Wonderful Revenue Recognition Note Disclosure Example

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

This document is not all inclusive of all disclosures.

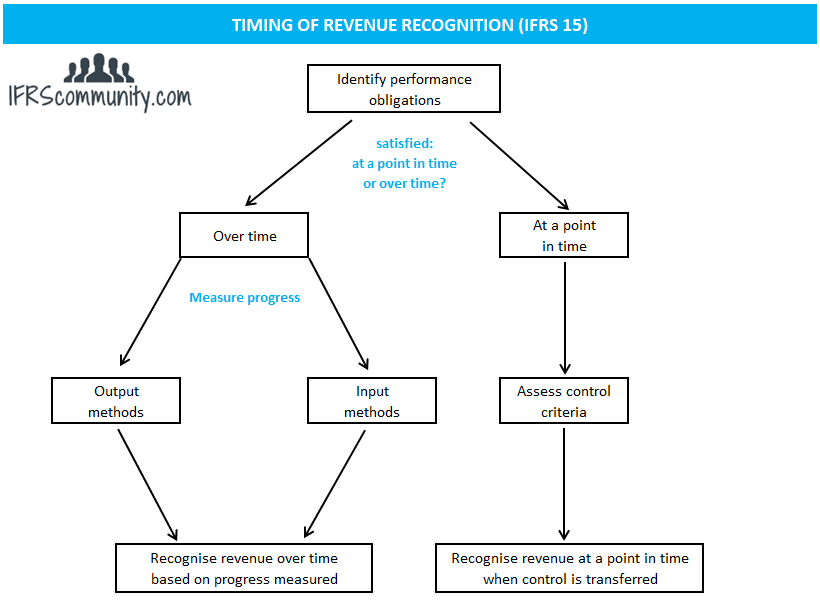

Revenue recognition note disclosure example. Your essential guide to the revenue disclosures. Our illustrative disclosures supplement PDF 16 MB will help you to navigate the requirements and enable you to focus on the information that is relevant to users of financial statements. To address the specific needs of the contractor as well as the judgment used in the recognition of revenue.

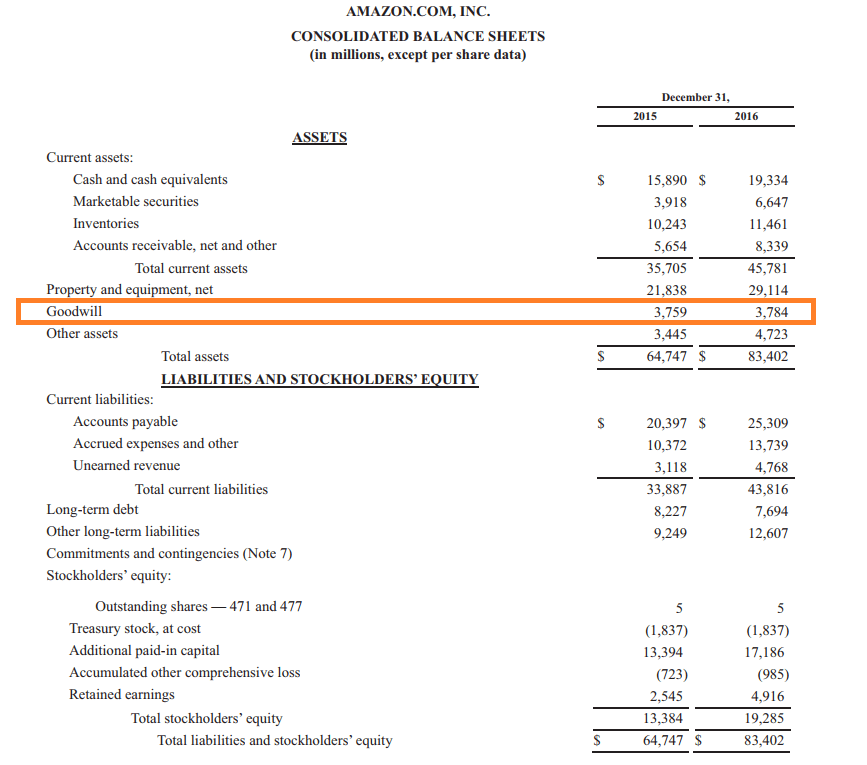

KPMGs insights on revenue disclosures under ASC 606. Disclosure Example 6 Our clients are billed based on fee schedules that are agreed upon in each customer contract. Disaggregation of RevenueQuantitative Disclosure.

When benchmarking your companys accounting and disclosure practices for revenue recognition against those used by other companies within and beyond your industry you may find. KPMG illustrates example presentation and disclosures under the FASBs new revenue standard. Under previous US.

Example Revenue Recognition Disclosures April 2018 The information in this document is not and is not intended to be audit tax accounting advisory risk performance consulting business financial investment legal or other professional advice. The purpose of this document is to provide the readers with examples of certain new disclosure requirements as part of the implementation of ASC 606. The new standard introduces a comprehensive disclosure package designed to better enable users to understand the nature amount timing and uncertainty of revenue recognized.

The following specific recognition criteria must also be met before revenue is recognised. Sample Disclosure Revenue Recognition 2 December 2008 Revenue recognition. This is the simplest example of revenue recognitionyou deliver the product or service immediately upon purchase and you record the revenue immediately.

The financial statements on a going concern basis. Download these sample non-authoritative revenue recognition disclosures intended to illustrate disclosures that could be prepared for fictitious nongovernmental NFPs under current GAAP. Revenue for one-time purchases should be recognized immediately.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)