Recommendation Types Of Audit Opinion Acca

And 2 Test data.

Types of audit opinion acca. Modifications to the Opinion in the Independent Auditors Report 975 usethecorrespondingphraseexceptforthepossibleeffectsofthematters forthemodifiedopinionRefparA24A25 AdverseOpinion19 When the auditor expresses an adverse opinion the auditor should statethatintheauditorsopinionbecauseofthesignificanceofthematters. In addition incorrect gainloss may be. It can be either packaged off-the-shelf software or it can be purpose written to work on a clients system.

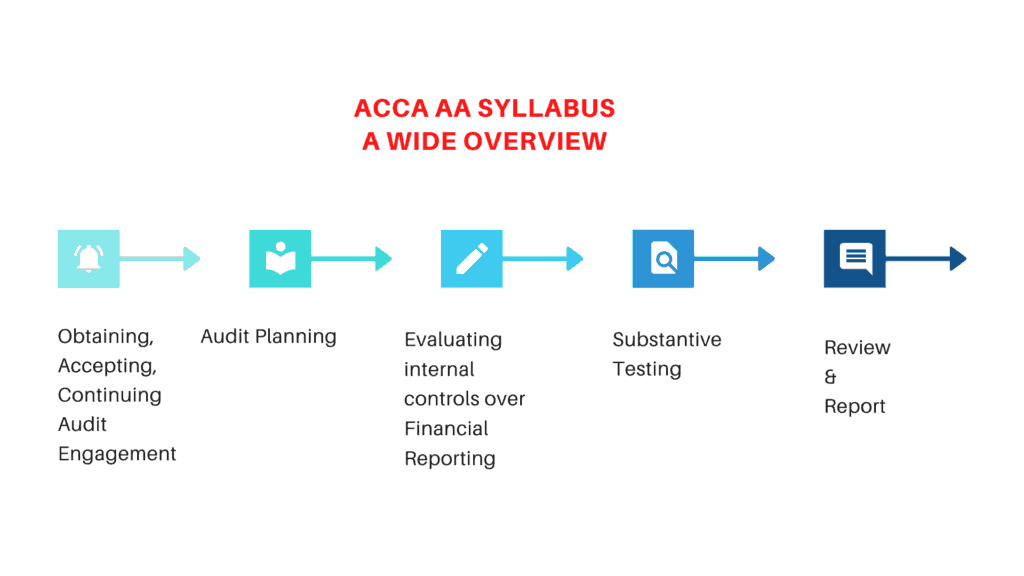

In such a situation an adverse opinion is issued ie. - Matters that do not affect the auditors opinion. Modification to the auditors opinion on the financial statements is necessary.

The decision regarding which type of modified opinion is appropriate depends upon. There are two broad categories of CAAT. Example unmodified audit opinion but material uncertainty exists in relation to going concern and the disclosures are adequate.

Material and Pervasive - Adverse Opinion. Disposal of Non- current Assets by Company. A disagreement which is material and pervasive is of such significance that the financial statements do not give a true and fair view.

In such a situation an adverse opinion is issued ie. The auditor must modify the audit opinion on the financial statements if the directors refuse to make the relevant adjustments in the financial statements requested by the auditors. Unmodied or Modied Matters that do not aect the auditors opinion Matters that do aect the auditors opinion Emphasis of matter material uncertainty related to going concern and other matters FS do contain a material misstatement.

Both the legal claim which should have been recognised and the proposed dividend which should have been disclosed rather than recognised are materially misstated. Disposed Asset should be removed from the asset register gainloss should be recorded in the PorL. An auditor opinion report is a letter that auditors attach to the statutory audit report that reflects their opinion of the audit.