Spectacular Tesla Balance Sheet Analysis

Tesla Motors case study provides a strategic dilemma for the protagonist.

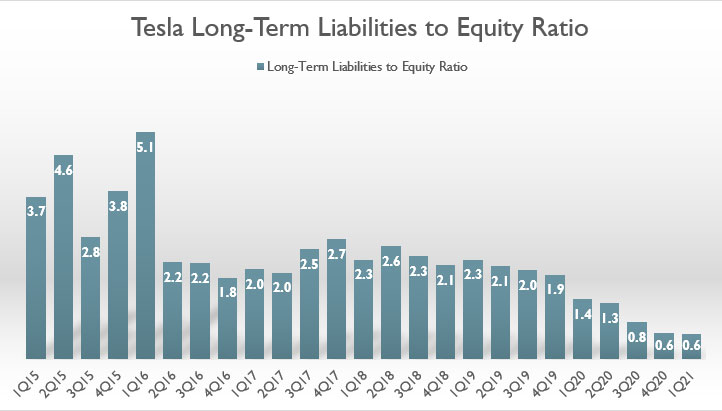

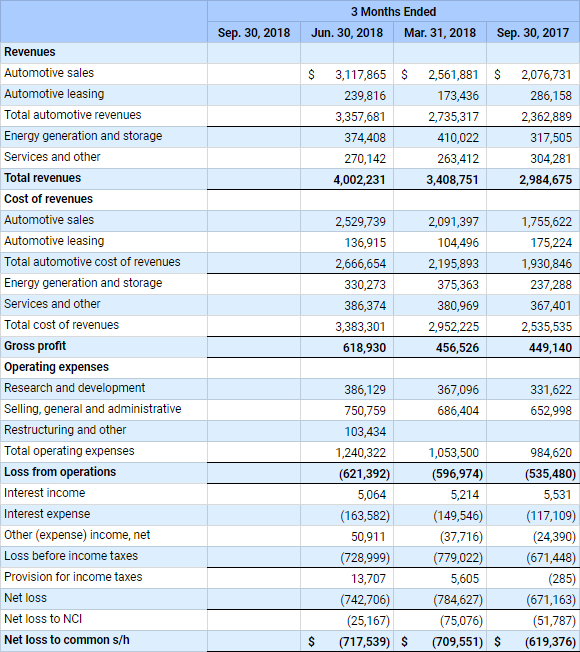

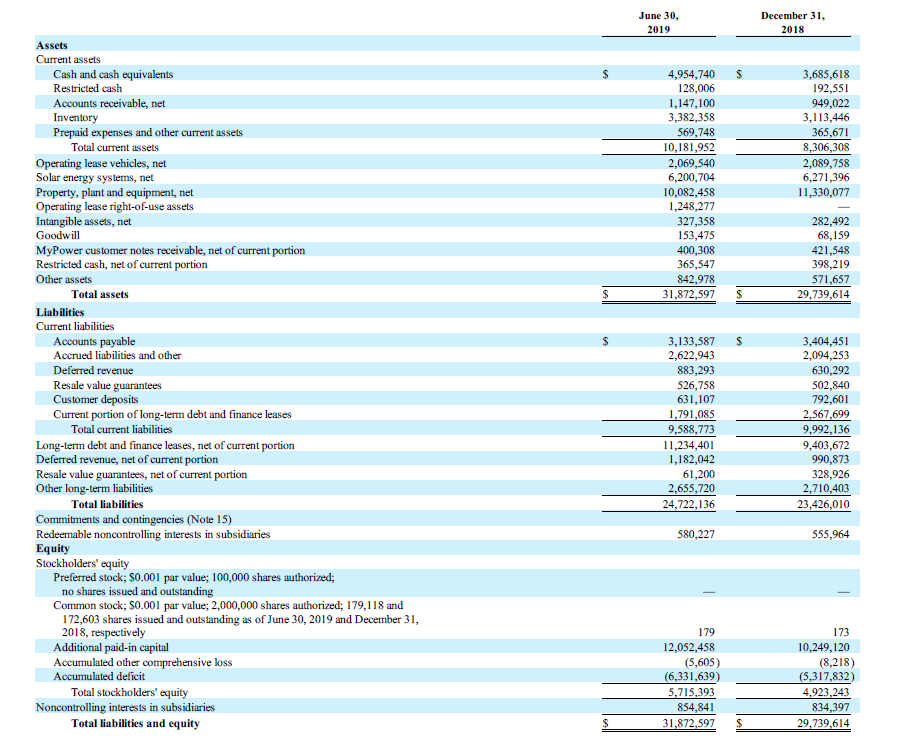

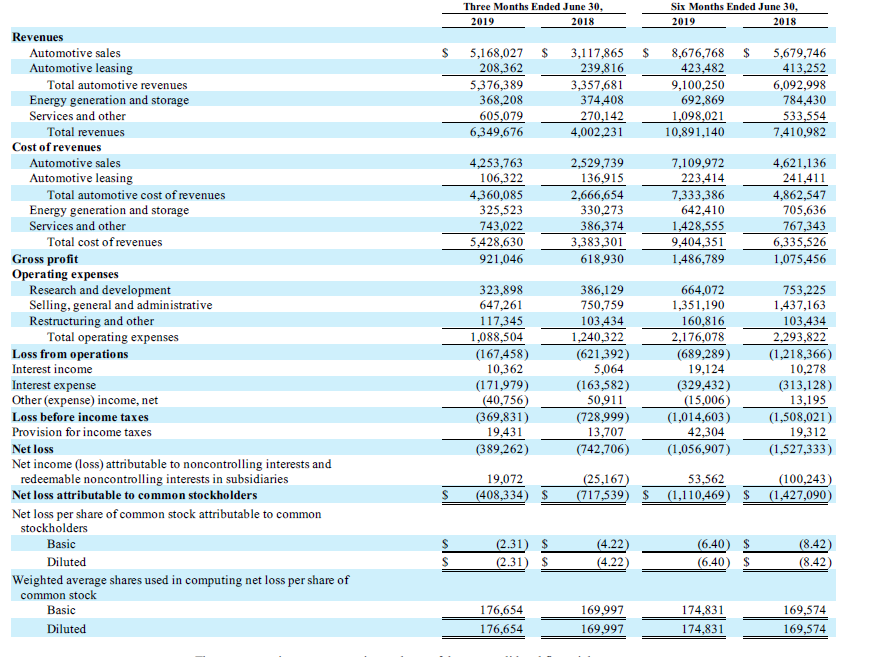

Tesla balance sheet analysis. From the ratio we can find out how Tesla funded its balance sheets whether entirely by debts or by equity or equally both. Which correlates with