Outstanding Financing Activities Brings Changes In

Both a and b.

Financing activities brings changes in. They can be identified from changes in long-term liabilities and equity. Not only has the recent shift in external pressures resulted in the need for leaner and more responsive back office functions but there is now a greater demand from the business for Finance to drive performance. Week Brings to Final Stages 236500000 of Proposed New Bond Issues BASIC CHANGE HELD NEED New-Money Flow to Industry Rather Than Reinvestment Called.

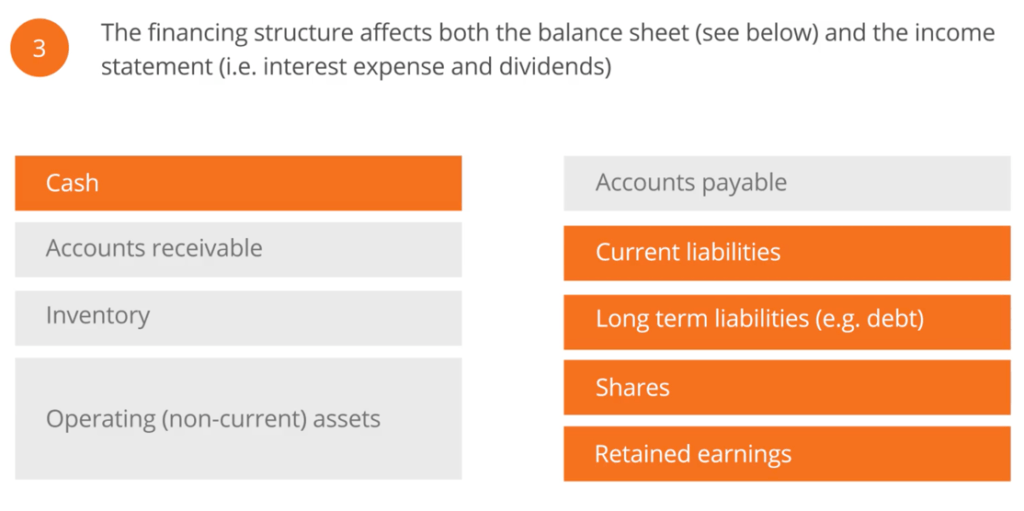

If the Company changes its name during the financial year this change should be disclosed as suggested below. Cash Flows from Financing Activities. Whenever long-term debt or equity is involved it is considered a financing activity.

Financing activity heartens wall st. Answer verified by Toppr. Issuance repayment of debt.

Like all financial statements the statement of cash flows has a heading that displays the company name title of the statement and the time period of the report. Includes all cash transactions that affect long-term liabilities and equity. A company issues debt as a way to finance its operations.

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets. Cash Flow From Financing Activities. Cash Flow from Operating Activities Net Income Depreciation Depletion Amortization Adjustments To Net Income Changes In Accounts Receivables Changes In Liabilities Changes.

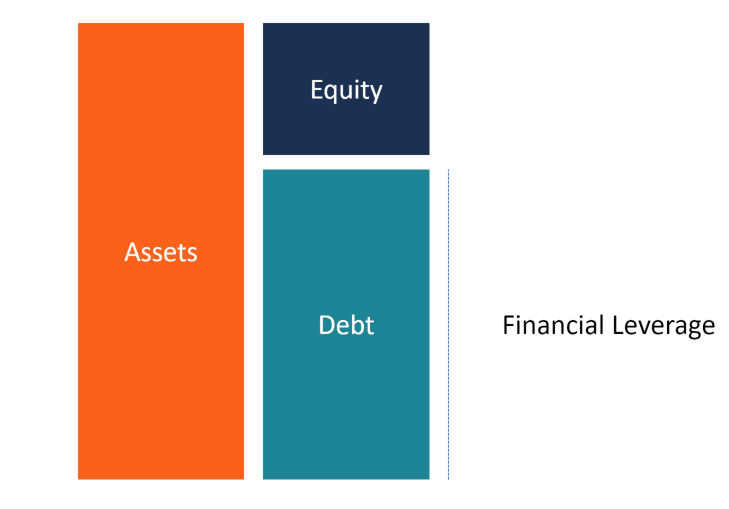

Cash flows mean the inflows and the outflows of cash and cash equivalents. In financial accounting a cash flow statement also known as statement of cash flows is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activities. The changes in long-term liabilities and stockholders equity in the balance sheet are reported in financing activities.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

/cash-flow-concept-992325826-02e39ab9d9394062817a6dd4c62b7a56.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)