Fine Beautiful Treatment Of Dividend In Consolidated Financial Statements

Need reliable software to perform your financial forecasts or KPI monitoring.

Treatment of dividend in consolidated financial statements. Consolidated Financial Statements provide information for identifying revenue profit for determining return on investment. IAS 138A requires an entity to present at a minimum two statements of financial position two statements of profit or loss and other. But if subsidiary company has declared the profit out of revenue gains then this dividend will add in general profit and loss account and will shown in the liability side of consolidated balance sheet.

The shares purchased on 3172009 are ex-dividend and ex-bonus from existing holder. The recipient records this transaction when it gains the rights to the payout. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee.

The dividends declared and paid by a corporation in the most recent year will be reported on these financial statements for the recent year. Where Dividends Appear on the Financial Statements. Iv Acquisition of Subsidiary.

IFRS 10 Consolidated Financial Statements Please note that the syllabus does not cover Joint Ventures but IAS 28 is applicable to Associates which are covered. Ad Discover our tailor-made solutions adapted to your company and your sector. H Ltd acquired 8000 shares on 142009 at Rs 110000 and on 3172009 6000 shares at Rs 86000.

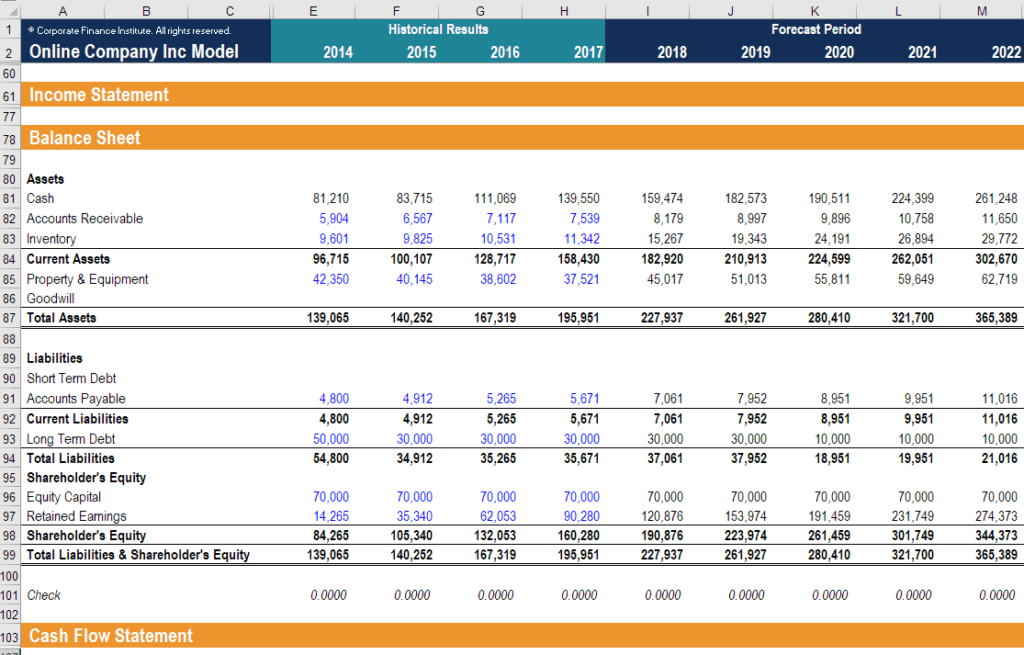

But for the consolidated statement of financial position any PROPOSED dividends are accounted for by deducting from the retained earnings of the paying company and the appropriate part of the subsidiary dividend payable to the parent is included within the parents retained earnings. If subsidiary company declare dividend out of capital profits then this will add in capital reserves in consolidated balance sheet. Statement of cash flows as a use of cash under the heading financing activities.

The dividend so received is not available to the shareholders of the holding company and thus cannot be taken to the revenue profits of the holding company. Paying the dividends reduces the amount of retained earnings stated in the balance sheet. In the consolidation process this dividend receivable account must be eliminated against the dividend payable account in the books of subsidiary.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)