Peerless Nike Cash Flow Analysis

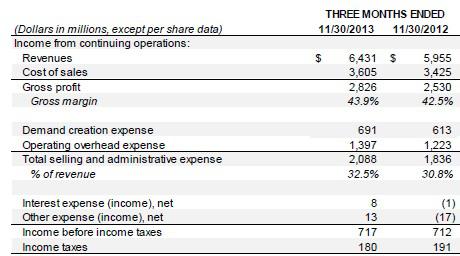

Nike Inc consolidated cash flow statement quarterly data.

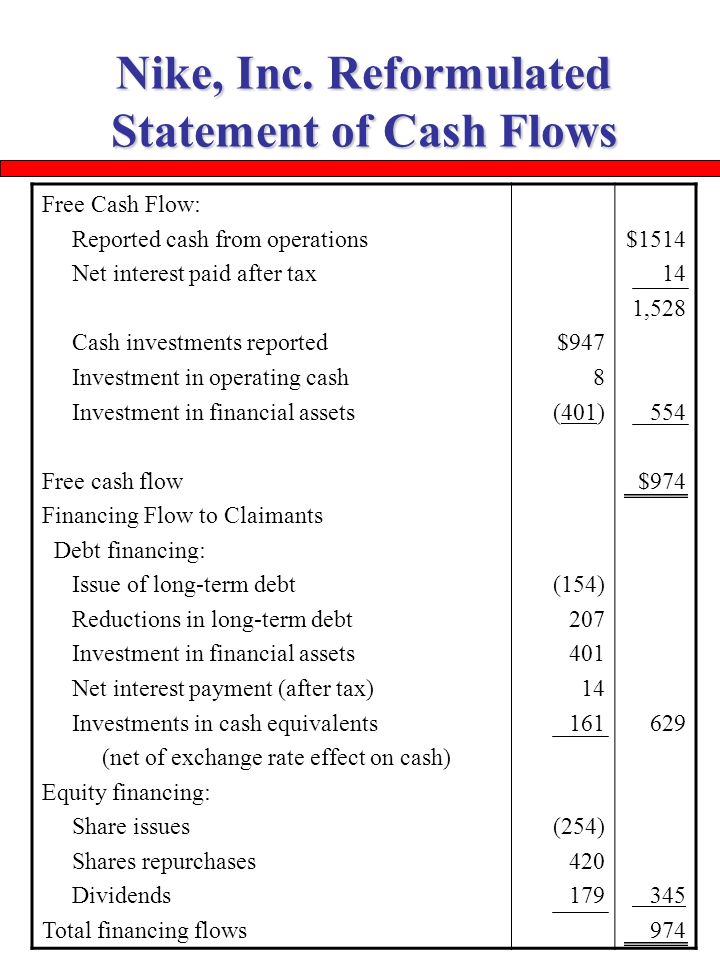