the increase in cost of goods sold and total revenue. The balance sheet also shows great improvement and potential for Tesla.

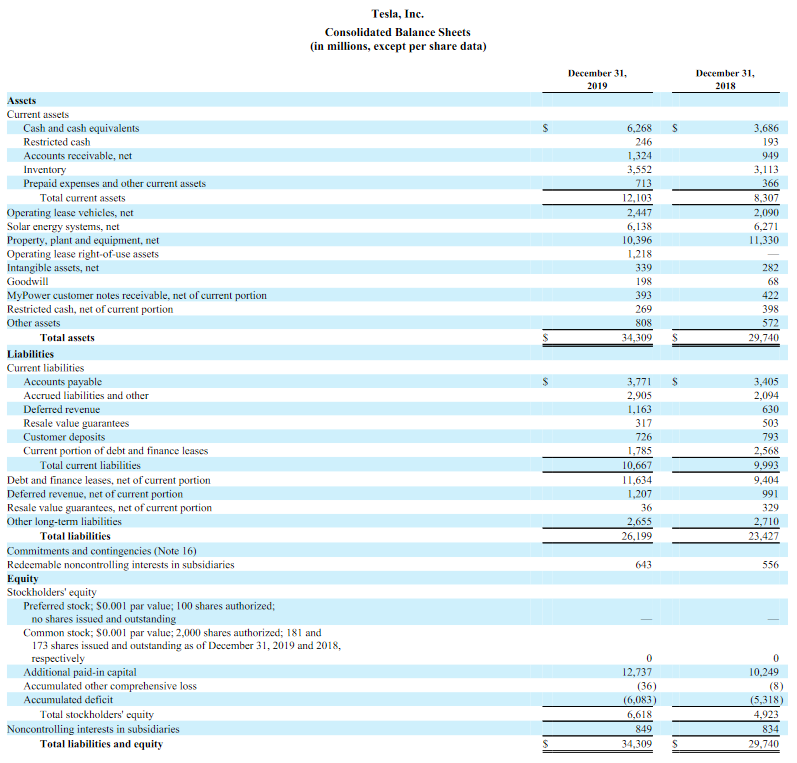

As mentioned in prior paragraphs the trend of the assets is an important aspect of balance sheet analysis. 66854 USD -1716 -250 Updated Jul 13 2021 400 PM EDT - Market closed. Total liabilities declined from 505 in 2016 to 428 in 2019 while shareholders equity falls from 140 to 106 in 2019.

