Neat Cash Flow Projection Definition

The cash flow forecast shows what cash was paid or received by the business during the accounting period.

Cash flow projection definition. Martin Gillespie 2 min read A Cash Flow Forecast is a tool that is used by a company to help them understand where their organisations cash balances will be at certain points in the future. Small business cash flow projection. Operating cash flow includes all.

Cash flows refer to the movements of money into and out of a business typically categorized as cash flows from operations investing and financing. Cash flow is the change in cash or treasury position from one period to the next period. A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

This includes calculating your income and all of your expenses which will give your business a clear idea on how much cash youll be. Cash flow projection involves calculating both expenses and income and using this information to determine how much cash will be left after a set period of time. The accounting period can be any length but is usually a month or a year.

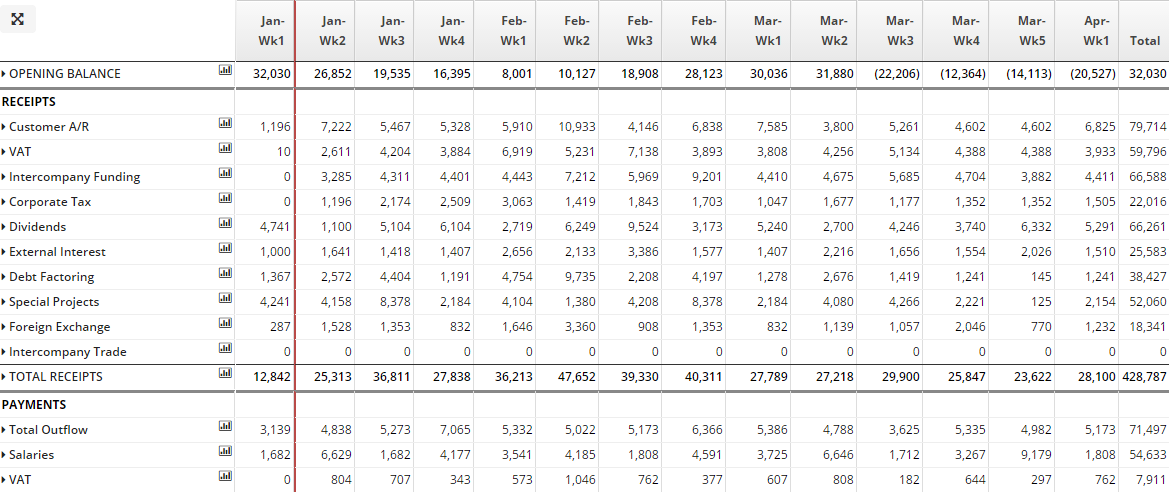

