Beautiful Work Hdfc Bank Financial Ratios

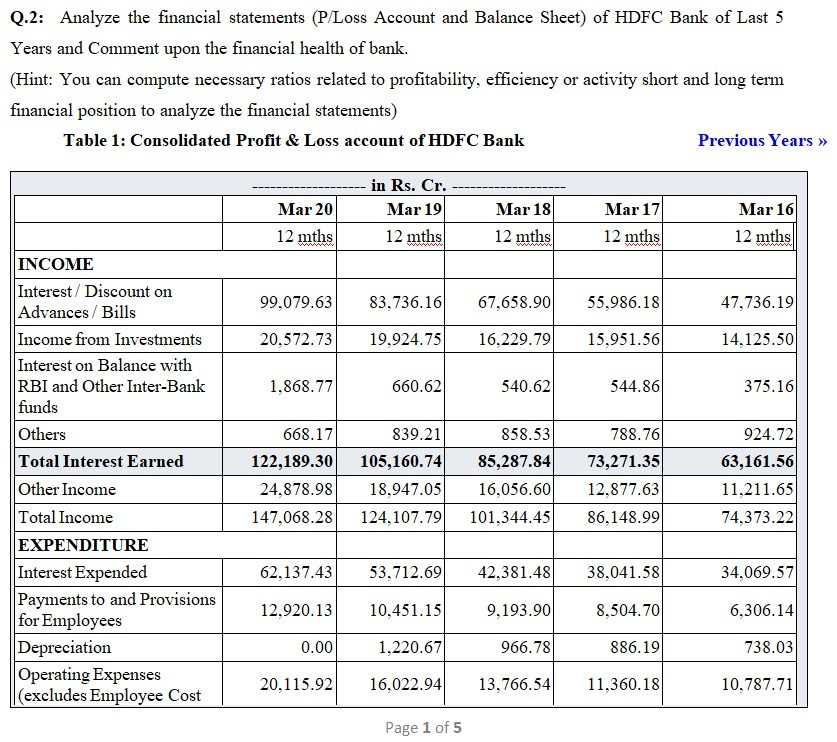

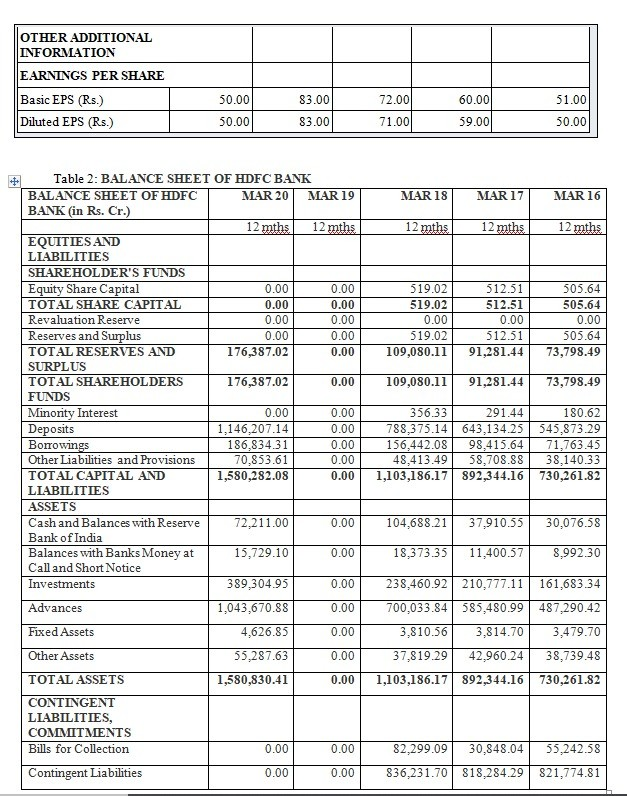

Book NAVShareRs 38059 32163 56429 42233.

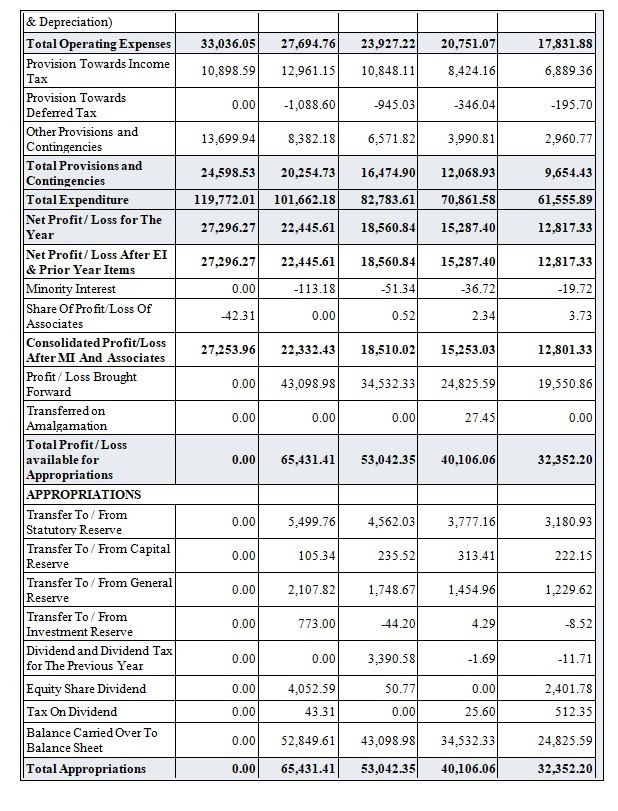

Hdfc bank financial ratios. Financial leverage ratio also known as financial leverage or leverage is a measure of how much assets a company holds relative to its equity. Adjusted EPS Rs 5644. Financial Leverage Ratio - HDFC Bank Ltd.

