Matchless Section 27a Of Income Tax Act

DIVISION B Persons Exempt from Tax.

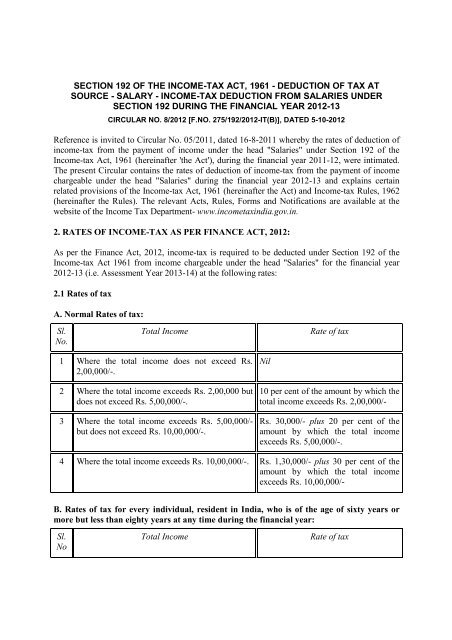

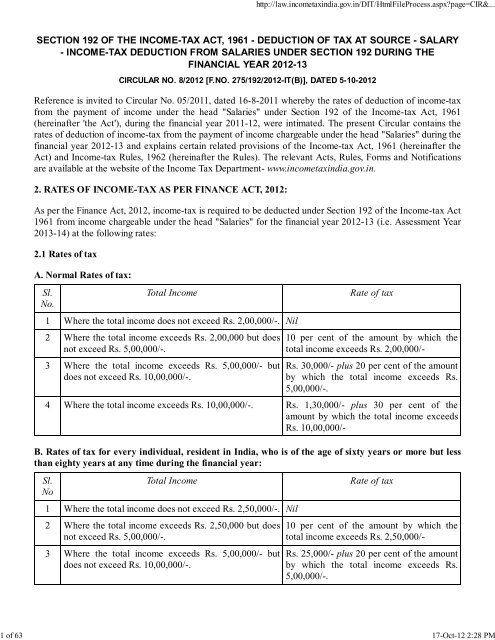

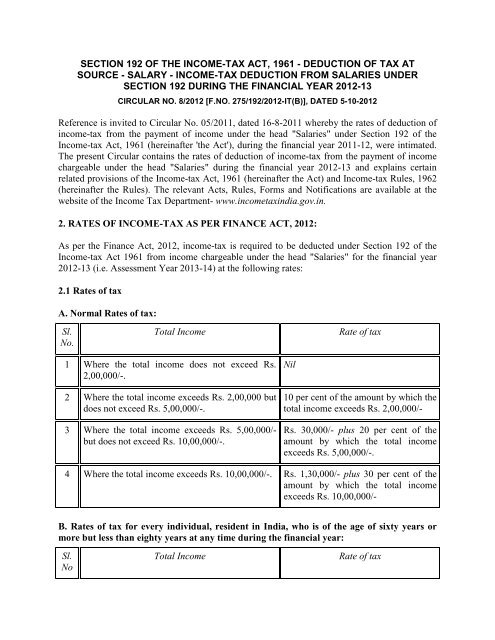

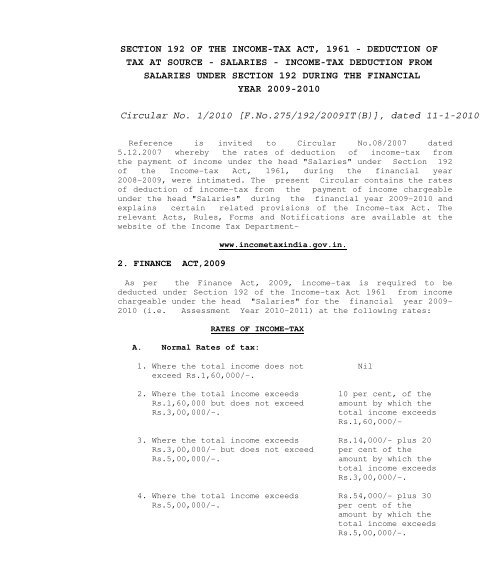

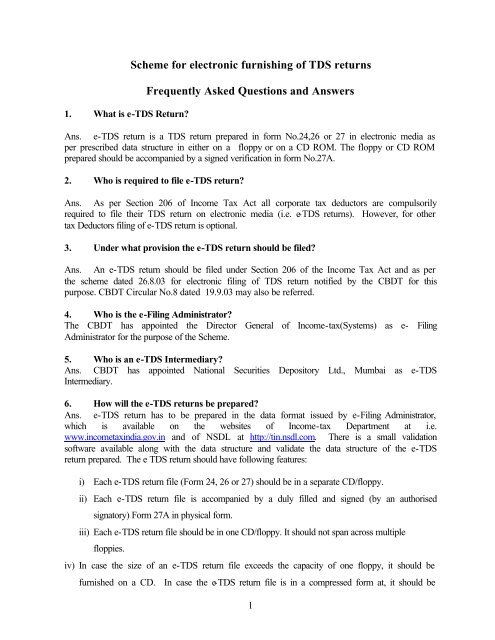

Section 27a of income tax act. Time limit to amend assessments 133. The particulars relating to deposit of tax deducted at source in the bank are correctly and properly filled in the table at item No6 of Form No24 or item No4 of Form No26 or item No4 of Form No27 as the case may be. 18 Subsection 1361 subparagraph ji of.

2 Taxable value means taxable value as calculated under section 27a of the general property tax act 1893 PA 206 MCL 21127a. The principal Act is amended by inserting a new section 28 as follows 27A. 1 A person who places an item of eligible property into service for the first time outside a radius of fifty kilometres from the boundaries of Kampala during a year of income.