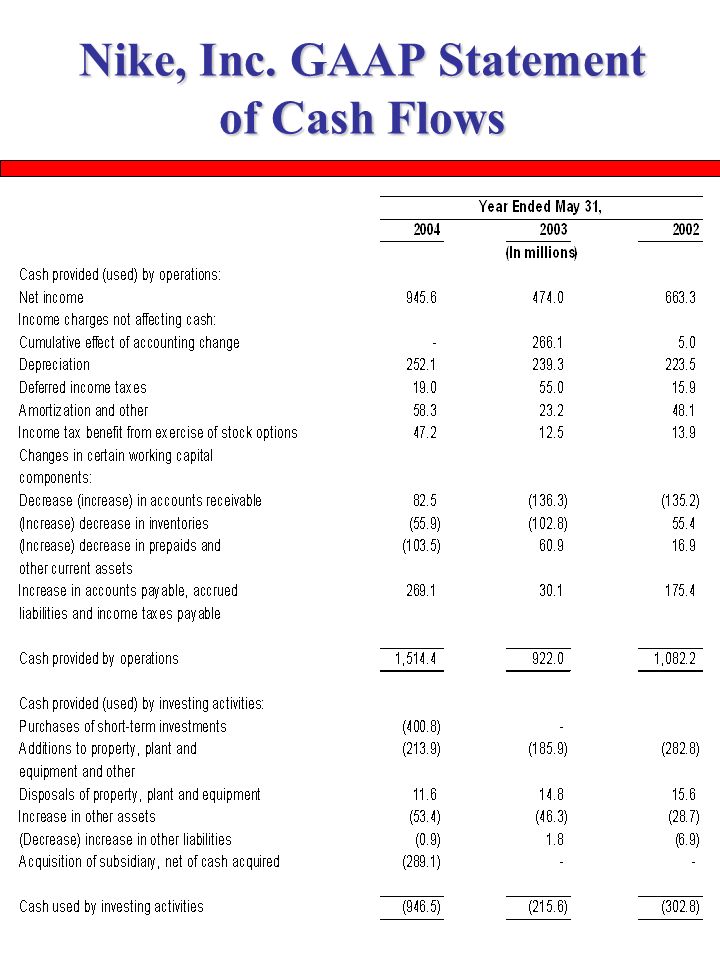

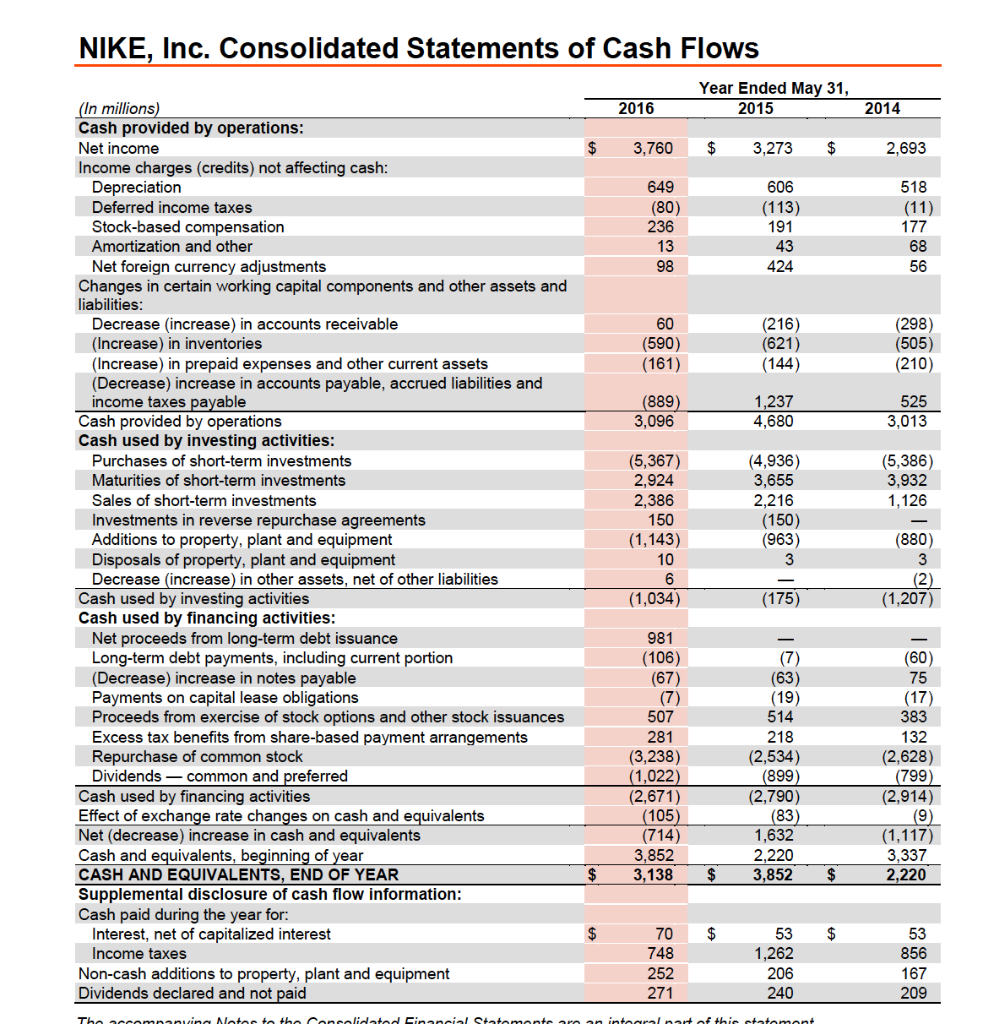

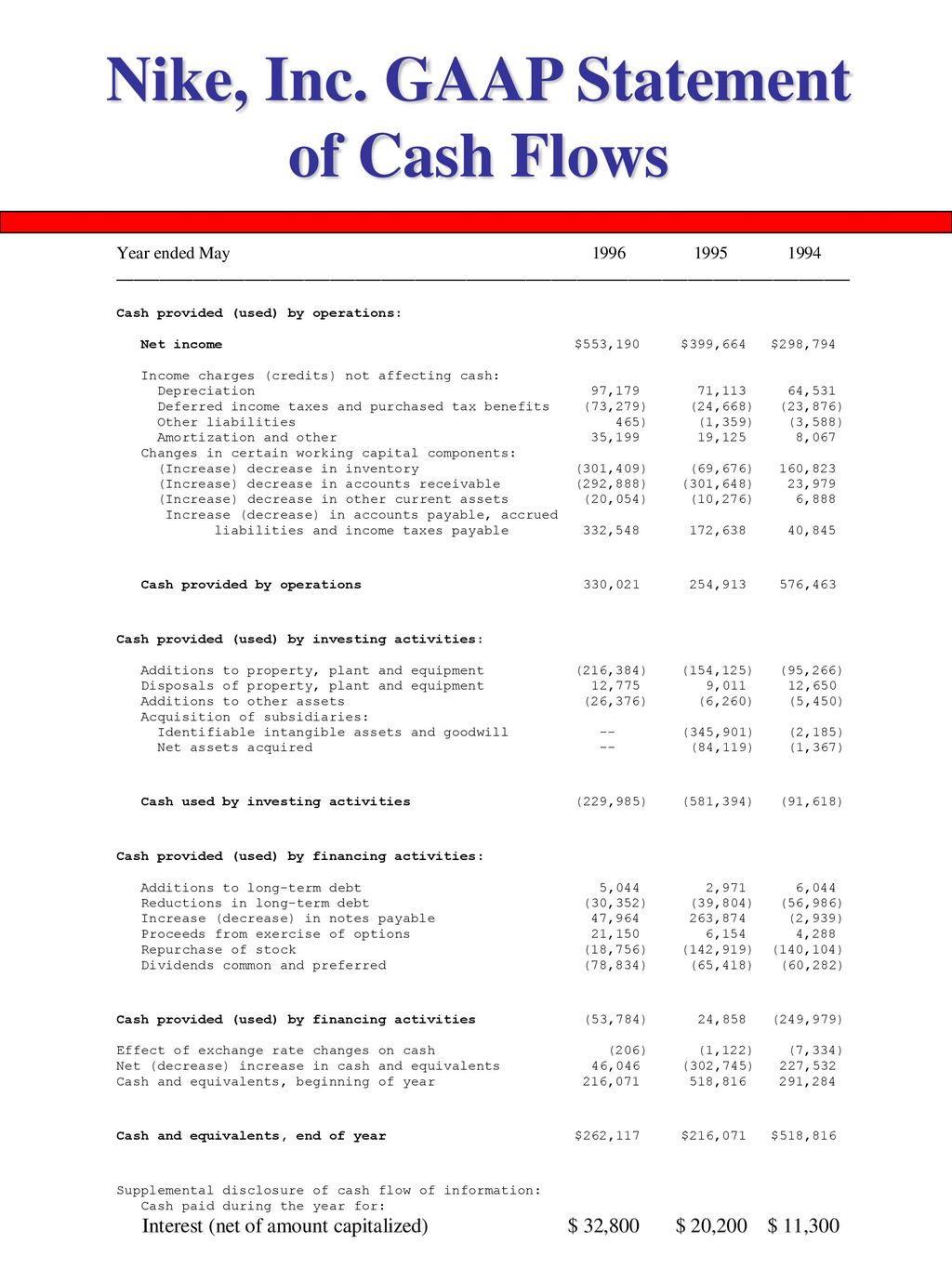