Earnings Per Share Rs 5774. This aspect of the financial position of a borrower is of concern to long term creditor security. Dividend Per ShareRs 650 250 1500 1300 1100 950.

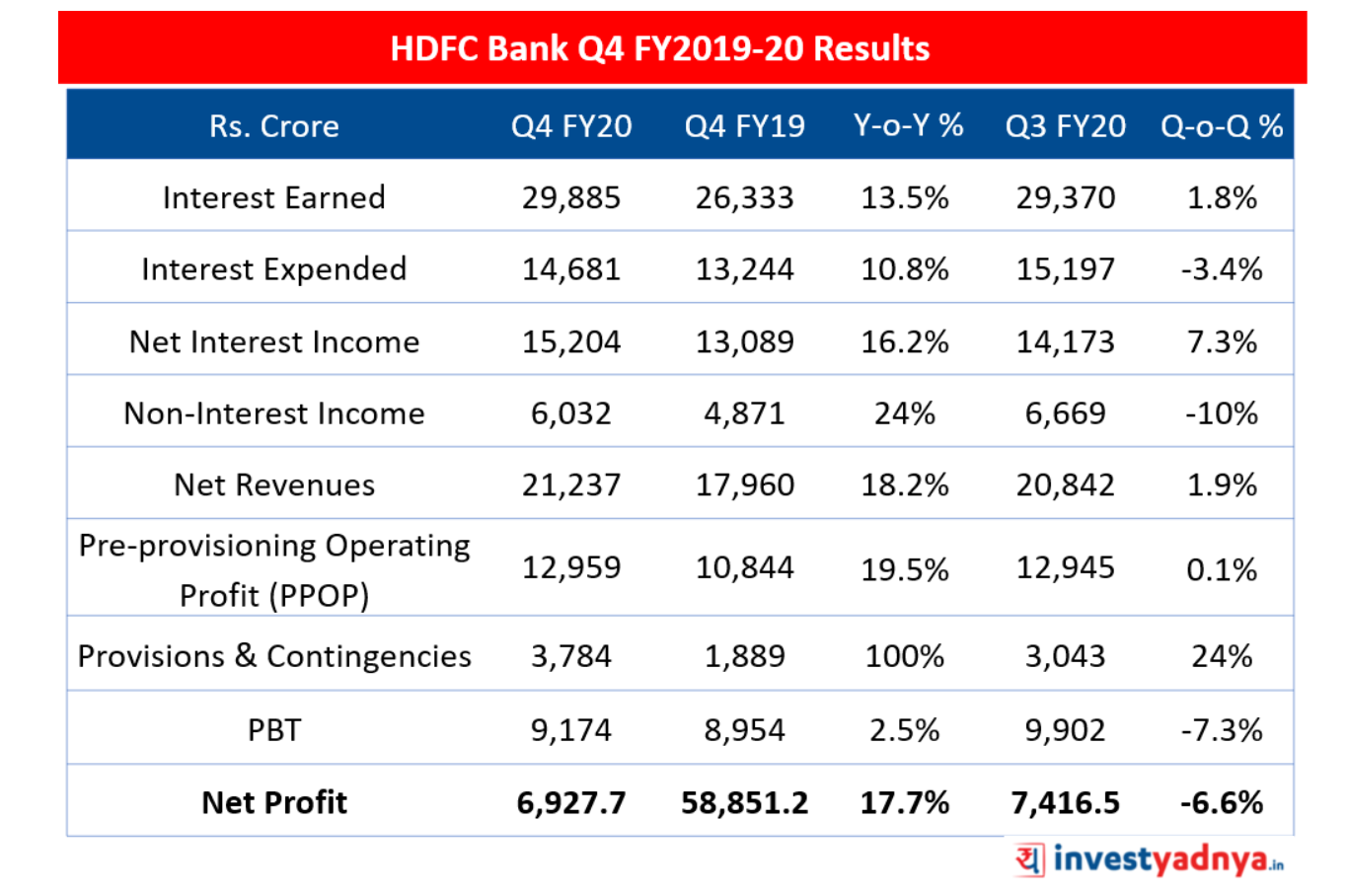

HDFC Bank Financial Ratios The three important factors leading to this is the market presence CASA ratio Current Account Savings Account and low Non Performing assets NPAs. At HDFC Bank Ratio analysis is equally useful for assessing the long term viability of a firm. Upgrade Membership to see this financial chart.

Earnings Per Share Rs 7740. Adjusted Cash EPS Rs. To conclude this article the Banks financial soundness during the study is satisfactory KeywordFinancial performance Ratio analysis of HDFC bank.

According to these financial ratios HDFC Bank Limiteds valuation is way below the market valuation of its sector. HDFC Bank opens 200th branch in Telangana at Khairatabad. Capital Adequacy Ratio which is a very important figure for any bank stands at 1852 for HDFC Bank.

If you want to check out HDFCBANK market capitalization PE Ratio EPS ROI and other financial ratios this page is your go-to hub. A high leverage ratio means that the company is using debt and other liabilities to finance its assets. The EVEBITDA NTM ratio of HDFC Bank Limited is significantly lower than its historical 5-year average.