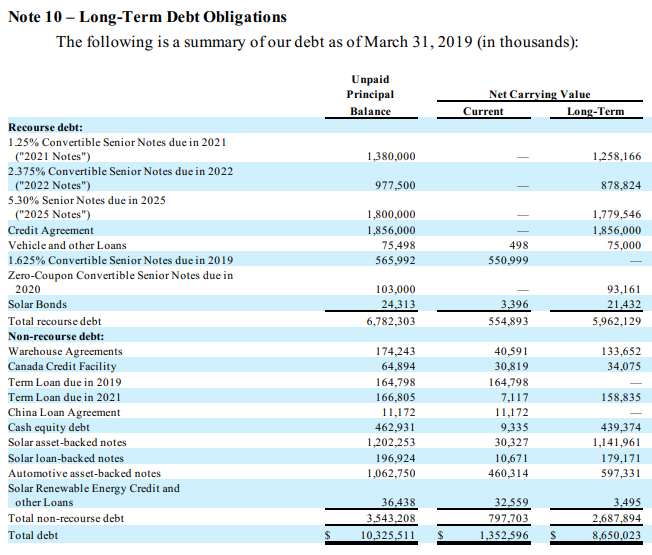

Breaking down Teslas balance sheet Teslas chief executive Elon Musk has been under intense pressure this year to show his money-losing debt-laden company can be a profitable high-volume electric vehicle EV manufacturer. Annual Balance Sheet - WSJ. In this case the debt to equity ratio will be 1.

Balanced Scorecard strategic analysis can help Car Tesla managers in understanding the relationship between activites and take the systems approach rather than the local optimization approach. The company reported a profit for the most recent quarter but now must show investors that was not a one-time event. Conclusion In 2019 Tesla achieved production and sales records producing 367656 vehicles and selling 365232 vehicles.

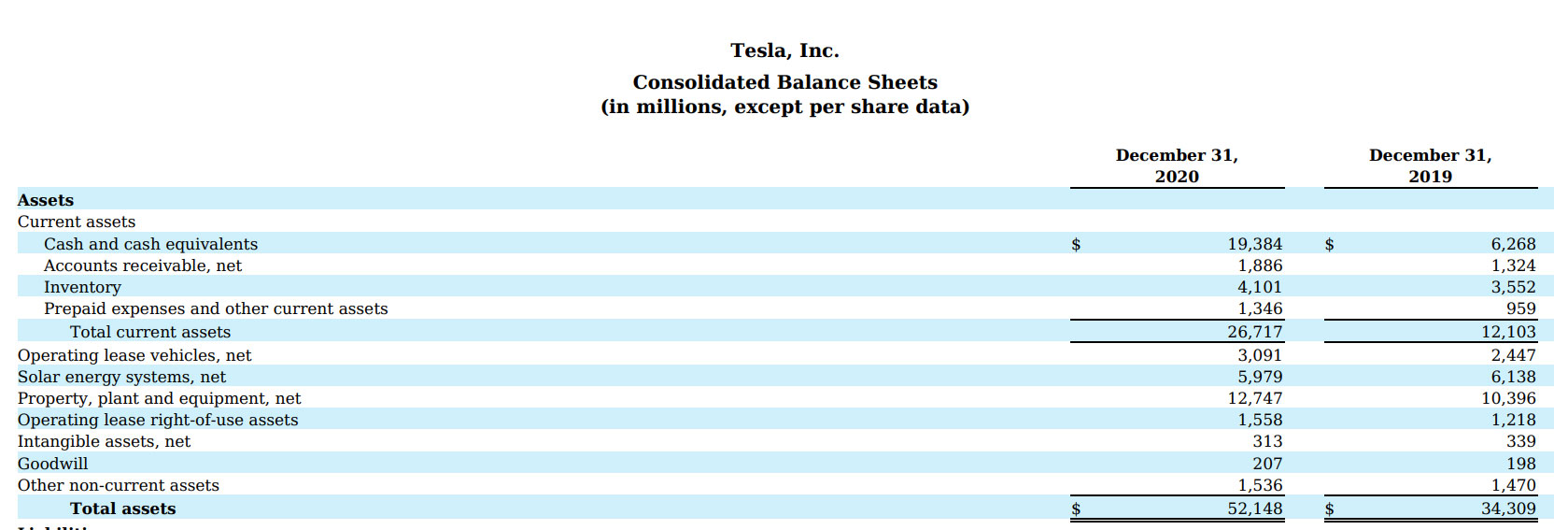

Tesla Incs property plant and equipment net decreased from 2018 to 2019 but then increased from 2019 to 2020 exceeding 2018 level. Also by looking at vertical analysis of the firm balance sheet the total assets declined from 668 in 2016 to 547 in 2019. 66375 -480 -072 Jul 13 747 PM.

As of 4Q 2020 Teslas total assets reached an all-time high at slightly over 50 billion. Get the latest balance sheet from Zacks Investment Research. Teslas return on equity ROE is -954 return on assets ROA is 070 and profit margin is -264 though its quarterly revenue growth year over year YOY as of.