Wonderful Ifrs 17 P&l

17 IFRS 9 and IFRS 7 may be met but are not intended to provide any view on the type of approach that should be applied.

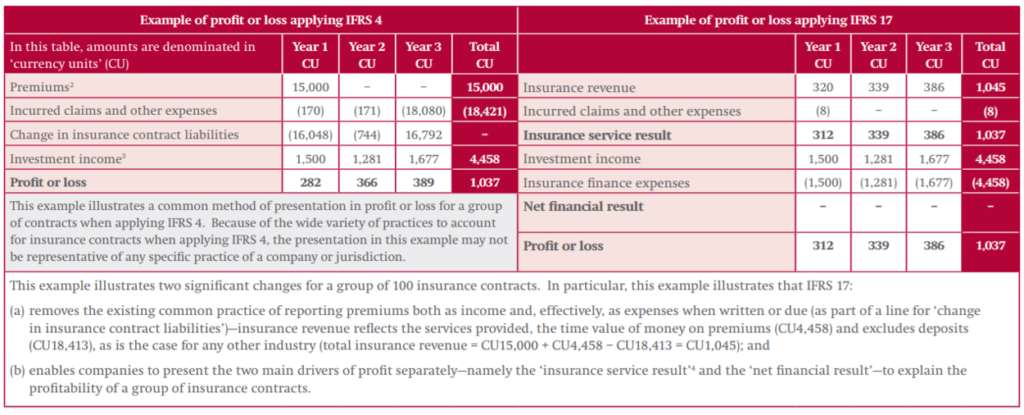

Ifrs 17 p&l. In this section we consider projections of PL for the illustrative contract under two example scenarios. Depreciation of CU 7 780 plus. One of the main reasons for this is the significant increase in the value of the insurance liabilities under IFRS 17.

This guide does not pre-empt that process. Expected loss onerous contracts need to go directly through PL. Some insurers are well on course for delivery.

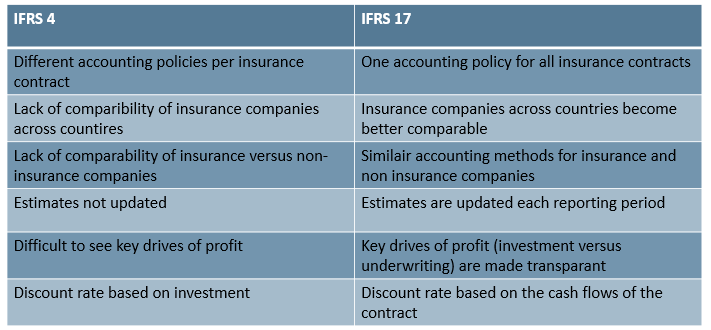

The IFRS 17 Transition Resource Group TRG offered some guidance in 2019 and concluded that the premium experience relating to current or past service should be recognized immediately in the PL as part of the insurance revenue. The existing IFRS 4 does not prescribe. However as per the third survey run by Deloitte around 53 of insurers.

