Breathtaking On A Balance Sheet Assets May Include

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

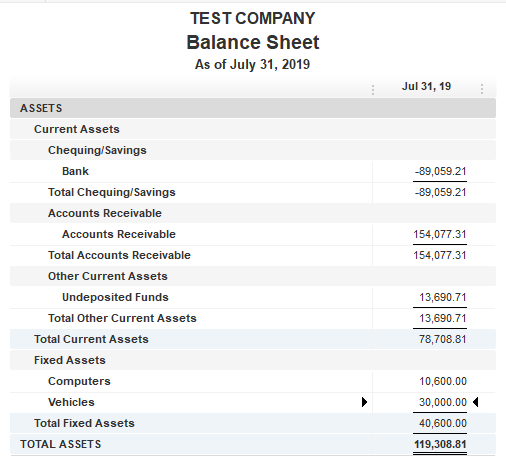

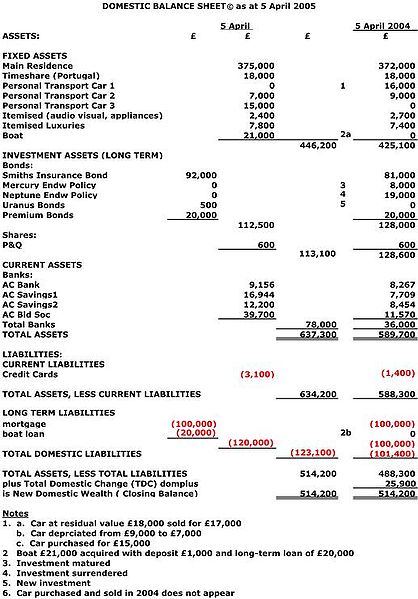

Balance sheet consist of assets fixed and current liabilities short and long term and owners equity.

On a balance sheet assets may include. The balance sheet is commonly used for a great deal of financial analysis of a business performance. To ensure the balance sheet is balanced it will be necessary to compare total assets against total liabilities plus equity. Your intangible assets will only appear on your balance sheet if theyre acquired by your small business.

As such it provides a picture of what a business owns and owes as well as how much as been invested in it. The assets side shows the tools the company has at its disposal to operate the business and the liabilitiesowners equity side shows how the company financed these assets. At any particular moment it shows you how much money you would have left over if you sold all your assets and paid off all your debts ie.

It also shows owners equity. A balance sheet lays out the ending balances in a companys asset liability and equity accounts as of the date stated on the report. According to money measurement convention financial statement are prepared by.

These fundamentals are important before we proceed to. Creating an income statement requires some basic math. Because these assets are easily turned into cash they are sometimes referred to as liquid assets.

The groupings include current assets and noncurrent assets as well as current liabilities and noncurrent liabilities. Liabilities including loans credit card debts tax liabilities money owed to suppliers. A balance sheet is a summary of all of your business assets what the business owns and liabilities what the business owes.

On the left side of a balance sheet assets will typically be classified into current assets and non-current long-term assets. The balance sheet includes information about a companys assets and liabilities. Common line items found in this section of the balance sheet include.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)