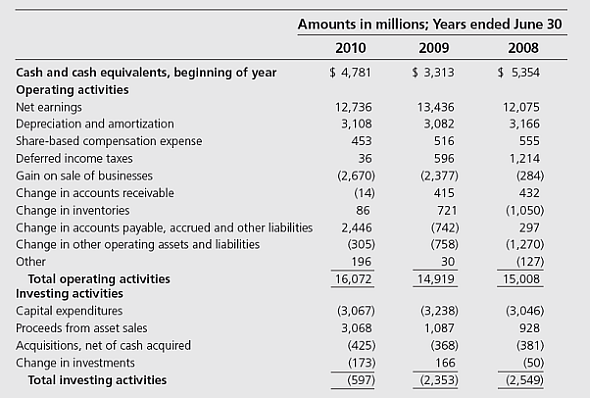

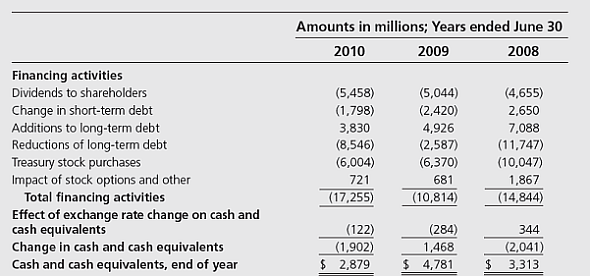

Nike cash flow analysis. The cash flows are grouped into three main categories. Cash Flow Analysis Estimate the after-tax incremental cash flows from the proposed apparel investment to Nike over the next 12 years. Cash used provided by.

