Wonderful Cash Flow Direct And Indirect Method Example

Using the indirect method operating net cash flow is calculated as follows.

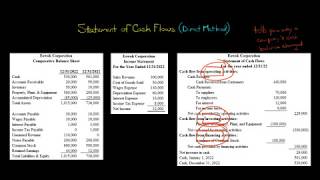

Cash flow direct and indirect method example. Ordinarily this information is readily available through your accounting system. Subtract amount from income. The indirect method on the other hand computes the operating cash flows by adjusting the current years net income for changes in balance sheet accounts.

This is the only difference between the direct and indirect methods. Example of the Statement of Cash Flows Indirect Method. Cash Flow Statement Direct Method Format.

The format shown below is for the direct method. The opposite is true about decreases. What is the Indirect Method.

Please see our separate tutorial on the indirect cash flow statement method for the format and explanations on how to put this together. Cash Flow Statement Indirect Method Cash Flow Example. Under the direct method actual cash flows are presented for items that affect cash flow.

Heres a general rule of thumb when preparing an indirect cash flow statement. The investing and financing activities are reported exactly the same on both reports. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses.

The statement of cash flows is prepared by following these steps. If you are a QuickBooks user QuickBooks generates their cash flow reports using the indirect method. Reporting rules a corporation has the option of using either the direct or the indirect method.