Unbelievable Financial Ratios Of Hdfc Bank

The EVEBITDA NTM ratio of HDFC Bank Limited is significantly lower than the average of its sector Banks.

Financial ratios of hdfc bank. 1770 Here we can see that HDFC bank has higher PE ratio as compared to ICICI bank A high PE value suggests that investors are expecting higher earnings. This a very positive sign for the banks profitability. Capital Adequacy Ratio which is a very important figure for any bank stands at 1852 for HDFC Bank.

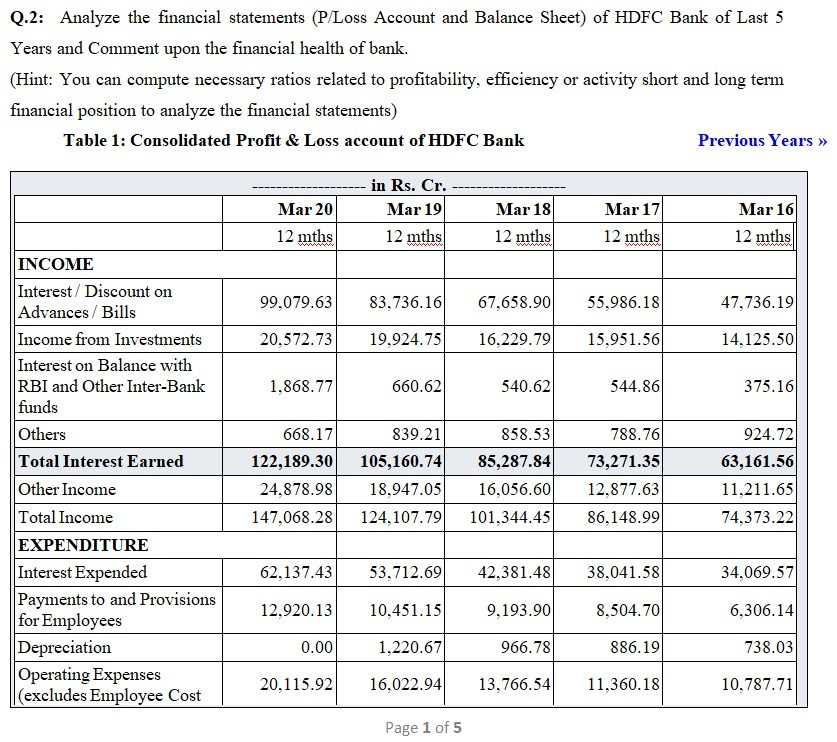

As of FY20 the net profit margin for the bank stands at 2287 which has seen a continuous rise for the last 4 fiscal years. Upgrade Membership to see this financial chart. Per Share Ratios.

HDFC Bank Limited HDB 7231 -08 -109 Financial Summary Financial Statements Quarter Financials Chart Financial Ratios Profile Historical Data DCF DCF Levered. To conclude this article the Banks financial soundness during the study is satisfactory KeywordFinancial performance Ratio analysis of HDFC bank. 2351 Investors The PE ratio for ICICI.

Cost of Liabilities 392 466 497 449 513 524. As of Sept 2020 HDFC is at the second position in bank advances with a 101 market share which has shown a rise from 925 a year ago. Yield on Investments 652 598 708 727 811 768.

DEBT EQUITY RATIO -016 chg. HDFC Bank Financial Ratios The three important factors leading to this is the market presence CASA ratio Current Account Savings Account and low Non Performing assets NPAs. Presents the key ratios its comparison with the sector peers and 5 years of Balance Sheet.

Dividend Per ShareRs 650 250 1500 1300 1100 950. Diluted EPS Rs 4826. Operational Financial Ratios.