Unbelievable Balance Sheet Reconciliation Best Practices Format Of Changes In Equity

It is also a best practice to include a note or.

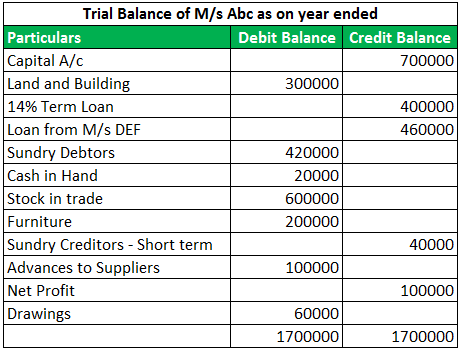

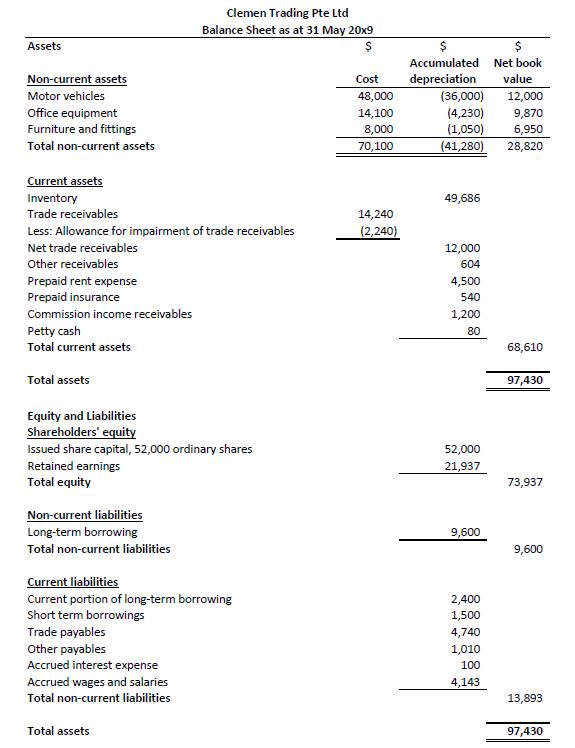

Balance sheet reconciliation best practices format of changes in equity. This is an important part of monthly accounting in order to ensure accurate records prepare for internal audits detect fraud quickly and manage cash flow. However this may be done simply to verify that transactions. When reconciling balance sheet accounts look at things like your businesss current and fixed assets current and noncurrent liabilities and owners equity.

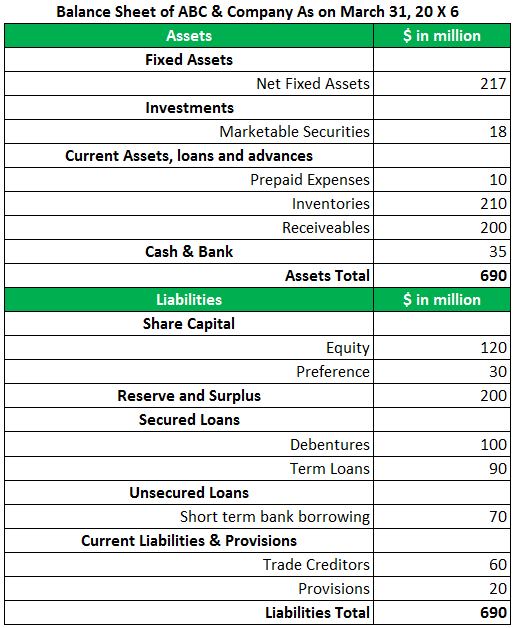

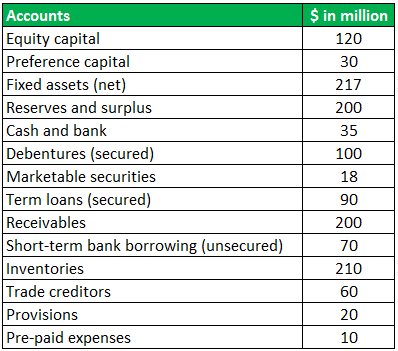

If one looks at the Balance Sheet account reconciliation process from a Best Practices perspective the following key areas are paramount. Once approved the reconciliation should be maintained in accordance with Administrative Guide Policy 381. Assets liabilities stockholders equity.

Line items is typically done in conjunction with projecting income statement line items Projecting Income Statement Line Items We discuss the different methods of. The balance sheet equation is. Projecting Balance Sheet Line Items.

Complete format checks to ensure the reconciliation template includes. The financial statements are key to both financial modeling and accounting. Over with the header section now start filling the body part of the template.

For more information refer to Topic Overview. Since you can perform this process with internal subledgers for specific balance sheet accounts or external bank statements the process is also known as bank reconciliation. The most common reconciliations stem from accruals and deferrals.

An account reconciliation is usually done for all asset liability and equity accounts since their account balances may continue on for many years. The reconciliation approver and attestation owner will review the reconciliation. Refer to Balance Sheet Account Balance Reconciliation Attestations.