Simple Cash Flow Direct And Indirect Method Format

2 FORMA TS FOR OPERA TING ACTIVITIES.

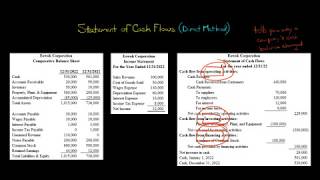

Cash flow direct and indirect method format. Net cash used by operating activities would be equivalent to cash-basis net loss 2 Indirect Method. The standard-setting bodies encourage the use of the direct method but it is rarely used for the excellent reason that the information in it is difficult to assemble. The indirect method on the other hand computes the operating cash flows by adjusting the current years net income for changes in balance sheet accounts.

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. There are no differences in the cash flows from investing activities andor the cash flows from financing activities Under the US. The format shown below is for the direct method.

Please see our separate tutorial on the indirect cash flow statement method for the format and explanations on how to put this together. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. Under the indirect method the cash flow is prepared on an accrual basis straight from the PL and so payments are recognised when they are earned rather than when they are actually paid.

The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. This method converts each item on the income statement directly to a cash basis. This method looks directly at the source of the cash flows and reports it on the statement.

There are two methods of presenting the cash flow statement format direct and indirect methods. Direct Method Cash Flow Format. However both the approaches have the arguments pros and cons.

The difference between the two methods stems from the presentation of operating cash flows. This is not only difficult to create. In the Indirect method of cash flow statement the net profit or loss is adjusted for the effects of the below type of transactions.