Favorite Net Increase In Cash Formula

This figure represents the net change in cash flow figure that will appear at the end of the companys cash.

Net increase in cash formula. Continuing the same example 30000 - 50000 20000. Calculating a companys net change in cash is as simple as finding three sometimes four entries on a cash flow statement. It is usually found at the bottom of the cash flow statement.

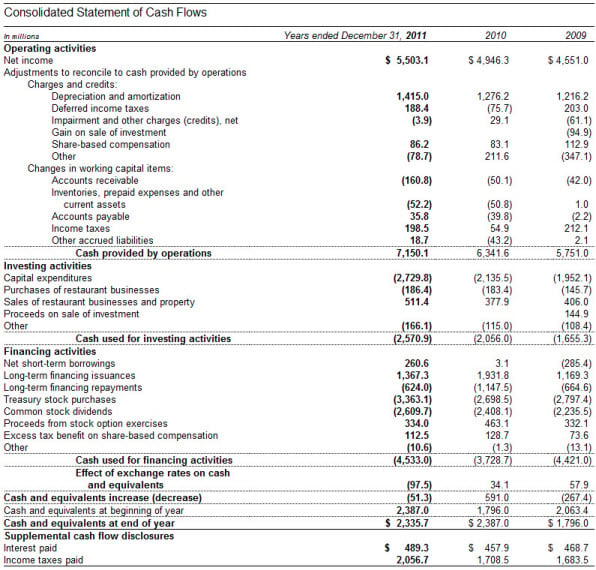

DIO and DSO. The net change in cash is calculated with the following formula. In the cash flow statement above we calculate the net increase or decrease in cash flow as follows.

This quantity describes the total change in available cash assets that the firm has realized after accounting for all transactions from operating activities financing activities and investing activities. Net cash flow can be derived through either of the following two methods. CFO Net Income non-cash expenses increase in non-cash net working capital.

C C C DI O DS O DP O where. The simple formula above can be built on to include many different items that are added back to net income such as depreciation and amortization as well as an increase in accounts receivable inventory and accounts payable. Free Cash Flow is calculated using the formula given below Free Cash Flow Net Income Depreciation Amortization Decrease in Working Capital Capex Free Cash Flow 10523 million 10529 million 3243 million 10051 million Free Cash Flow 14244 million.

Change in Net Working Capital is calculated using the formula given below. This appears at first to be the most direct method of deriving net cash flow but the accounting transaction recording system does not aggregate or report information in this manner. Cash receipts minus cash payments.

This amount is often referred to as gross cash Once totaled cash outflows paid out for. In finance the net increase is the total effective change in cash flow over a firms last period of activity. Based on this information the accountant utilized the following formula to calculate the net cash flow.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)