Ideal P&l Adjustment Account Format

Understand the procedure of Preparing trading and profit and loss account and balance sheet of a business.

P&l adjustment account format. PL account is prepared by all types of businesses. Accounting and legal fees 11700 Advertising 15000 Depreciation 38000 Electricity 2700 Insurance 15200 Interest and bank charges 27300 Postage 1500 Printing and stationery 8700 Professional memberships 1800 Rent for premises 74300 Repairs and maintenance 21100 Training 6900 Vehicle operating costs. Other Income and Other Expense.

Partners share adjustment profit profit sharing proportion Working notes adjustment table gives a net adjustment of 17500 to PL ac which indicates a credit in that account. A working note in this format would be useful Symbols - Add Deduct Show Remove. Smallco Limited 2015 Smallco Limited FIXED ASSETS FRS 102 Section 1A Smallco Limited.

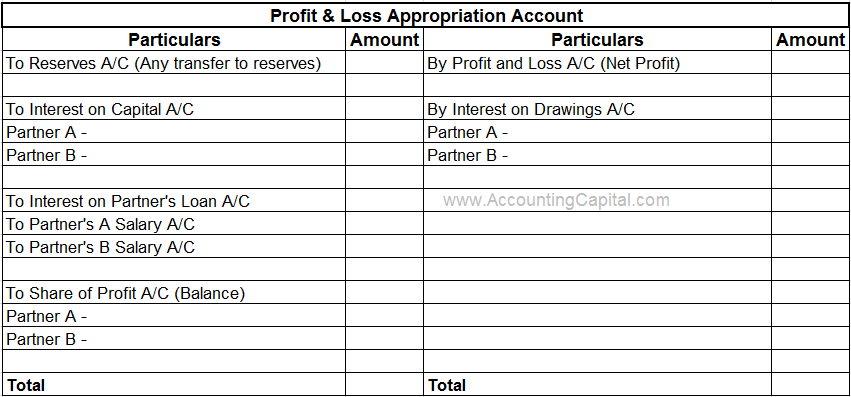

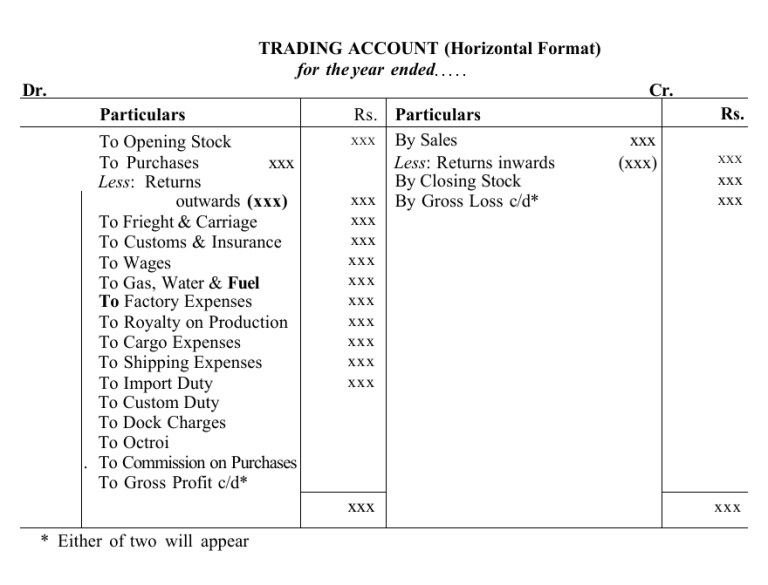

Final Accounts format for Sole proprietors Format of Trading Ac Format of PL ac Balance Sheet format Adjustments to Final acs Format of Trading Ac Format of Profit and Loss Ac Balance Sheet format Balance Sheet format in the order of liquidity Adjustments 1. Apart from the usual items of gains incomes losses and expenses which will appear in the profit and loss accounts of both the holding and the subsidiary companies and which will therefore be aggregated some adjustments will be required. PL appropriation account is prepared mainly by partnership firms.

It shows how the profits are appropriated or distributed among the partners. Selling and Administrative Expenses. Step 1Fill in the heading of your worksheet with your companys name and the period the P L statement will reflect.

Thereafter all those expenses or losses which have not been debited to the Trading Account are debited to the Profit and Loss Account. To know about the profit and loss of a business we provide and account format about the absolute profit and loss of a business which is built in Microsoft excel. From the following balances extracted from the books of X Co prepare a trading and profit and loss account and balance sheet on 31st December 1991.

The stock on 21st December 1991 was valued at 25000. Profit and loss account dont have any opening or closing balance as it is prepared for a specific accounting period. PL account is a component of final accounts.