Exemplary Entrepreneurs Should Prepare Income Statements

These statements are the common language used by everyone to gain an understanding of the financial status of a business.

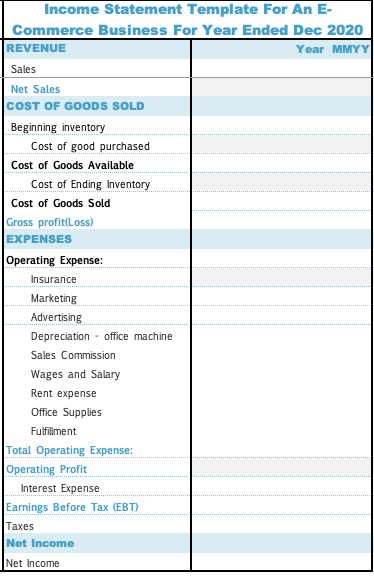

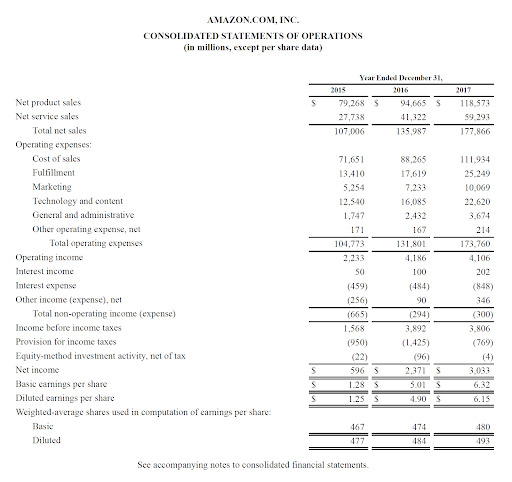

Entrepreneurs should prepare income statements. A cost of goods sold section is included in. The balance sheet d. An income statement shows the revenue expenses and ultimately the amount of profit or loss generated by a business for a specific reporting period.

An income statement subtracts expenses from revenue to get to Net Income. The financial statement prepared first is your income statement. Without getting too much into the weeds here are three financial statements which you as entrepreneurs need to understand.

It shows your revenue or sales and subtracts your costs or expenses to determine if you are making a profit ie when your revenue exceed you expenses. The cash flow statement b. The success of an entrepreneurs lies in financial statements because financial statements provide details for better decisions.

Revenues would be any sales that your business generates. All businesses no matter their size should keep accurate accounting records and prepare these financial statements on a monthly. If the entrepreneur is a sole proprietor he or she will be responsible for the budgeting.

Which business below is most likely to have cash flow. You need your income statement first because it gives you the necessary information to generate other financial statements. Businesses also generate income statements on a periodic basis to identify business trends and evaluate financial results.

The major financial statements entrepreneurs should be familiar with are. If net income is positive you have a net gain. Operating and capital budgets.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)