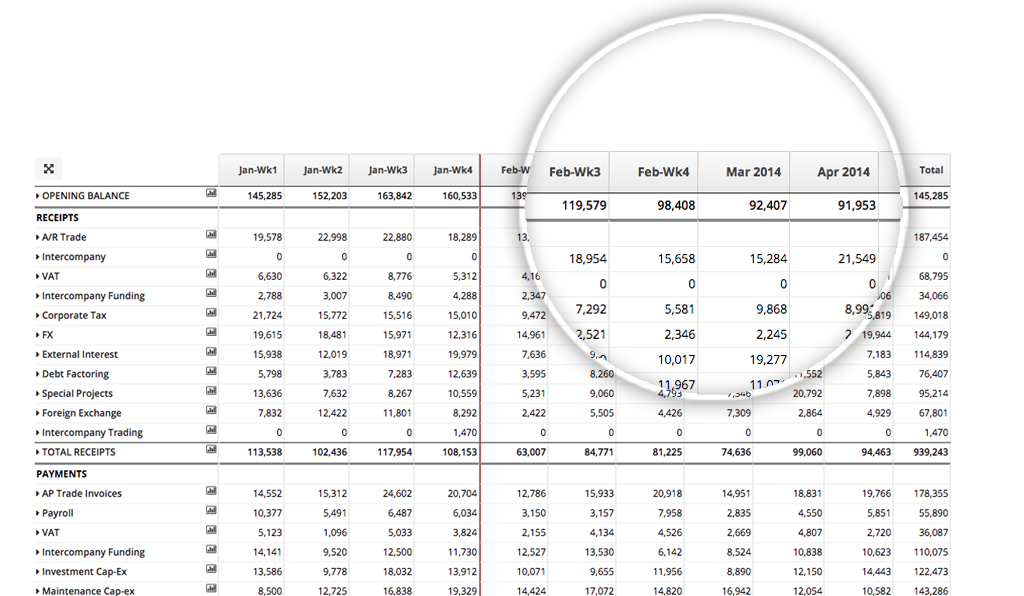

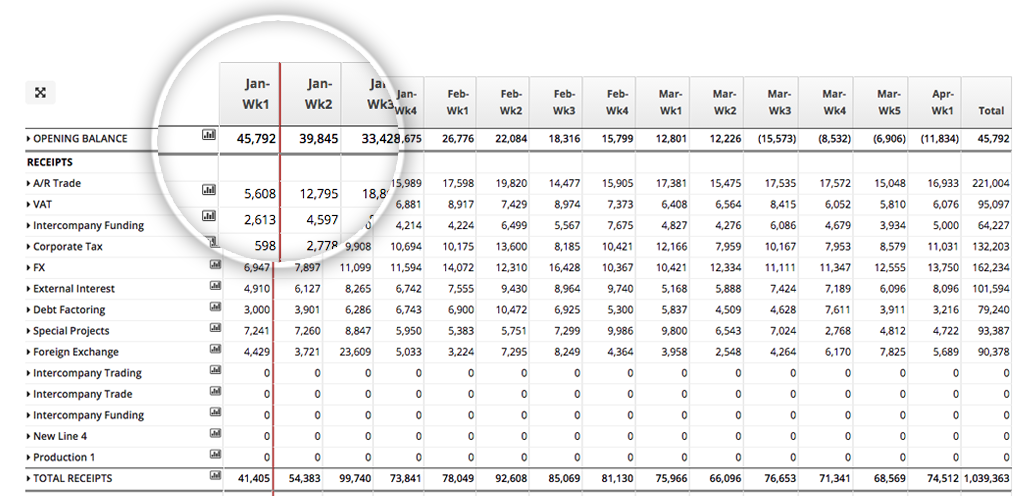

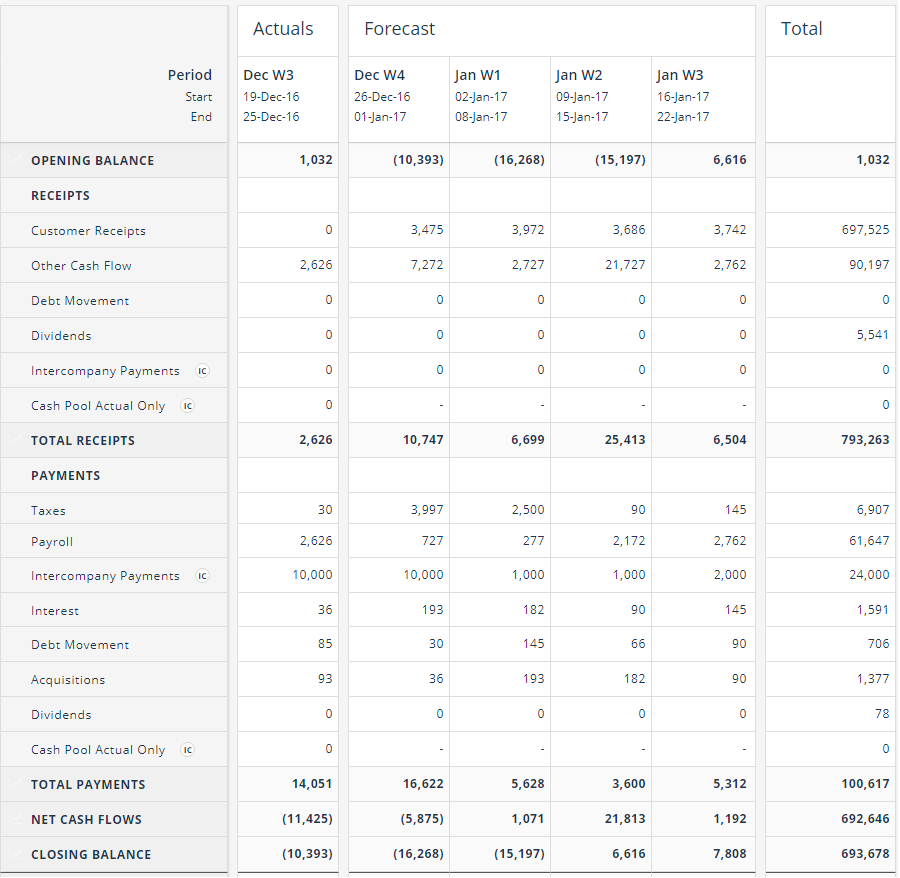

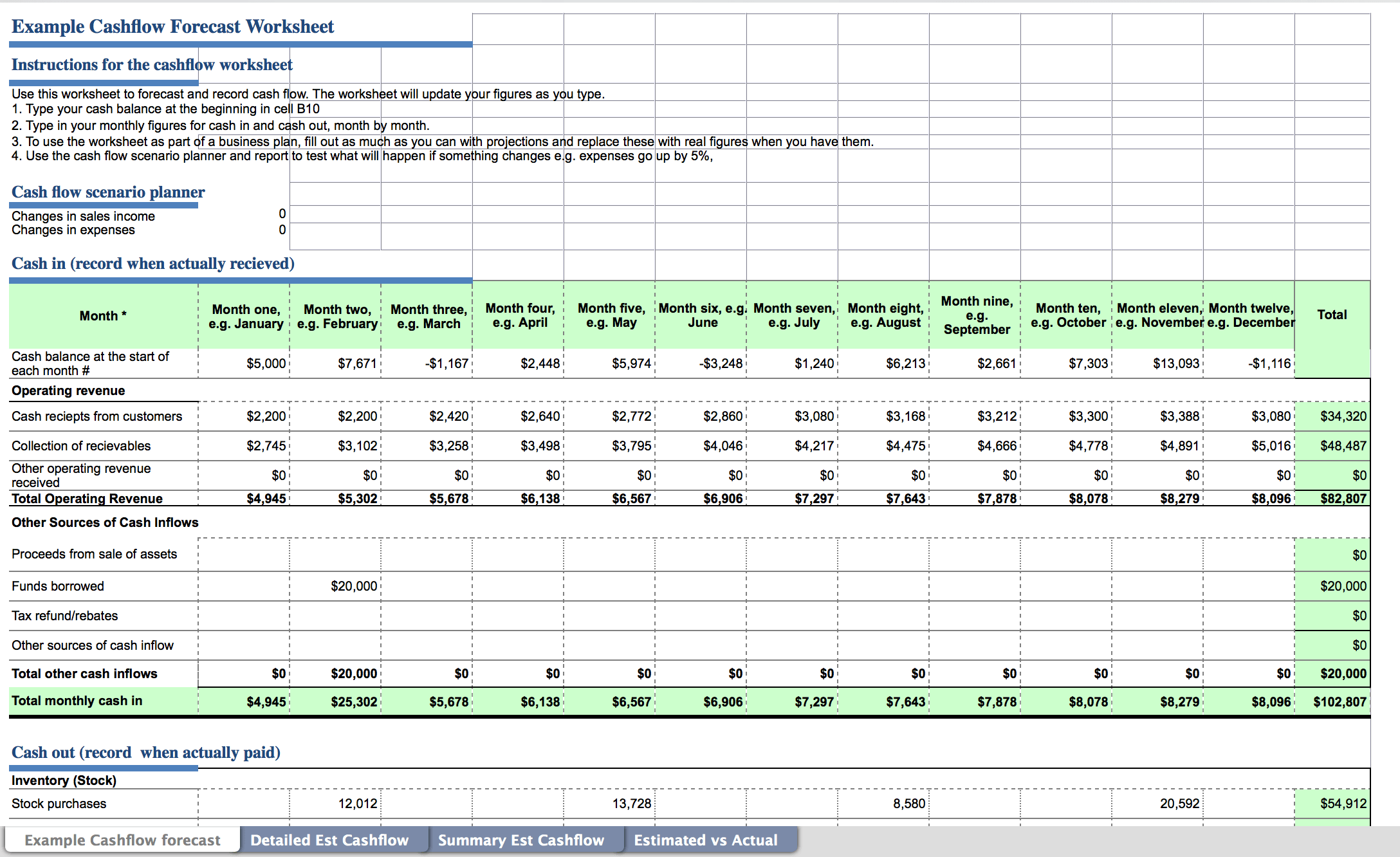

Cash flow projection is a statement showcasing the expected amount of money to be received into or paid out of the business over a period of time. A cash flow forecast is an estimated projection of the amount of money you expect to flow in and out of the business over a set period of time such as the next month quarter or year. Projected cash balances below the minimum amount you specify are displayed in red.

