Fabulous P&l Management Meaning

These reports are prepared as frequently as managers need them usually monthly or quarterly perhaps even weekly in some businesses.

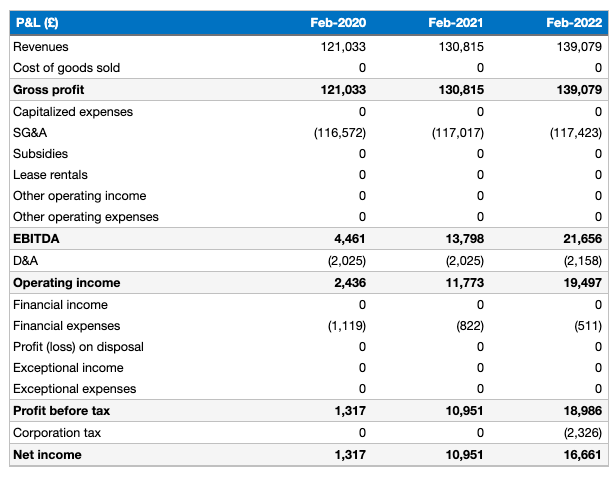

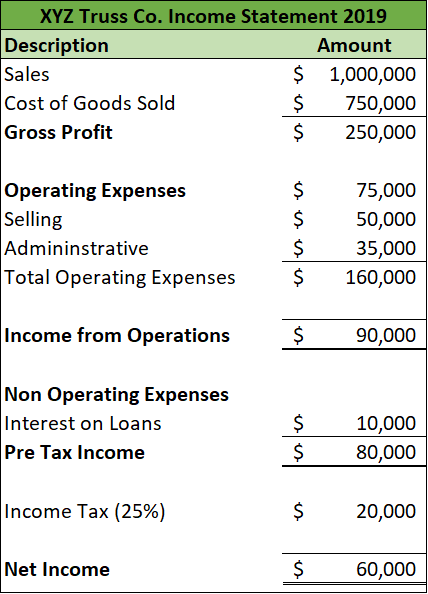

P&l management meaning. Profit and loss PL statements are one of the three financial statements used to assess a companys performance and financial position. The two others are the balance sheet and the cash flow statement. You can start that process by looking at your businesss profit and loss statement aka income statement.

Profit and loss PL management is the process of determining how to cut costs and increase revenue. So I had to learn how to. A PL statement shows a companys revenue minus expenses for running the business such as rent cost of goods freight and payroll.

Managing PL means you work toward having greater revenues and fewer expenses. You need to understand income statements. Profit and loss responsibilities at an organization often includes overseeing cash flow and advising on budget allocations for either a department or the organization as a whole.

Most PL statements start with revenue and then deduct the cost of goods sold which includes the cost of inventory and the direct labor involved in creating it. You manage the revenues and the costs and get your team to understand and help you meet profitability goals. This is more of a mindset than anything.

Since your income statement breaks down your businesss costs and gains it offers key insights into growing your revenue and upping your businesss chance of success. Youll need to understand what drives sales pricing and expenditures. Profit and loss management is the way you handle your businesss profits and losses.

Lets start with the PL ie. PL responsibilities mean that you are responsible for managing your business units profitability - or bottom line. I technically owned the PL for my brand.