Best Airbus Financial Ratios

The EVEBITDA NTM ratio of Airbus Group SE is slightly higher than the average of its sector Aerospace.

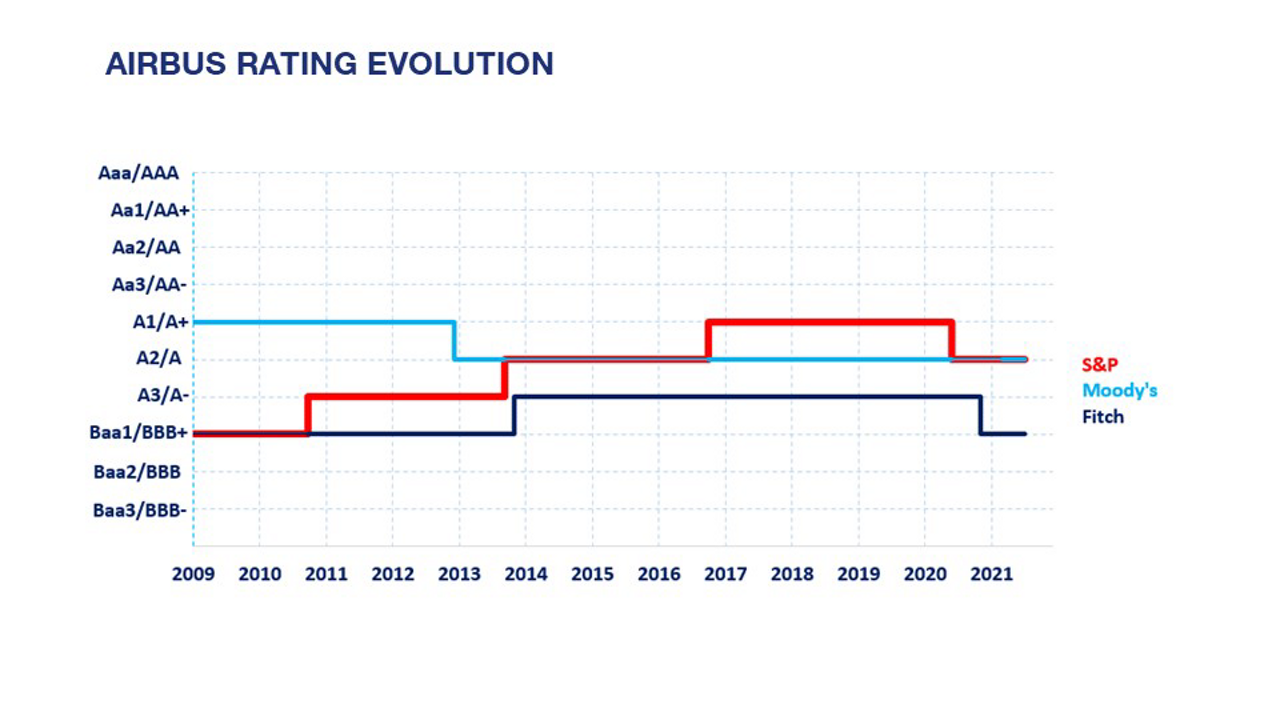

Airbus financial ratios. Generally speaking AIRBUSs financial ratios allow both analysts and investors to convert raw data from AIRBUSs financial statements into concise actionable information that can be used to evaluate the performance of AIRBUS over time and compare it to other companies across industries. 10 April 2027 10 April 2047. AIRBUS key financial stats and ratios If you want to check out AIR market capitalization PE Ratio EPS ROI and other financial ratios this page is your go-to hub.

08072021 222207 Cookie Policy 44 0 203 8794 460 Free Membership Login. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Airbus Group SEs latest financial. Get the detailed quarterlyannual income statement for AIRBUS AIRPA.

Dec 30 2012 EUR Dec 30 2013 EUR Dec 30 2014 EUR Dec 30 2015 EUR Turnover. Airbus financial information fundamentals and company reports including full balance sheet profit and Loss debtors creditors financial ratios rates margins prices and yields. 15 bn split in 750 m and 750 m.