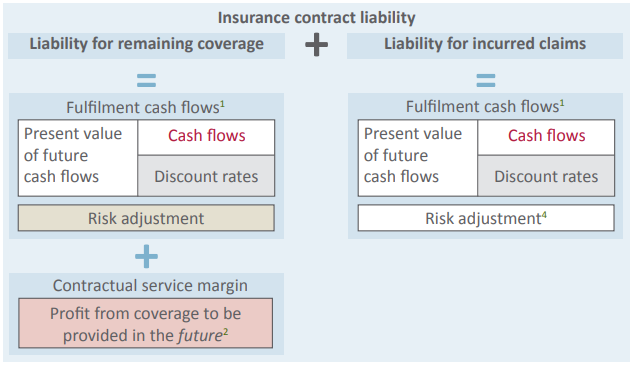

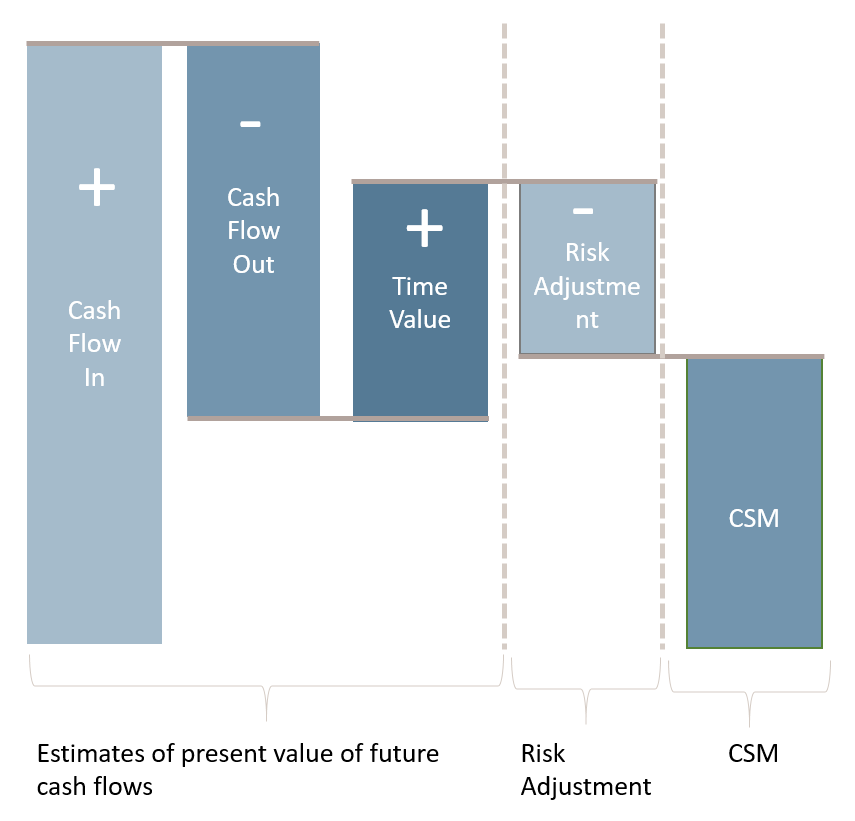

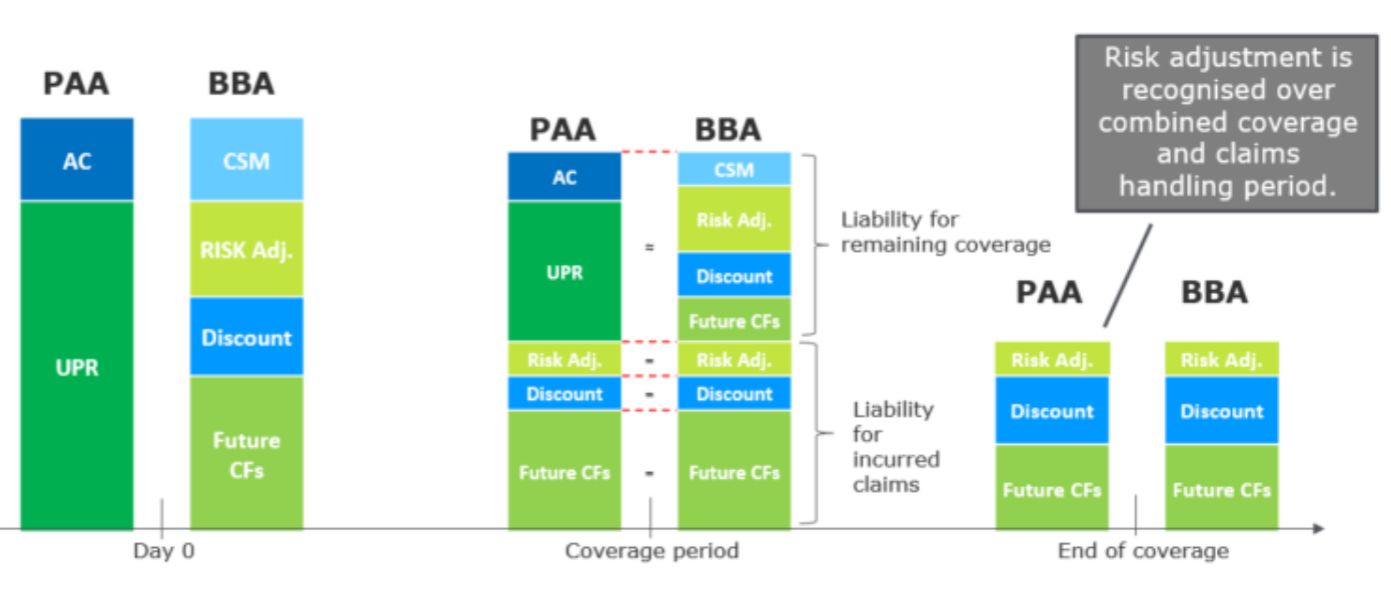

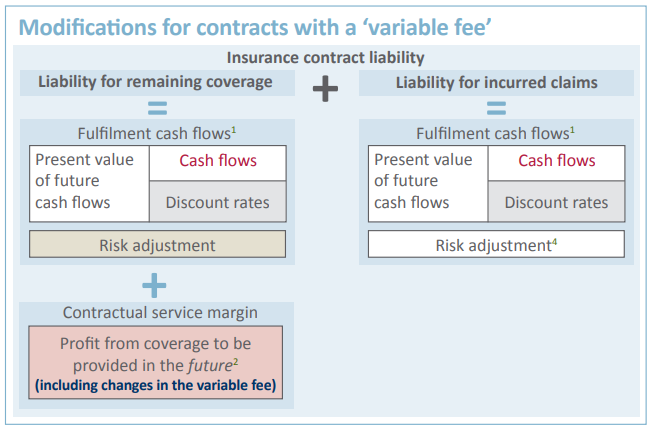

Managing IFRS 17 PL. IFRS 17 is the first comprehensive international accounting standard for insurance contracts issued by a company including the reinsurance contracts. IFRS 17 Measurement models The General measurement model GMM or Building Block approach.

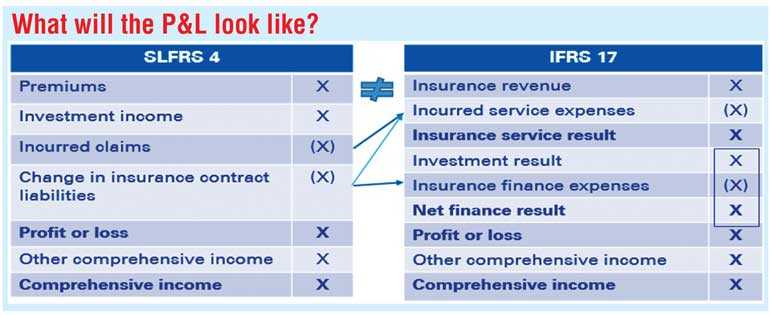

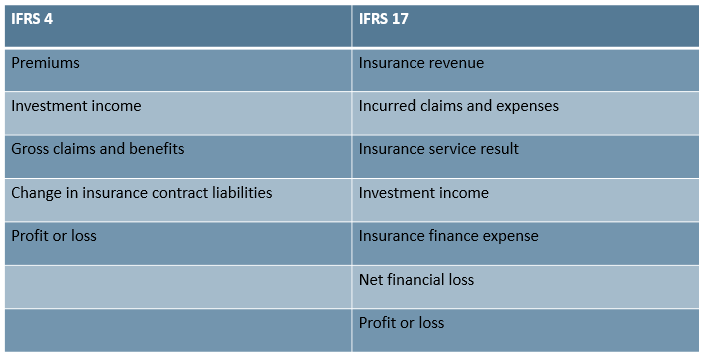

The publication is current as of February 2019 and is based on IFRS 17 as issued by the International Accounting Standards Board in May 2017. IFRS 17 Income Statement 9 9 PL 20X1 20X0 Insurance revenue 9856 8567 Insurance service expenses 9069 8489 Incurred claims and insurance contract expenses 7362 7012 Insurance contract acquisition costs 1259 1150 Gain or loss from reinsurance 448 327 Insurance service result 787 78 Investment income 9902 9030. Interest of CU 1 167 plus.

Companies have to master the possible levers induced by this concept and to define their new management tools. IFRS 17 will supersede the earlier standard on insurance contracts IFRS 4. It states which insurance contracts items should by on the balance and the profit and loss account of an insurance company how to measure these.