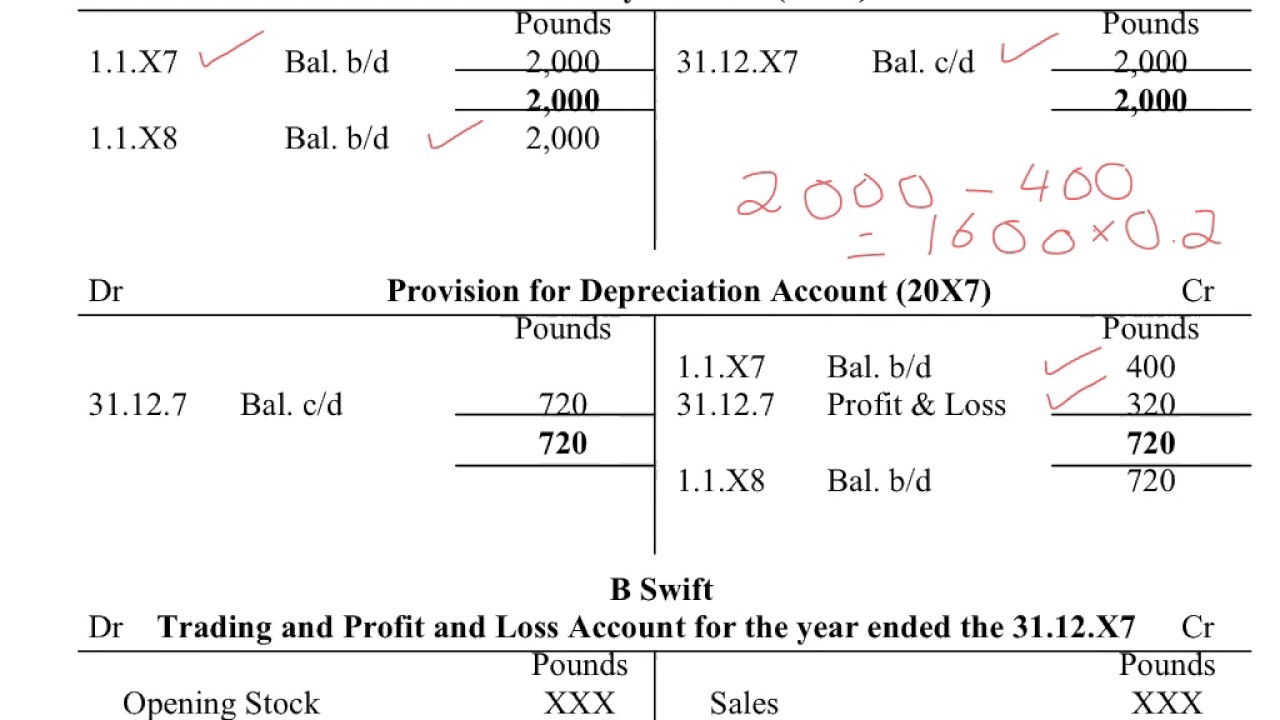

Any remaining difference between the two is recognized as either a gain or a loss. Less carrying amount of investment in Baby in Mommys financial statements. When a non-current asset is sold there is likely to be a profit or loss on disposal.

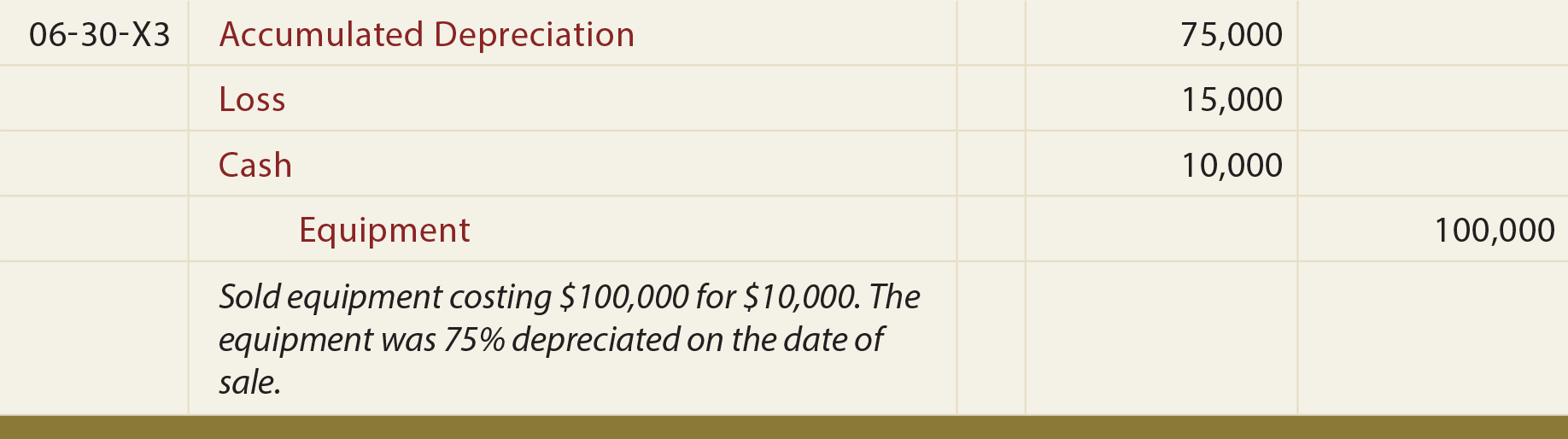

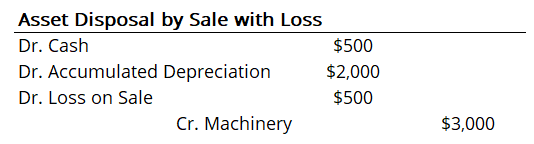

The accounting for disposal of fixed assets can be summarized as follows. The account is usually labeled GainLoss on Asset Disposal. Loss on Disposal of a Fixed Asset.

Profit or Loss on Disposal of Asset. Double entries for property disposal. Investment property held on companys accounts at 250k made up of cost 190k and revaluation in 2016 of 60k - reflecting market value.

If the sales proceeds were lesser that the machines carrying amount the company would have suffered a loss on disposal. It is not necessary to keep an asset until it is scrapped. Disposal account 105000 Credit.

Fair value of consideration received. The asset may be sold at profit or loss. The remaining value of the fixed asset needs to be shown as an expense on the profit and loss account and reducing the fixed asset value in the balance sheet.