Glory First Year Cash Flow Statement

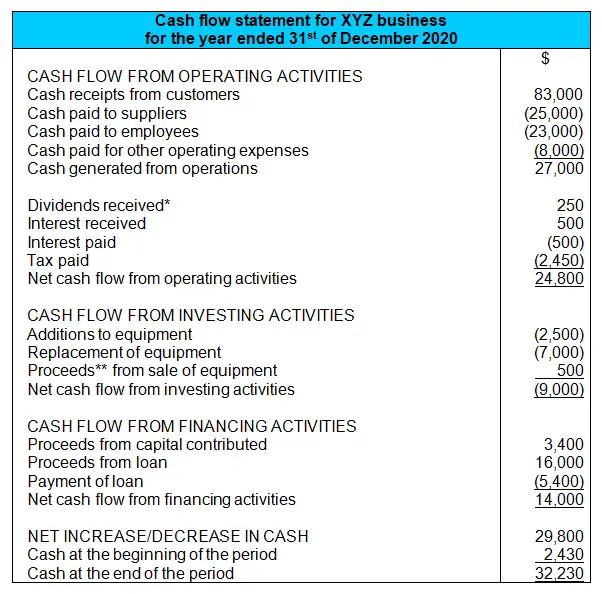

In this video we have discussed the concept along with the format required while preparing cash flow statement using direct method.

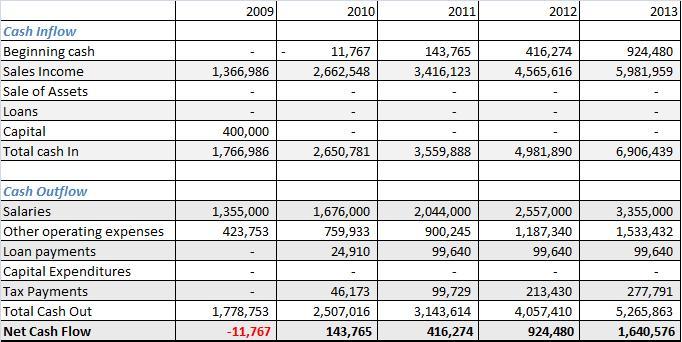

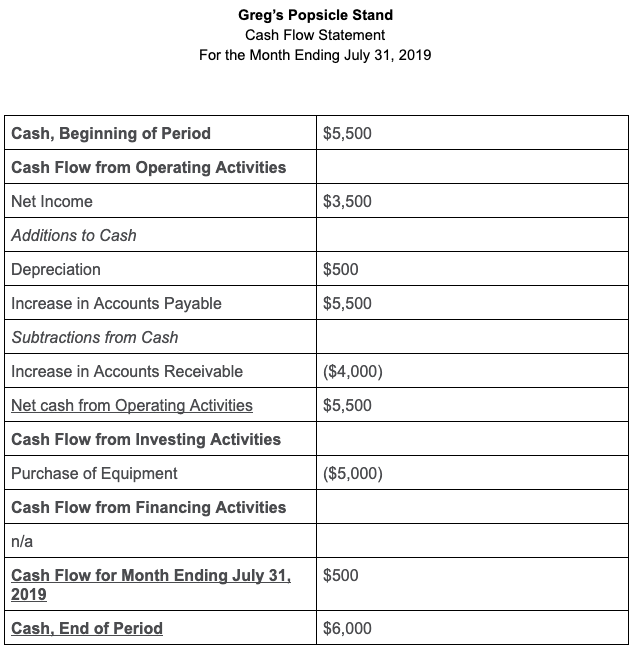

First year cash flow statement. For the first month start your projection with the actual amount of cash your business will have in your bank account. Steps To Create A Cash Flow Statement The heading of the cash statement it has three lines. Do one month at a time.

Here are the steps you need to follow to create a cash flow statement like the sample below. Both of these are considered financing activities and. Investopedia defines a cash flow statement as a mandatory statement that records the amount of cash and cash equivalents entering and leaving a company The key function of the CFS is to let investors and lenders take a look at how your companys finances are being managed and.

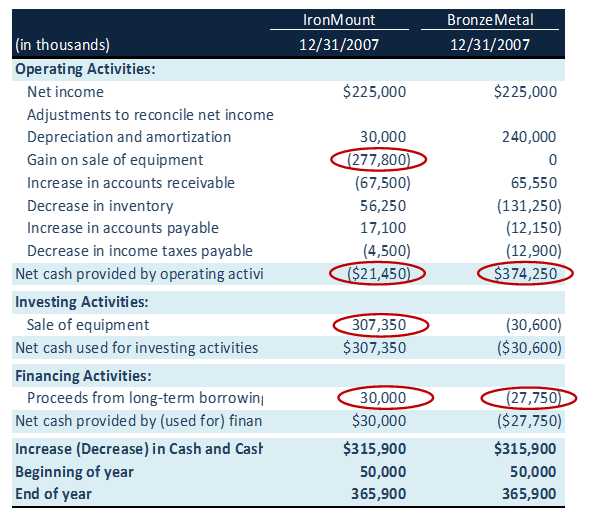

These changes are allocated to three categories. The first section of the cash flow statement is cash flow from operations which includes transactions from all operational business activities. This transaction should be shown on the statement of cash flows indirect method as a n a.

First Statement Your companys first cash flow statement will reflect your initial cash contribution and any small business loans you obtained. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. The cash flow statement is prepared based on the movements of the year in the.

1 The main components of the cash flow statement. Create your cash flow statement. A cash flow statement tracks all the money flowing in and out of your business.

Your operating cash flow in the first year is 5000 or 200500 minus 195500. The purpose of the cash flow statement is to explain the changes in cash between two accounting years. Cash flow from investment is the second section of.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)