Fantastic Nbfc Ratio Analysis

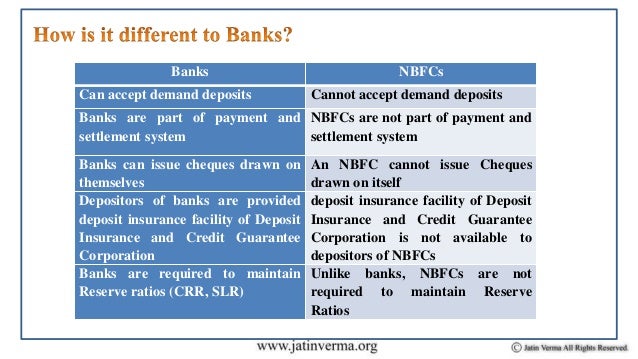

Maria Nevis Soris Introduction to the Indian NBFC Industry According to the Economic Survey 2010-11 it has been reported that NBFCs as a whole account for 112 per cent of assets of the total financial system.

Nbfc ratio analysis. The NBFCs has em-ployed Long-term debts to the extent of 4 to 5 times that of Shareholder funds. 282 An analysis of the possible solvency contagion losses 50 to the banking system caused by idiosyncratic failure of any NBFC indicates that as at end-March 2020 contagion losses on account of failure of the top three PSU NBFCs ranged between 43 per cent to 5 per cent of the banking systems Tier-1 capital. Gold price fall not so much a worry for NBFCs but banks need to be.

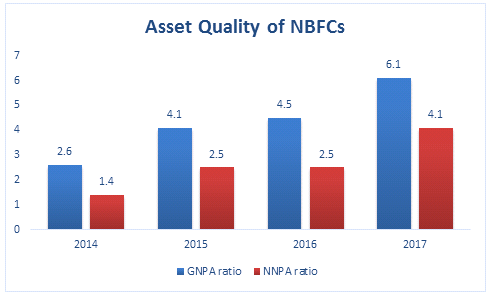

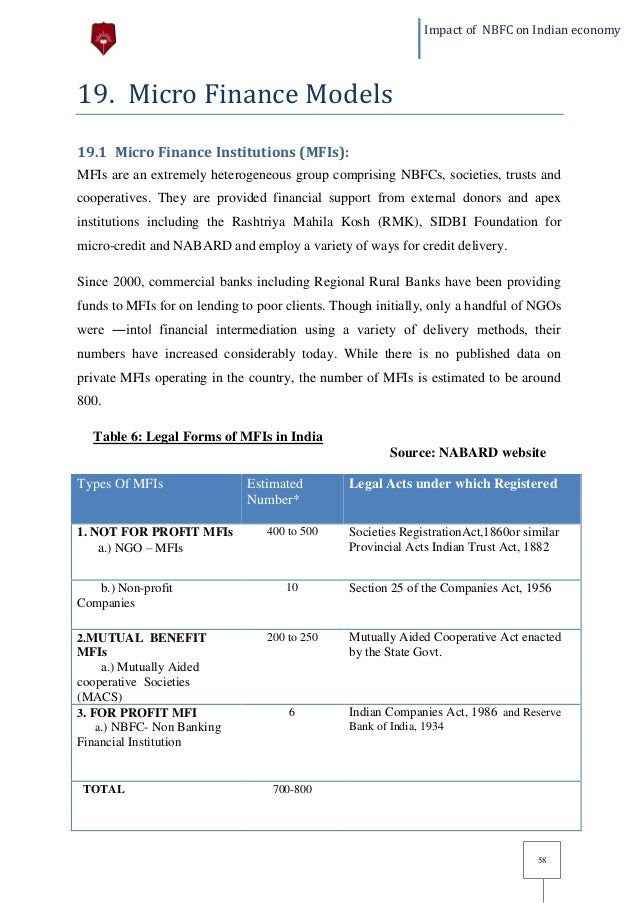

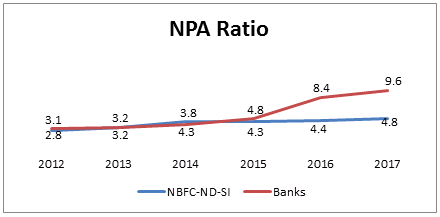

Asset Quality Ratios Asset quality of a bankNBFC is the cornerstone of its operational efficiency and a direct reflection of its risk management practices and credit appraisal mechanism. And ii Twelve per cent on or before March 31 1999 of its aggregate risk weighted assets and. The average ratio of Debt Equity is 5 and for the Long-term Debt Equity are 4.

Ratio Formula Significance in Analysis Growth in Interest Income Interest Income t Interest Income t-1 100 Interest Income t-1 portfolio as well as changes in. Better liquidity buffer at NBFCs cushions fall in Q1 collections. Ratio analysis mean standard deviation coefficient variation and ANOVA test have been applied.

Sornaganesh and N. In this way assets are of short duration as compared to the liability. It shows the capacity to service the additional debts are low for the NBFCs.

In case of vehicle financing NBFC the average loan tenure is of 16 to 18 months for SME loan it is 12 to 16 months and for Micro-finance it is 8 to 9 months. The Interest Coverage Ratio is low for the NBFCs. Statistical techniques has been made.

The period of the study is from 2003-2012. Further asset quality of a bankNBFC is also impacted by. Press Release July 15 2021.