Further we declare the we qualify as Insurer as per section 27A of the Insurance Act 1938 and _____ is the beneficial owner of dividend income and is eligible for exemption from withholding taxes as per section 194 Income Tax Act 1961 for the FY 2021-22. Section 27 in The Income- Tax Act 1995. A Income Tax Delegation of Powers and Duties Order 11960.

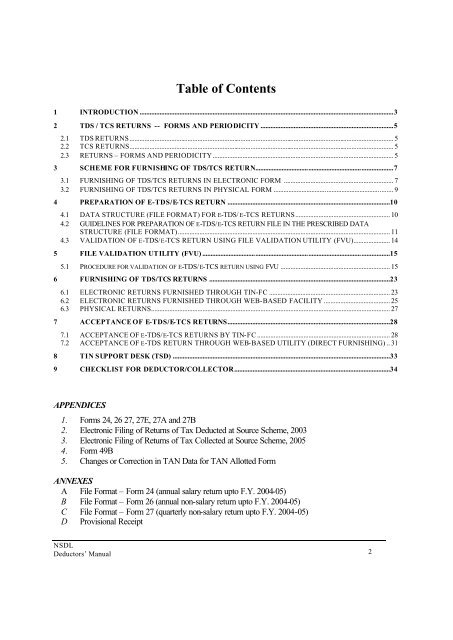

Form No27A as also in the e-TDS return as required by sub-section 2 of section 203A of the Income-tax Act. DIVISION C Calculation of Assessable Income. This Act may be cited as the Income Tax Act.

Determination of objections 131C. I an individual who transfers otherwise than for adequate consideration any house property to his or her spouse not being a transfer in connection with an agreement to live apart or to a minor child. MRA THE INCOME TAX ACT 91995 Please refer to endnotes at Appendix 1 Page 9 of 426 131A.

Objection to claims 131B. Penalty for non-payment of income tax assessed Repealed 27 134. 1 Tax includes interest and penalties and further includes the tax required to be withheld on income under part 3 unless the intention to give it a more limited meaning is disclosed by the context.