Top Notch Short Note On Trial Balance

The trial balance serves two main purposes.

Short note on trial balance. Thus if trial balance agrees there may be errors or may not be errors. Iii Partial Omission of an Entry. What is a Trial Balance.

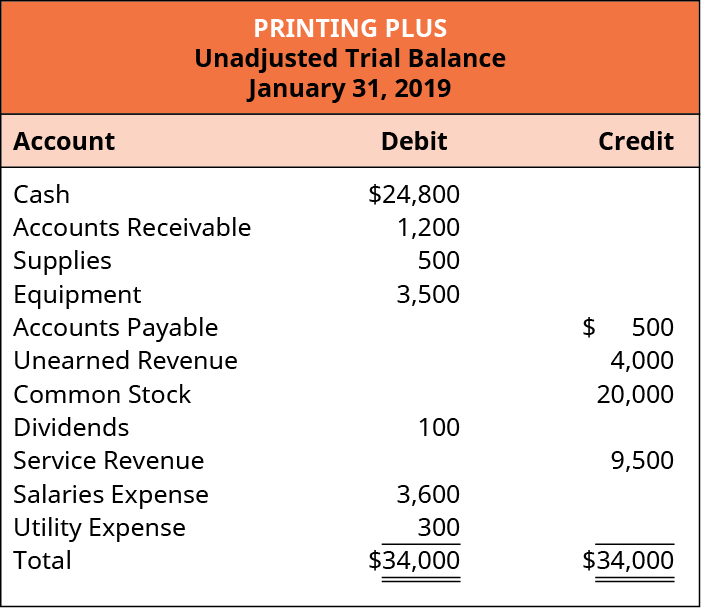

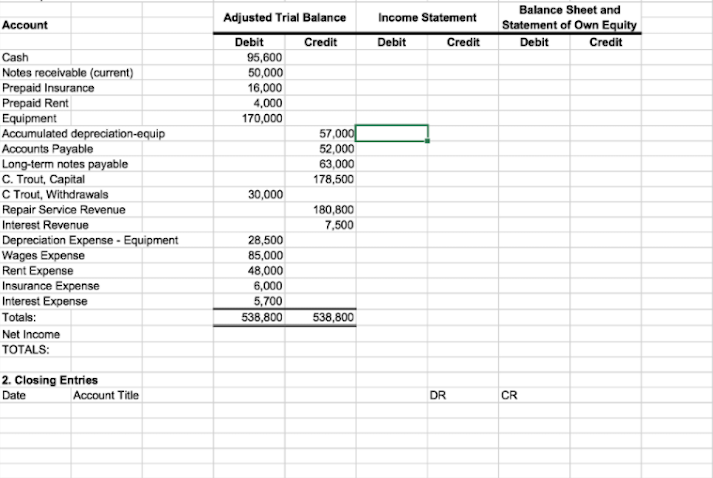

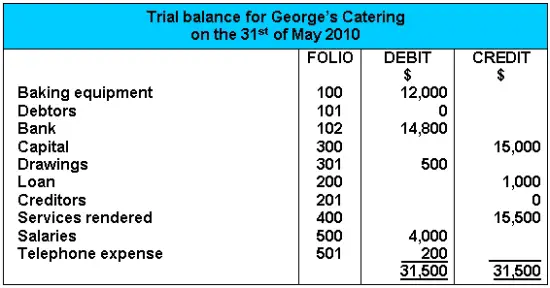

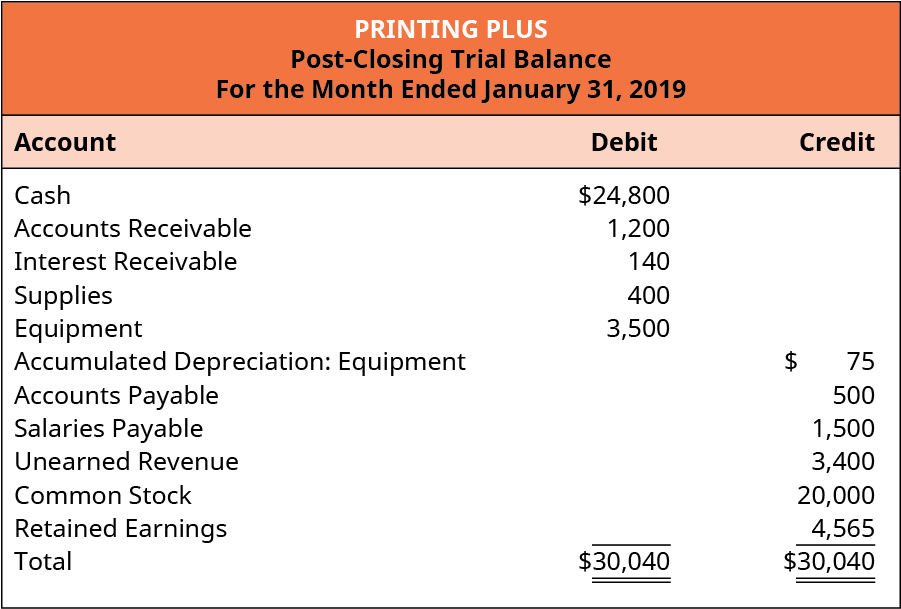

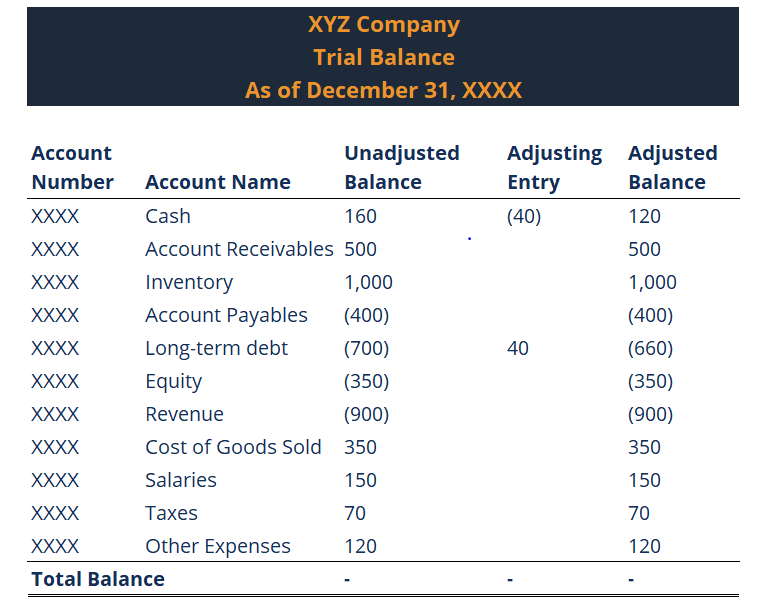

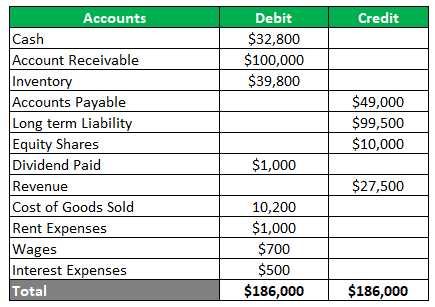

What is a trial balance. The trial balance is not an absolute or solid proof of the accuracy of books of accounts. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order.

Characteristics of Trial Balance. The trial balance is an accounting report or worksheet mostly for internal use listing each of the accounts from the general ledger together with their closing balances debit or credit. Short Note on Trial Balance Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

It appears from the definitions of trial balance that the trial balance contains the following features. 5650 instead of Rs. But if it does not agree certainly there are errors.

5850 then the Trial Balance will show the total credits exceeding the total debits by Rs. We will illustrate this later in the chapter. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

Errors that can be detected by a trial balance include. Certain errors affect the agreement of trial balance. Further it is used in preparing the final accounting statements of the business.