Fantastic Gaap Accounting For Reimbursed Expenses

These parties use their own cash to pay for company expense and then they reimburse back.

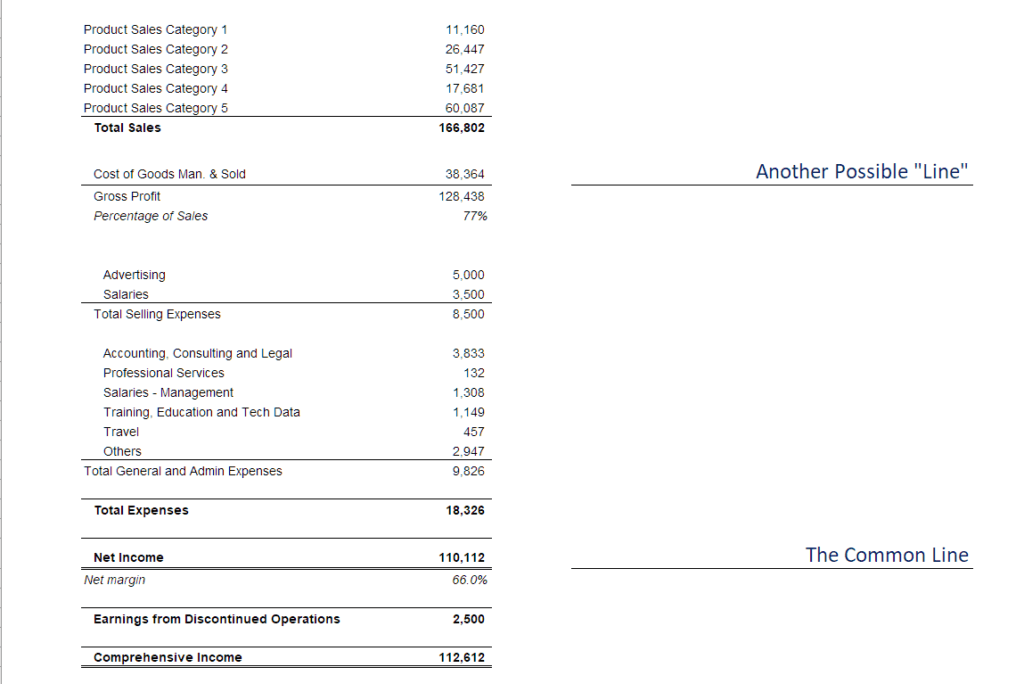

Gaap accounting for reimbursed expenses. Revenues are usually measured by the price of the product or service sold and expenses the cost to receive products or services. Depending on the number of reimbursed employee expenses the business might establish a separate account for each employee in the accounts payable ledger or if the amount is to be reimbursed through wages post the amount to the net wage control account. Now the expenditure path goes completely around the seller and the buyer pays.

To make an entry for expense reimbursement make a credit entry to decrease the expense and a debit entry to note the reimbursement. DR Cash system generated entry on object code 1000 CR Expense corresponding to the initial expenditure. However the expense and related reimbursement may be netted in profit or loss under both IFRS and US GAAP.

Validate or refuse with just one click. Validate or refuse with just one click. Integrated Cash Management Tools.

Reimbursement related to customer activities is Sales not washing away your expense. 1 Misleading readers of the financials as to your revenue 2 Skewing all ratios and financial measurements. Reimbursement is a Process not the Expense Account reason.

Ad Managing your expenses has never been easier. CR Directors Loan ac 30. Company A director incurred expenses.

The Accounting Equation Expense Recorded. Reimbursement is the payment that company pays to staff customer and other parties to settle the expenses that they have paid on behalf of the entity. I also act for one of the limited companies who he provides consultancy services to.