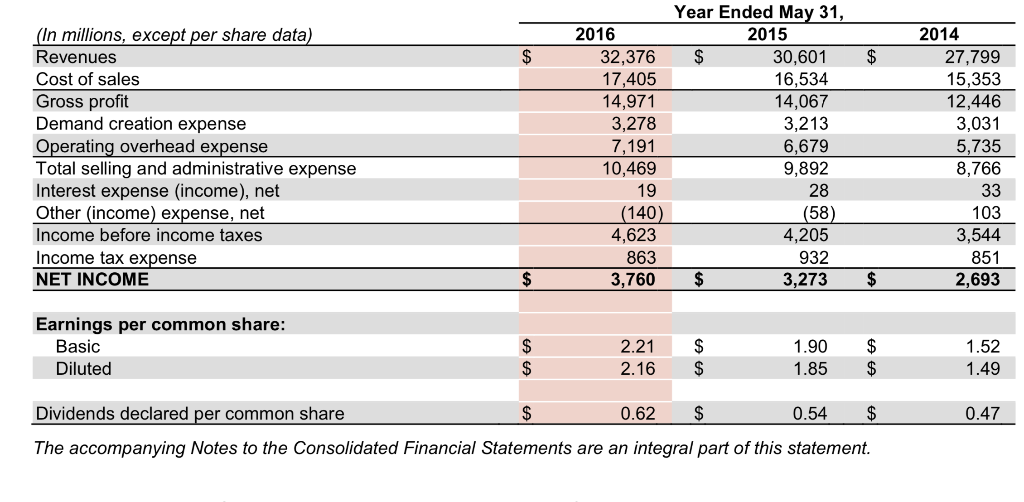

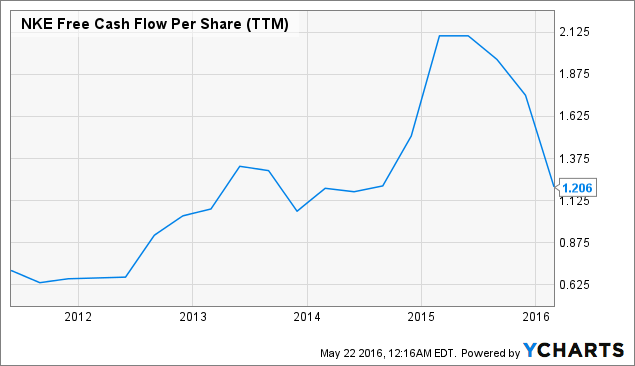

One of the most critical aspects of the cash flow statement is liquidity which is the degree to which Nikes non-liquid assets can be. Based on this rate the Free Cash Flow of Nike in year 6 will be 5791 Million. It breaks the analysis down to operating investing and financing activities.

Nikes purchase of property plant equipment for the three months ended in May. 2021 was 1113 Mil. The cash flow statement is a summary of the cash inflows and outflows for a business over a given period of time.

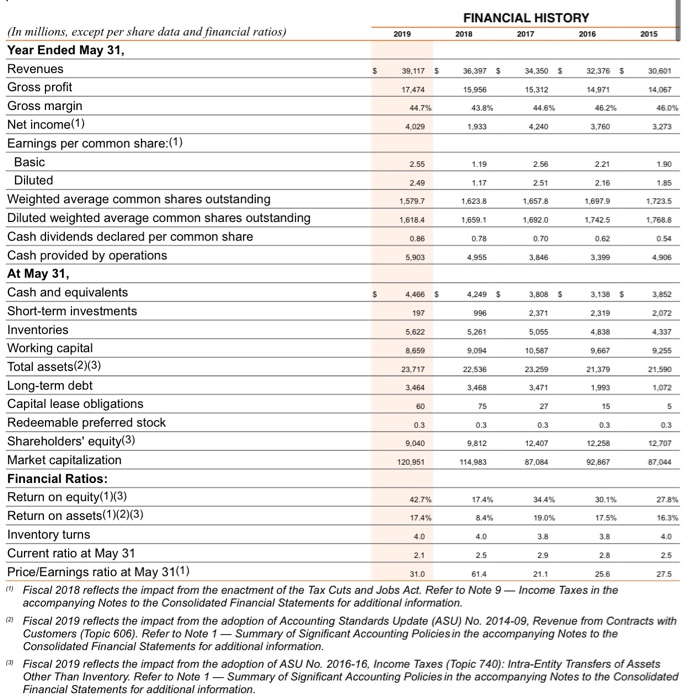

Purchase of PPE indicates the amount used to purchase property plant and equipment. The cash flow statement consists of three parts. Nike is in a good position despite their Cash and Cash equivalents decreasing by 665 from May 13 to May 14.

Find the latest Financials data for Nike Inc. Ten years of annual cash flow statements for NIKE NKE. Cash flow from operations cash flow from investing and cash flow.

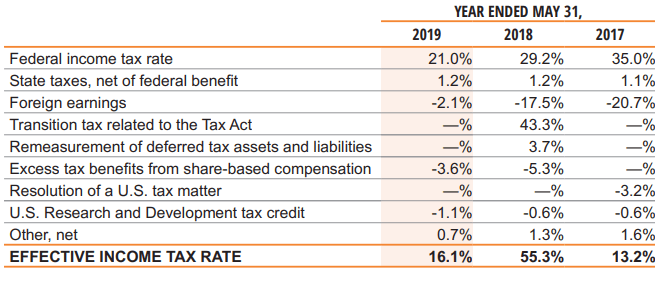

The financial performance of Nike has evaluated using methods of Horizontal analysis vertical analysis tends analysis and selected key ratios for improvements to increase cash flow and improve dividend and reduce labilities. If the real value is higher than the market price Nike Inc is considered to be undervalued and we provide a buy recommendation. Cl B Annual cash flow by MarketWatch.