Glory Ifrs 9 Fair Value Through Profit And Loss

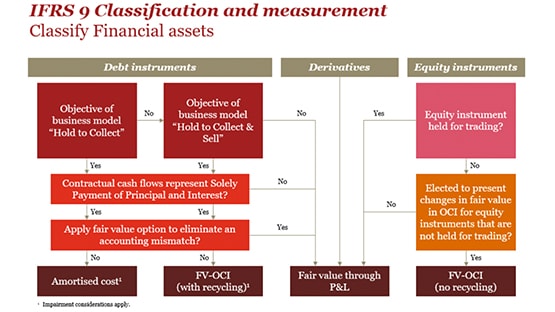

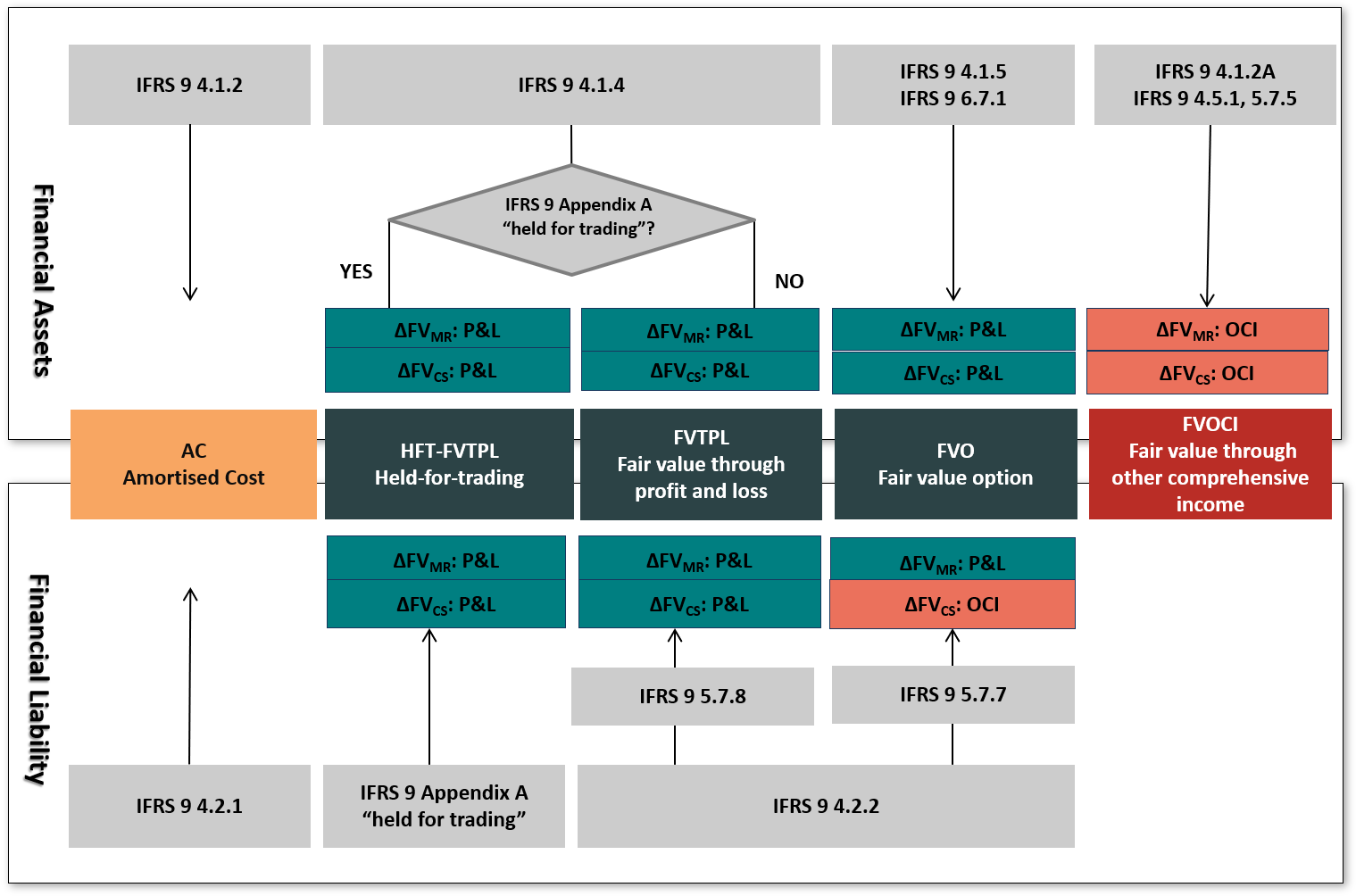

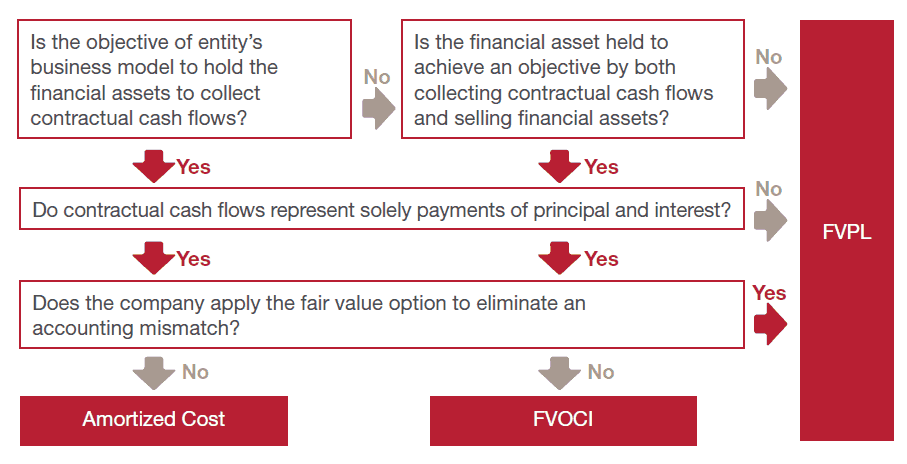

Amortised cost fair value through other comprehensive income FVOCI and fair value through profit or loss FVPL.

Ifrs 9 fair value through profit and loss. Issued debt instruments deposits received from customers investments in equity. For items of income and expense and gains or losses provide. All equity investments in scope of IFRS 9 are to be measured at fair value in the statement of financial position with value changes recognised in profit or loss except for those equity investments for which the entity has elected to present value changes in other comprehensive income.

When and only when an entity changes its business model for managing financial assets it must reclassify all affected financial assets. Financial liabilities at amortized cost. These changes are likely to have a significant impact on entities that have significant financial assets and in particular financial institutions.

This requirement is consistent with IAS 39. Classification under IFRS 9 for debt instruments is driven by the entitys business model for managing the financial assets and. Under IFRS 9 all financial instruments are initially measured at fair value plus or minus in the case of a financial asset or financial liability not at fair value through profit or loss transaction costs.

Comprehensive income for liabilities designated at fair value through profit or loss. More income statement volatility. It also includes the new hedging guidance that was issued in November 2013.

An analysis of the gain or loss recognised in the statement of profit or loss and OCI arising from the derecognition of financial assets measured. At fair value through profit or loss as cryptocurrencies are not physical assets. Food and drink 379 Effect of hedge accounting on the financial position and performance extract.

IFRS 9 will be effective for annual. It also includes the new hedging guidance that was issued in November 2013. The previous IAS 39 2 categories of held-to-maturity loans and receivables and available-for-sale have been eliminated.