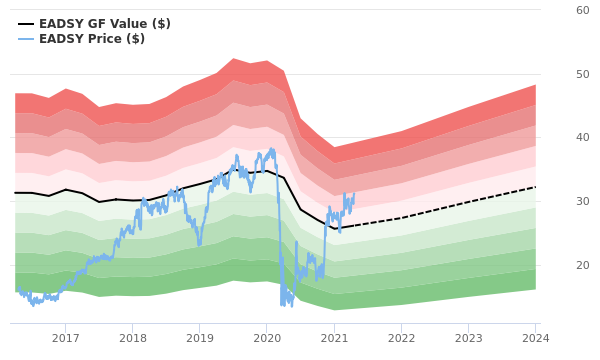

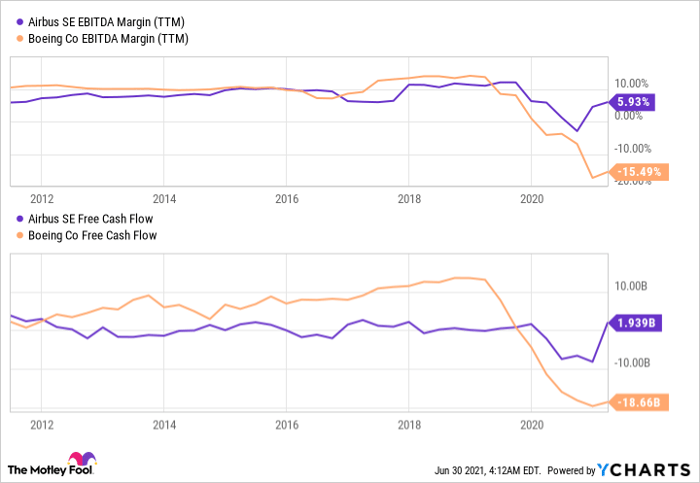

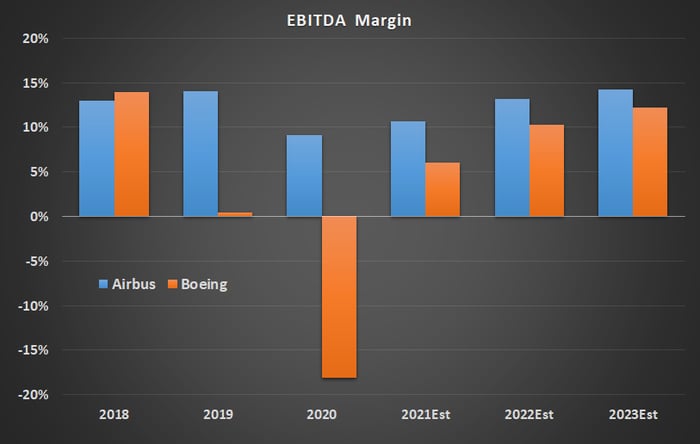

22Investor Ratios Table 3 - Investor Ratio Boeing Airbus 2015 2014 2013 2015 2014 2013 PE Ratio 1853 1884 2283 1756 1734 3133 Earnings Per Share 748 738 596 342 299 185 Dividend Per Share 38 3 21 14 125 09 Dividend Yield 227 205 Source Authors Work inputs from financial times and ycharts PE PriceEarnings Ratio for Airbus has increased significantly in 2013 PE. The EVEBITDA NTM ratio of Airbus Group SE is significantly higher than its historical 5-year average. Airbus revenue was 4991 b in FY 2020 which is a 292 year over year decrease from the previous period.

The EVEBITDA NTM ratio of Airbus Group SE. Guaranteed by Airbus SE JPMorgan Citigroup Barclays Morgan Stanley RBS. Airbus SE Annual Report 2017 1288 MB.

JPMorgan Citigroup GoldmanSachs Morgan Stanley. Airbus Financial Ratios In the table presented above we can see the value of the different ratios found of the company where we can see for example the Current Ratio Current Assets Current Liabilities the Cash or Liquidity Ratio Cash Current Liabilities and the ROA Net Income Total Assets. Find out the revenue expenses and profit or loss over the last fiscal year.