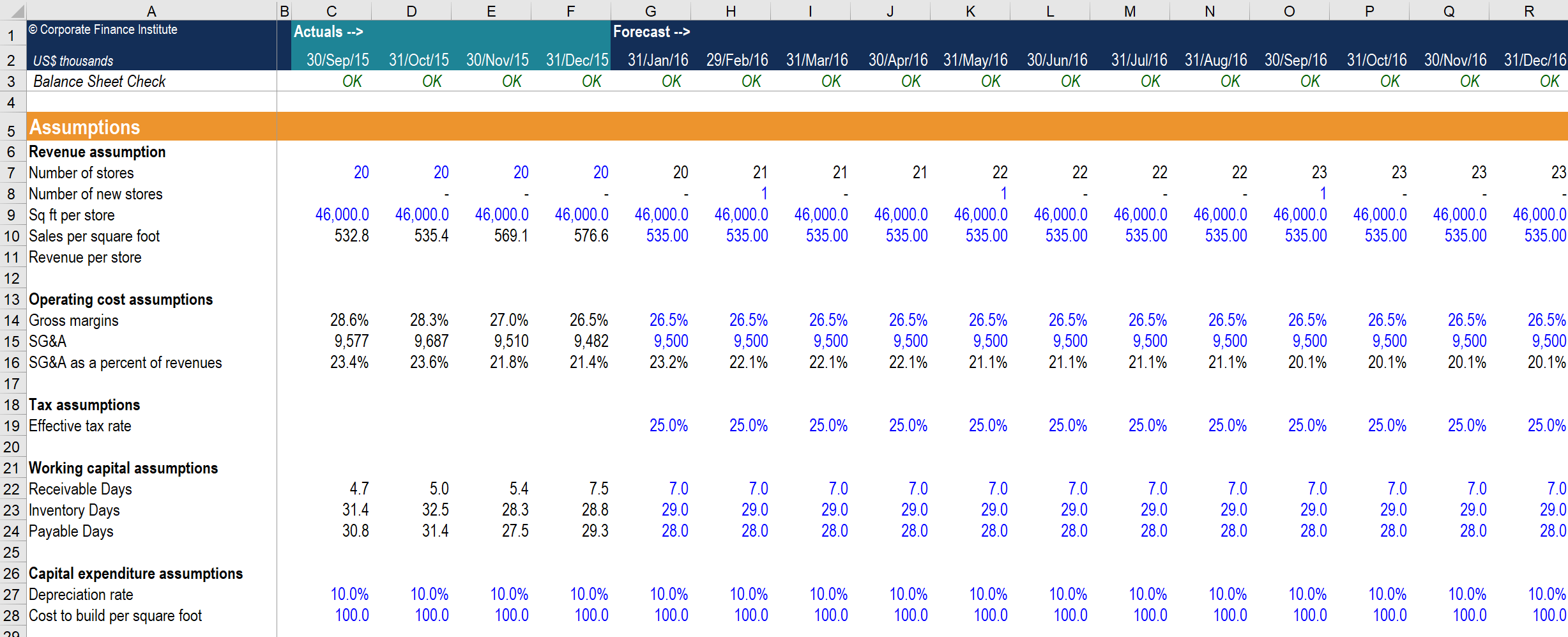

The cash flow forecast is one of the three main accounting statements for business plan financials. The cash flow projection is an important input into valuation of assets budgeting and determining appropriate capital structures in LBOs and leveraged recapitalizations. It is usually prepared on a monthly basis but that can be reduced to a shorter period of say a week and also can be extended to include 5 to 10 years.

A cash flow projection can take the form of a spreadsheet breaking down the cash flowing into and out of the account each month which and identifying a positive or negative cash balance. Regardless of the incentives for running your business you need cash to operate because it takes money to make money. You can also see a chart of your projected.