Casual Bonus Payable In Balance Sheet

The Employee Bonus Payable would normally be shown on the balance sheet under long-term liabilities asked Sep 23 2015 in Business by NYNancy Indicate whether the.

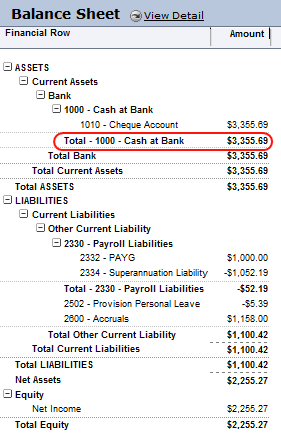

Bonus payable in balance sheet. So when the company decided to pay the bonus for its employees then those accounts should be treated as the bonus expenses under the salary expenses classification and then recognize payable at the same time in the balance sheet. One question you need to answer before accounting for any bonuses however is if they will be payable at all. If the tax is no longer collectable or the employee you had bonus obligation against gets fired and doesnt have the right for the bonus any longer and so on.

You can see the profit levels being earned or decision was made and agreed with the employees that no matter what the bonus will be paid you account for the payable balance and if its less likely the bonus will be paid out you dont account for the payable balance. This assumes that the bonus liability will be. Companies like to reward the shareholders without affecting the cash flows.

If the bonus is more probably going to be paid out ie. For example you may give an employee a flat bonus of 300 per quarter. Bonus is payable annually within 8 months from close of accounting year.

19 The Employee Bonus Payable would normally be shown on the balance sheet under long-term liabilities. Types of Notes Payable on Balance Sheet. Where in respect of any accounting year referred to in section 10 the allocable surplus exceeds the amount of minimum bonus payable to the employees under that section the employer shall in lieu of such minimum bonus be bound to pay to every employee in respect of that accounting year bonus which shall be an amount in proportion to the salary or wage earned by the employee during the.

You can choose to accrue a flat rate or percentage for a bonus. Bonus shown as payable to employees is taken into consideration for computation of tax on Salary income of employees. The Two and a Half Month Rule If a company accrues a bonus expense at the end of one tax year and does not pay out the bonus within two and a half months of the year end these payments are not tax deductible unless the employee receiving the bonus has reported the bonus payment.

The Employee Bonus Payable would normally be shown on the balance sheet under long-term liabilities. The news of the issuance of bonus shares brings cheer to the investors. This preview shows page 2 - 5 out of 12 pages.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)