First Class Pfizer Financial Ratios

017 043 DATA AS OF Jul 02 2021.

Pfizer financial ratios. Price to Book Ratio. Per Share Ratios. The EVEBITDA NTM ratio of Pfizer Inc.

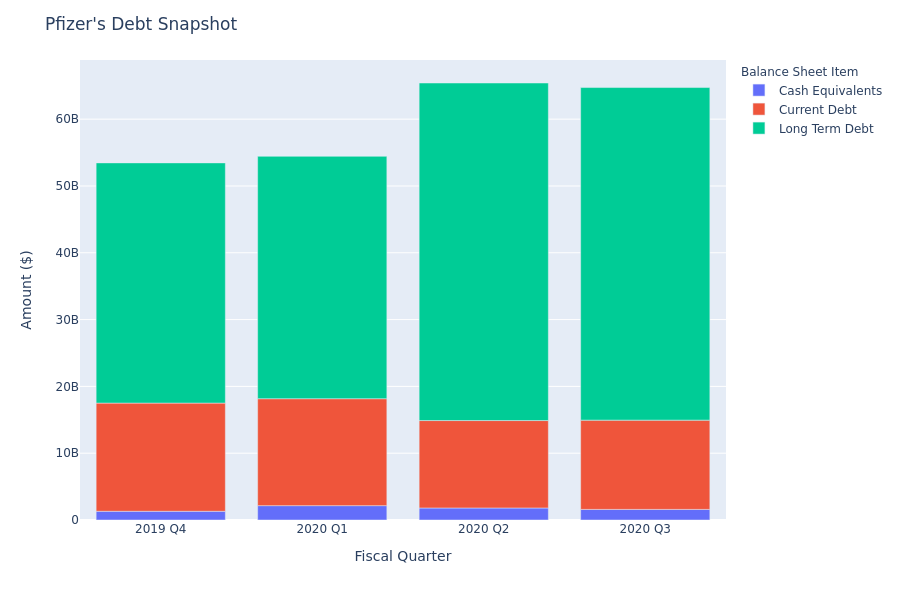

Net Profit Margin 2223. The financial condition of Pfizer Inc. The ratio of Number of Shares Shorted to Debt to Equity for Pfizer Inc is about 103767361.

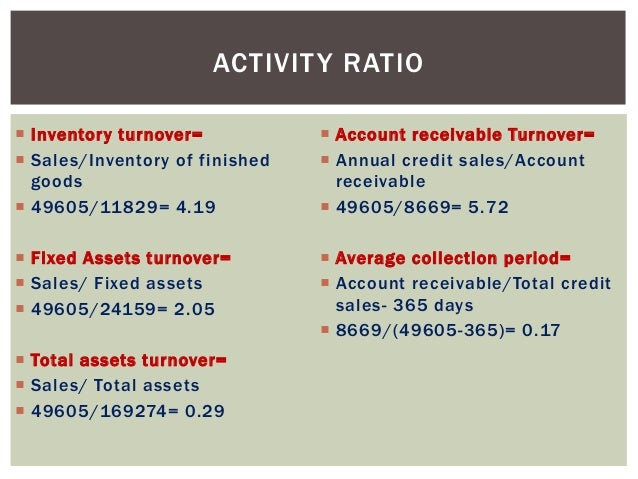

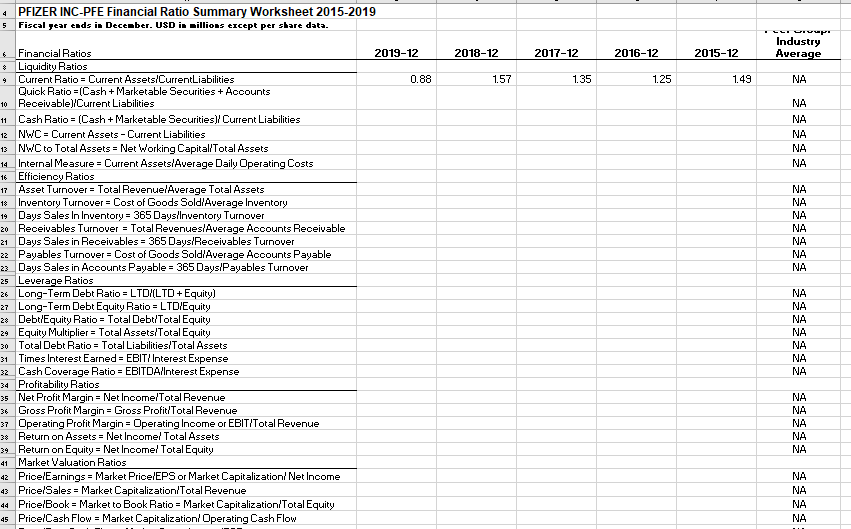

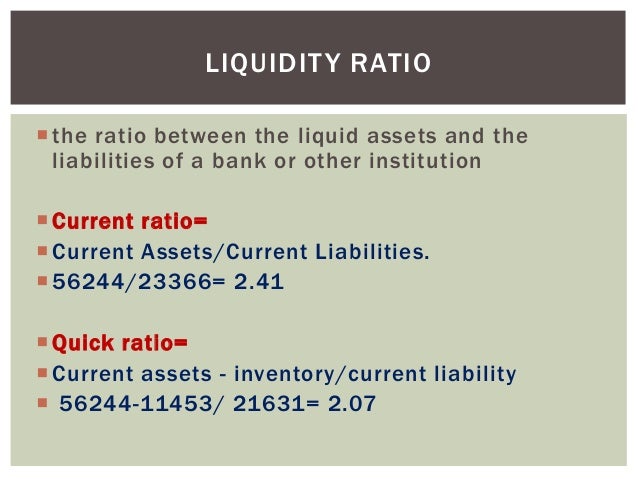

This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Pfizer Incs latest financial reports. Pfizer Incs current ratio deteriorated from 2018 to 2019 but then improved from 2019 to 2020 not reaching 2018 level. In reviewing each of their financial ratios I first start with defining the financial ratio.

Common Stock PFE Nasdaq Listed. Pfizer Incs adjusted financial leverage ratio increased from 2018 to 2019 but then decreased significantly from 2019 to 2020. Is slightly lower than its historical 5-year average.

Pfizer Financial Ratios for Analysis 2005-2021 PFE. Cash EPS Rs 10411. Price to Sales Ratio.

The current year Average Equity is expected to grow to about 599 B whereas Long Term Debt to Equity is forecasted to decline to 051. Finally I offer a brief analysis of their important Financial ratios. Is slightly lower than its historical 5-year average.