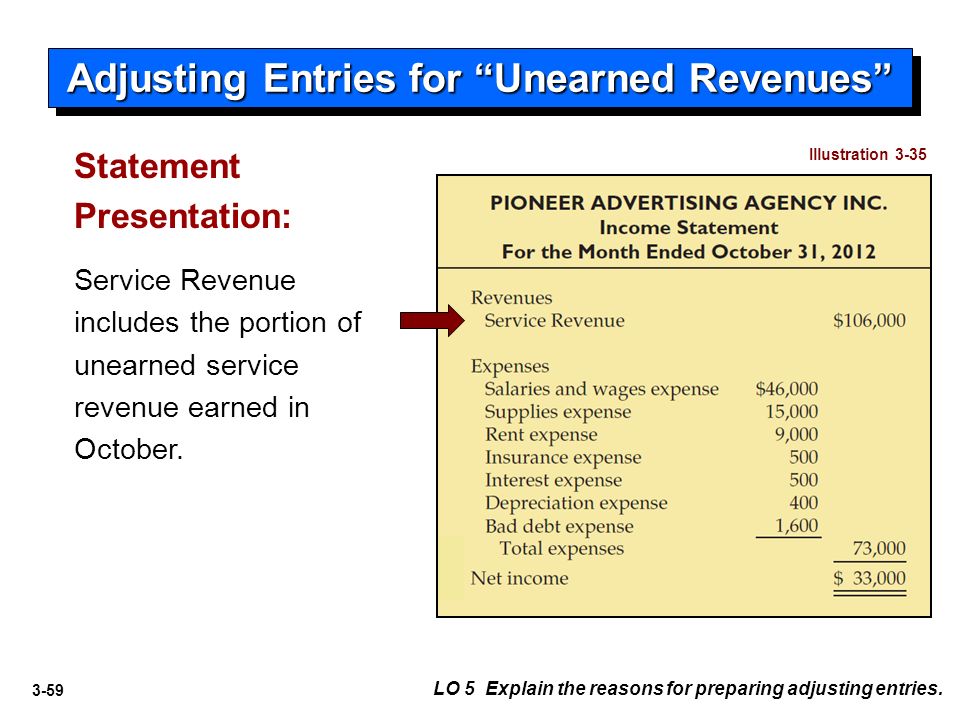

Ace Unearned Service Revenue Income Statement

C Appears on the income statement as a liability.

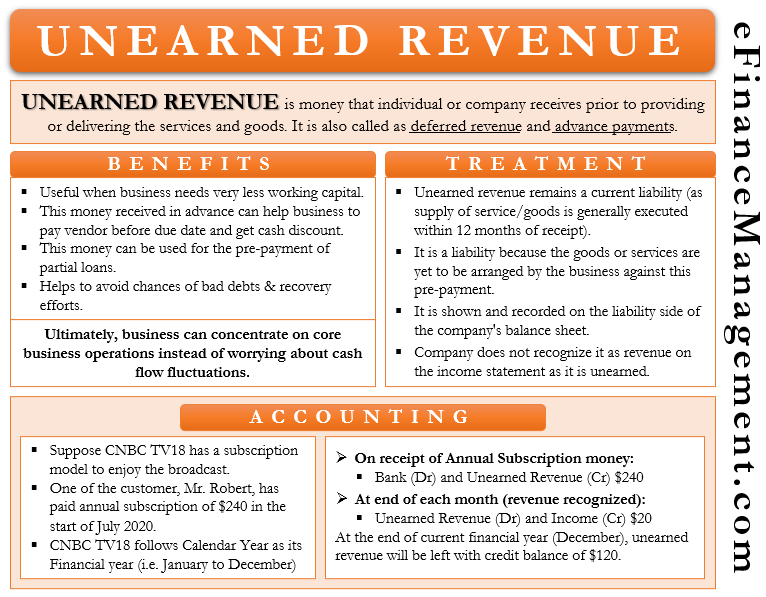

Unearned service revenue income statement. This is also referred to as deferred revenues or customer deposits. Revenue is not recorded in the income statement until it is earned. According to service contracts 4810 of the Unearned Service Revenue has been earned in March.

Both of these revenue types are shown in the Financial Statements regardless of the fact that they have been paid for or not. Definition of Unearned Income Unearned income or deferred income is a receipt of money before it has been earned. There was only one adjustment to Service Revenue.

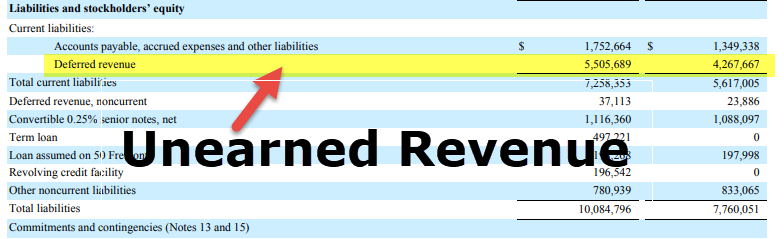

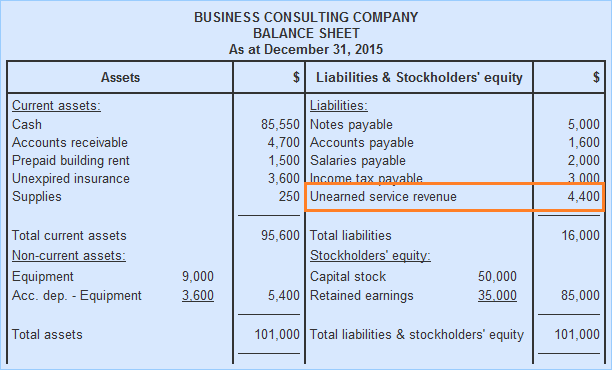

Revenue is only included in the income statement when it has been earned by a business. The unearned amount is initially recorded in a liability account such as Deferred Income Deferred Revenues or. D Appears on the balance sheet as a liability.

E3-29A Learning Objectives 3 5. B Appears on the income statement as a reduction to income. Unearned revenues are recorded in the income statement as income received at the time it was incurred i e.

Use the following to answer questions 65-67. Journalize the adjusting and closing entries of Draper Production Company at December 31. A Appears on the income statement as income.

Unearned Revenue is not shown in the Income Statement until the goods or services have been delivered against that sale whereas Accrued Revenue is shown as Income regardless of the cash collection process. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. For example if ABC Service Co.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)